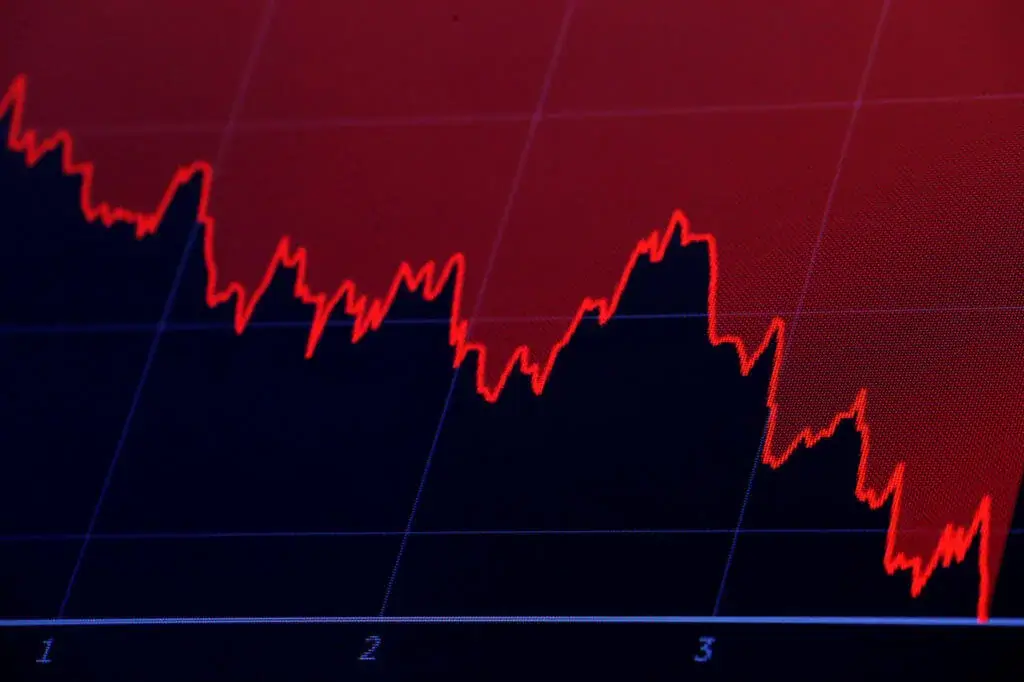

Trump’s Tariffs Could Trigger Tech Industry Collapse, Warns Analyst

06.04.2025 17:40 2 min. read Alexander Stefanov

Investment analyst Dan Ives from Wedbush Securities believes that the US tech industry could face a major downturn due to tariffs imposed by President Trump.

In an interview with CNBC, Ives explained that the wide-ranging and reciprocal tariffs introduced by Trump are set to have a particularly negative impact on tech companies that depend on Chinese labor and components.

Recently, Trump signed an executive order introducing a 10% tariff on all imported goods entering the US, aimed at protecting domestic manufacturing. This order also includes specific tariffs for certain countries, resulting in a combined 54% tariff on Chinese imports.

Ives pointed out that this move forces US tech giants like Apple to reconsider their operational strategies, as they face the risk of higher production expenses. He warned that the situation could escalate into a severe economic crisis if the tariffs remain, emphasizing that the political rhetoric does not match the complex reality of shifting global supply chains.

According to Ives, companies with significant exposure to China, including Nvidia and other semiconductor manufacturers, are now experiencing heightened investor anxiety similar to the early days of the COVID-19 pandemic in March 2020.

To cope with rising costs, Ives predicts that tech companies may increase prices, which would ultimately reduce consumer demand. He estimates that if the tariffs persist, the resulting cost increases could lead to a 15% to 20% decline in demand.

Ultimately, Ives argues that consumers will bear the financial burden, as higher costs for goods like iPhones and other electronics will inevitably be passed on to buyers. He suggests that despite debates over tariffs, it will be ordinary Americans who end up paying more for everyday tech products.

-

1

Cardano Considers Crypto Wealth Fund to Supercharge DeFi

13.06.2025 21:00 2 min. read -

2

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read -

3

Massive Foreign Capital Exodus from U.S. Markets Raises Alarms

23.06.2025 9:00 1 min. read -

4

Crypto Market Outlook Strengthens as U.S. Economic Clouds Begin to Clear

14.06.2025 8:00 2 min. read -

5

Arthur Hayes Sees a “Stablecoin Gold Rush” – and a Graveyard of Future Flops

18.06.2025 13:00 2 min. read

Key U.S. Events to Watch This Week That Could Impact Crypto

The first week of July brings several important developments in the United States that could influence both traditional markets and the cryptocurrency sector.

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

Ric Edelman, one of the most influential voices in personal finance, has radically revised his stance on crypto allocation. After years of cautious optimism, he now believes that digital assets deserve a far larger share in investment portfolios than ever before.

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

In the case involving Terraform Labs and its co-founder Do Hyeong Kwon, the defense has asked the Federal Court for the Southern District of New York to extend the deadline for pretrial filings by two weeks, pushing it beyond the original date of July 1, 2025.

Coinbase Surges 43% in June, Tops S&P 500 After Regulatory Wins and Partnerships

Coinbase has emerged as the best-performing stock in the S&P 500 for June, climbing 43% amid a surge of bullish momentum driven by regulatory clarity, product innovation, and deeper institutional interest in crypto.

-

1

Cardano Considers Crypto Wealth Fund to Supercharge DeFi

13.06.2025 21:00 2 min. read -

2

Pakistan Turns Unused Power Into Bitcoin and AI Infrastructure

13.06.2025 22:00 1 min. read -

3

Massive Foreign Capital Exodus from U.S. Markets Raises Alarms

23.06.2025 9:00 1 min. read -

4

Crypto Market Outlook Strengthens as U.S. Economic Clouds Begin to Clear

14.06.2025 8:00 2 min. read -

5

Arthur Hayes Sees a “Stablecoin Gold Rush” – and a Graveyard of Future Flops

18.06.2025 13:00 2 min. read