Top Crypto Sectors in July: Meme, Staking, Gaming Lead

12.07.2025 14:13 1 min. read Kosta Gushterov

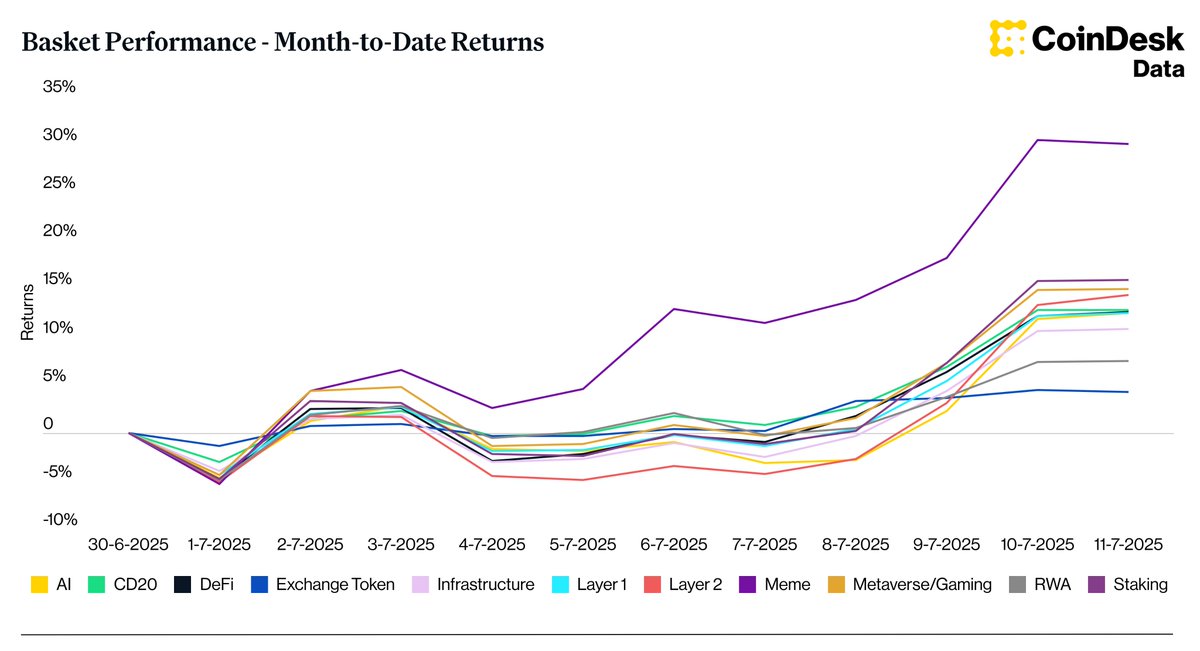

Meme coins are dominating the crypto market in July, outperforming all other sectors with a staggering 30.06% return so far this month, according to the latest data from CoinDesk.

The basket performance chart highlights strong momentum in community-driven tokens, far ahead of other narratives.

Staking, gaming, and Layer 2 also surge

Following meme coins, staking tokens have returned 15.83% month-to-date, reflecting growing interest in passive yield strategies. Metaverse and gaming assets are close behind at 14.93%, showing renewed investor appetite in virtual ecosystems.

Layer 2 solutions also delivered a solid 14.37% gain, suggesting confidence in scalable blockchain alternatives. Layer 1s performed slightly below with 12.45%, still a notable rebound amid recent market strength.

Other strong performers include DeFi (12.57%), the CoinDesk 20 index (12.75%), and infrastructure-related tokens (10.80%).

AI suffers sharp decline

In contrast, the AI category is the biggest underperformer with a -12.40% return. Despite previous hype around artificial intelligence integrations, the sector has failed to maintain upward momentum in July.

Exchange tokens posted a modest 4.21% gain, while real-world asset (RWA) tokens climbed 7.43%, continuing their steady ascent in recent months.

The chart, which covers performance from June 30 to July 11, shows a clear divergence in market sentiment—where meme-driven tokens and staking strategies are currently leading the charge.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

5

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read

Top 10 Biggest Crypto Developments This Week

The latest WuBlockchain Weekly report captures a high-volatility week in crypto. From Bitcoin’s new all-time high to controversy around Pump.fun’s presale and Elon Musk’s political Bitcoin endorsement, markets are witnessing sharp shifts in momentum and policy.

Federal Reserve Chair Jerome Powell Reportedly Weighing Resignation

U.S. financial circles are bracing for a potential shake-up as reports suggest Federal Reserve Chair Jerome Powell is considering stepping down.

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

Report Claims That Binance Played a Foundational Role in the Creation of Trump Related StableCoin

Changpeng Zhao, the former CEO of Binance, reportedly supported crypto projects linked to the Trump family while privately seeking a presidential pardon, according to a July 11 report by Bloomberg News.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

5

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read