U.S. Bitcoin ETFs See $494 Million Surge in Six-Day Inflow Streak

28.09.2024 15:00 2 min. read Kosta Gushterov

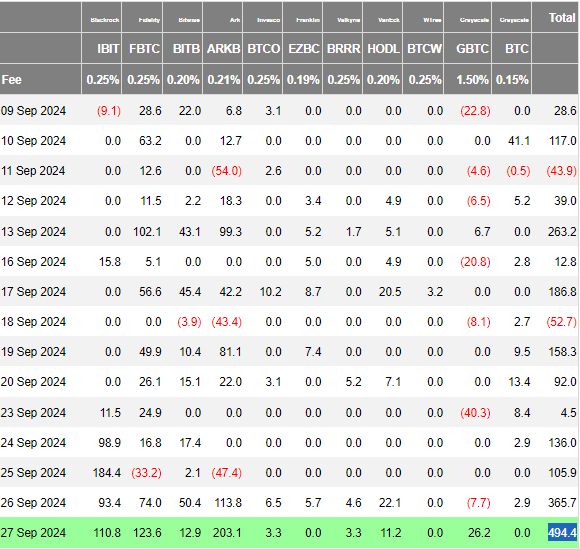

On September 27, U.S. spot Bitcoin ETFs recorded net inflows totaling $494.27 million, continuing a positive trend that began on September 19.

Over the past six days, none of the approved ETFs reported outflows, with just four showing no activity.

Ark & 21Shares’ ARKB led the pack with inflows of $203.07 million, raising its cumulative total to $2.72 billion, a notable increase from $113.8 million the previous day. Fidelity’s FBTC followed with $123.61 million, up from $74 million on September 26. BlackRock’s iShares Bitcoin Trust (IBIT) also saw inflows of $110.82 million, marking five consecutive days of gains, bringing its cumulative net inflow to $21.42 billion, making it the top spot Bitcoin ETF.

Grayscale’s GBTC saw inflows of $26.15 million after reporting outflows of $7.7 million the day prior. Bitwise’s BITB came next with $12.91 million in inflows, though down from $50.4 million the day before, bringing its total to $2.15 billion. VanEck’s HODL added $11.17 million, reaching a cumulative $650.13 million.

Invesco’s BTCO and Valkyrie’s BRRR had smaller inflows of $3.28 million and $3.26 million, respectively, both declining from the previous day’s figures. Other funds, including Grayscale’s BTC and WisdomTree’s BTCW, did not see any activity, and no outflows were recorded across the ETFs.

Collectively, Bitcoin ETFs have brought in $18.69 billion in cumulative net inflows, an increase from $18.31 billion on September 26, with total net assets across all Bitcoin spot ETFs amounting to $61.21 billion, representing 4.71% of Bitcoin’s market capitalization.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

Bitcoin (BTC) has hit a new all-time high today at $123,090 as per data from CoinMarketCap and trading volumes have exploded as a result. Nearly $180 billion worth of Bitcoin has exchanged hands in the past 24 hours. This represents a 284% increase during this period. This volume accounts for 7.5% of BTC’s circulating supply. […]

Bitcoin Price Prediction From Bernstein After the Recent All-Time High

As Bitcoin surged to another record high above $123,000 on Monday, analysts at Bernstein offered a bullish long-term outlook for the digital asset, forecasting a transformative period ahead for the entire crypto sector.

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

Bitcoin treasury firm Strategy—formerly known as MicroStrategy—has expanded its already-massive BTC holdings with a fresh $472.5 million acquisition.

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

Famed author of Rich Dad Poor Dad, Robert Kiyosaki, has once again thrown his support behind Bitcoin following its recent surge above $120,000, calling it a win for those who already hold the asset—and a wake-up call for those who don’t.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read