TRON Inc Files $1 Billion Mixed Shelf Offering With SEC

28.07.2025 17:47 2 min. read Kosta Gushterov

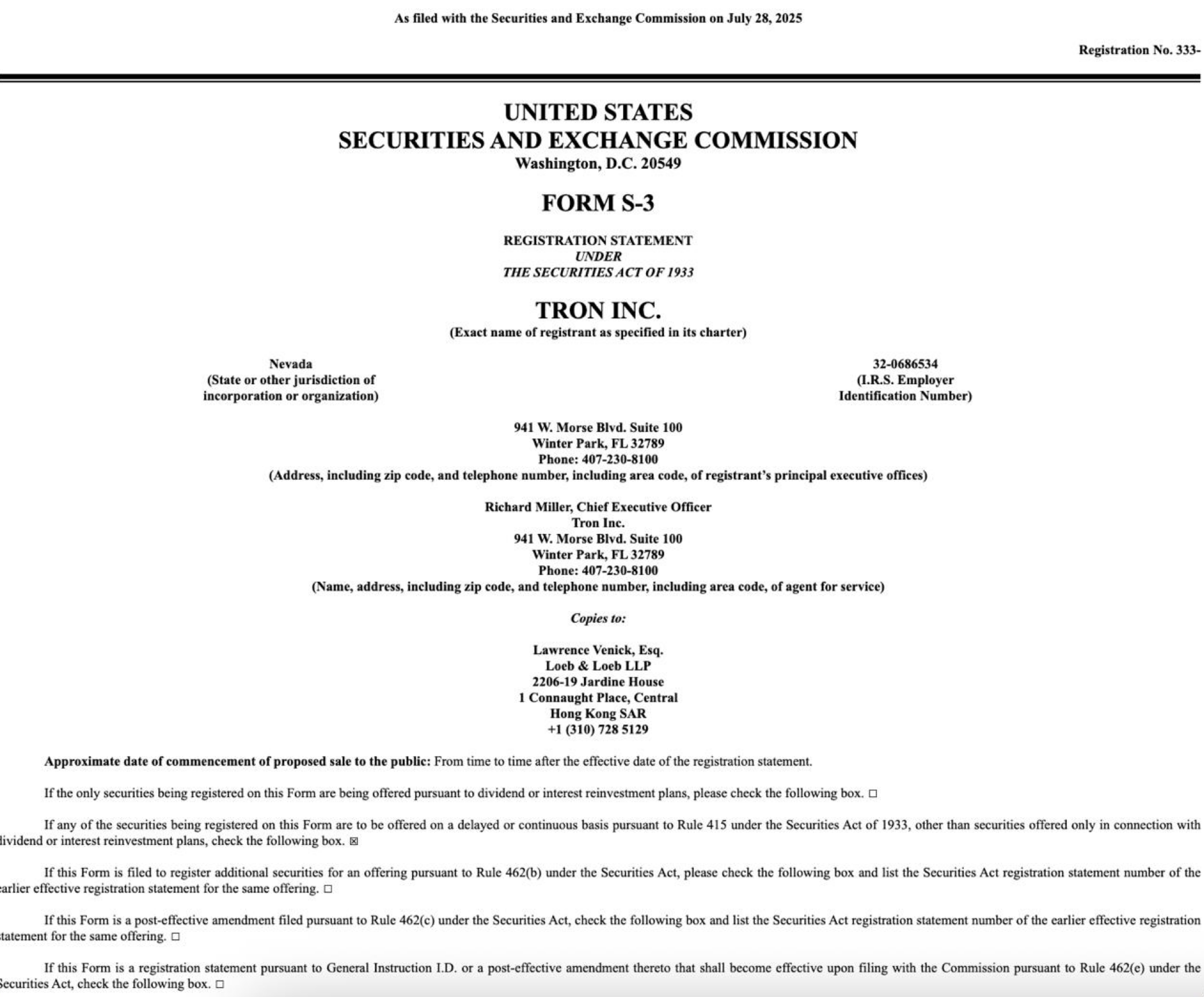

TRON Inc., a blockchain-based technology firm incorporated in Nevada, has officially filed a Form S-3 with the U.S. Securities and Exchange Commission (SEC) to initiate a mixed shelf offering of up to $1 billion.

The filing, submitted on July 28, 2025, opens the door for TRON Inc. to offer a variety of securities—including common stock, preferred stock, debt securities, and warrants—on a delayed or continuous basis.

The company, headquartered at 941 W. Morse Blvd, Winter Park, Florida, listed Richard Miller, its Chief Executive Officer, as the primary contact. Legal representation for the filing is provided by Lawrence Venick of Loeb & Loeb LLP, based in Hong Kong.

A shelf registration like this allows the company flexibility to raise capital over time rather than all at once, which is commonly used by companies planning multiple rounds of fundraising or wishing to respond swiftly to changing market conditions.

The filing does not immediately issue any securities but enables TRON Inc. to do so in the future without submitting additional registration statements each time. The proceeds from such offerings could be used for various purposes, including product development, strategic acquisitions, expansion, or balance sheet restructuring.

This move comes amid heightened interest in crypto-aligned corporate issuances, as regulatory clarity improves and blockchain infrastructure continues to attract institutional investors.

While no specific timeline for issuance was disclosed, the filing notes the company’s intent to commence offerings “from time to time after the effective date.”

With this filing, TRON Inc. joins the ranks of blockchain-native companies leveraging traditional capital markets for strategic financial flexibility. Investors will now be watching closely for further details on the nature and timing of any securities to be offered under this registration.

-

1

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

2

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read -

3

Crypto Sector H1 2025 Roundup: Binance Report Shows Institutional Surge and Tech Growth

19.07.2025 11:00 2 min. read -

4

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

5

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

06.07.2025 13:00 2 min. read

JPMorgan: Coinbase Could Gain $60B From USDC-Circle Ecosystem

A new report from JPMorgan is shedding light on the staggering upside potential of Coinbase’s partnership with Circle and its deep exposure to the USDC stablecoin.

5 Major US Events and How They Can Shape Crypto Market in The Next Days

The week ahead is shaping up to be one of the most pivotal for global markets in months. With five major U.S. economic events scheduled between July 30 and August 1, volatility is almost guaranteed—and the crypto market is bracing for impact.

eToro Launches 24/5 Stock Trading, Unlocking Round-the-clock Access to Top US Shares

Global fintech platform eToro has officially rolled out 24/5 trading on its 100 most popular U.S. stocks, giving users the ability to buy and sell equities at any time from Monday to Friday.

Stablecoins are Overtaking Visa: Here is The Latest Data

A new chart from Bitwise Asset Management has sent shockwaves through the financial world, showing that stablecoin transaction volumes are now rivaling—and in some cases surpassing—Visa’s global payments.

-

1

Binance Founder Says Bloomberg’s USD1 Report is False, Threatens Lawsuit

13.07.2025 8:30 2 min. read -

2

Binance CEO Issues Urgent Crypto Security Reminder

09.07.2025 17:30 2 min. read -

3

Crypto Sector H1 2025 Roundup: Binance Report Shows Institutional Surge and Tech Growth

19.07.2025 11:00 2 min. read -

4

Top 7 Crypto Project Updates This Week

19.07.2025 18:15 3 min. read -

5

EU Risks Falling Behind in Digital Finance, Warns Former ECB Board Member

06.07.2025 13:00 2 min. read