Trump’s Crypto Strategy: A Boost for Bitcoin or a Blow to the Dollar?

06.03.2025 12:19 2 min. read Alexander Zdravkov

Speculation is mounting over the U.S. government's decision to integrate Bitcoin into its financial strategy, with some experts questioning its impact on the dollar.

Economist Peter Schiff, a vocal Bitcoin skeptic, believes this move could accelerate the currency’s decline, arguing that gold remains the superior long-term asset.

Over the weekend, President Donald Trump signed an executive order adding Bitcoin and select altcoins to the nation’s reserves. The announcement has fueled anticipation ahead of Friday’s White House Crypto Summit, where more details are expected.

Schiff warns that the government’s embrace of Bitcoin could weaken the dollar’s standing. He suggests that while Bitcoin may benefit in the short term, gold will ultimately prove to be the more stable investment. His remarks come as economic uncertainty grows, with market conditions already volatile due to trade tensions under the Trump administration.

Meanwhile, author of “Rich Dad, Poor Dad” Robert Kiyosaki offers a contrasting view, seeing Bitcoin as a solution to America’s financial instability. He believes investors who sold during recent price dips may regret their decision, while those who held firm stand to gain significantly.

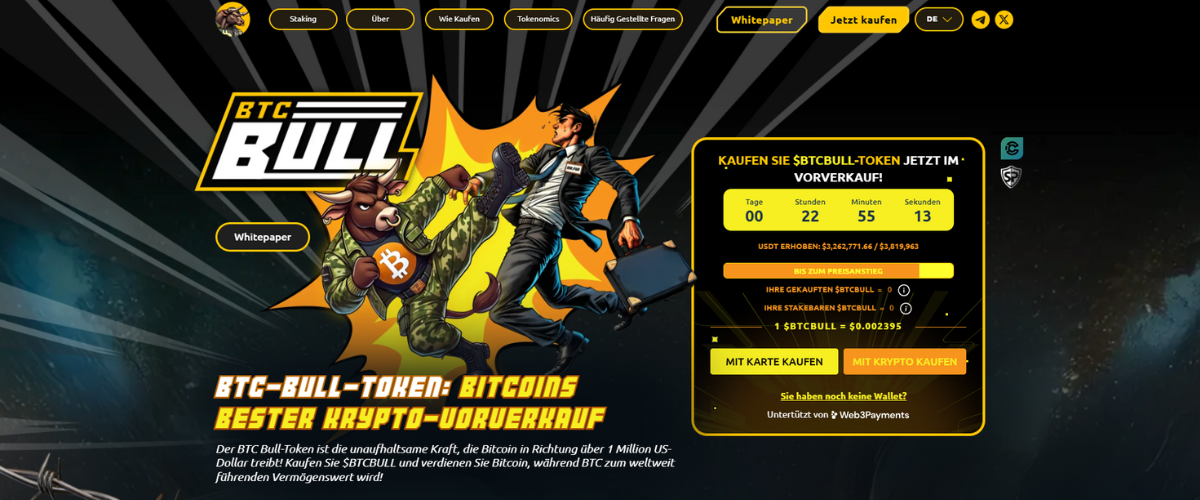

BTC Bull Token – Don’t Miss Out on This Hidden Gem

BTC Bull Token ($BTCBULL) is a new meme token that brings together two of the strongest ecosystems in the crypto world: Bitcoin and Ethereum.

What makes the BTC Bull Token so special is its drive to spread Bitcoin ownership to everyday people.

$BTCBULL is a decentralized token that combines the power of meme culture with real Bitcoin rewards. Every time Bitcoin reaches a price milestone, holders of $BTCBULL receive BTC airdrops.

Furthermore, the token is subject to a burn mechanism, which reduces its supply and increases its value.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

4

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

5

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read

Elon Musk’s SpaceX Moves $150M in Bitcoin

SpaceX has moved 1,308 BTC—worth roughly $150 million—to a new wallet address, marking its first on-chain activity in more than three years.

Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read -

4

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

5

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read