Top Analyst Shares His Forecast for Bitcoin and the Altcoin markets

01.07.2024 10:30 1 min. read Alexander StefanovRenowned analyst Ali Martinez recently shared his views on Bitcoin and the broader cryptocurrency market.

Martinez highlighted that the simple moving average in the ETH/BTC ratio has exceeded 365, which he interprets as an early indicator of the upcoming altcoin season.

However, the analyst highlighted that the price of the leading cryptocurrency often rises when least expected.

Continuing his Bitcoin analysis, Martinez revealed that 14,000 BTC has been transferred on crypto exchanges in the past four days, which equates to approximately $851 million.

The expert noted that despite these large transfers, the Bitcoin kitty has made significant purchases when the price was in its low ranges, which has caused the buy/sell ratio for BTC to rise.

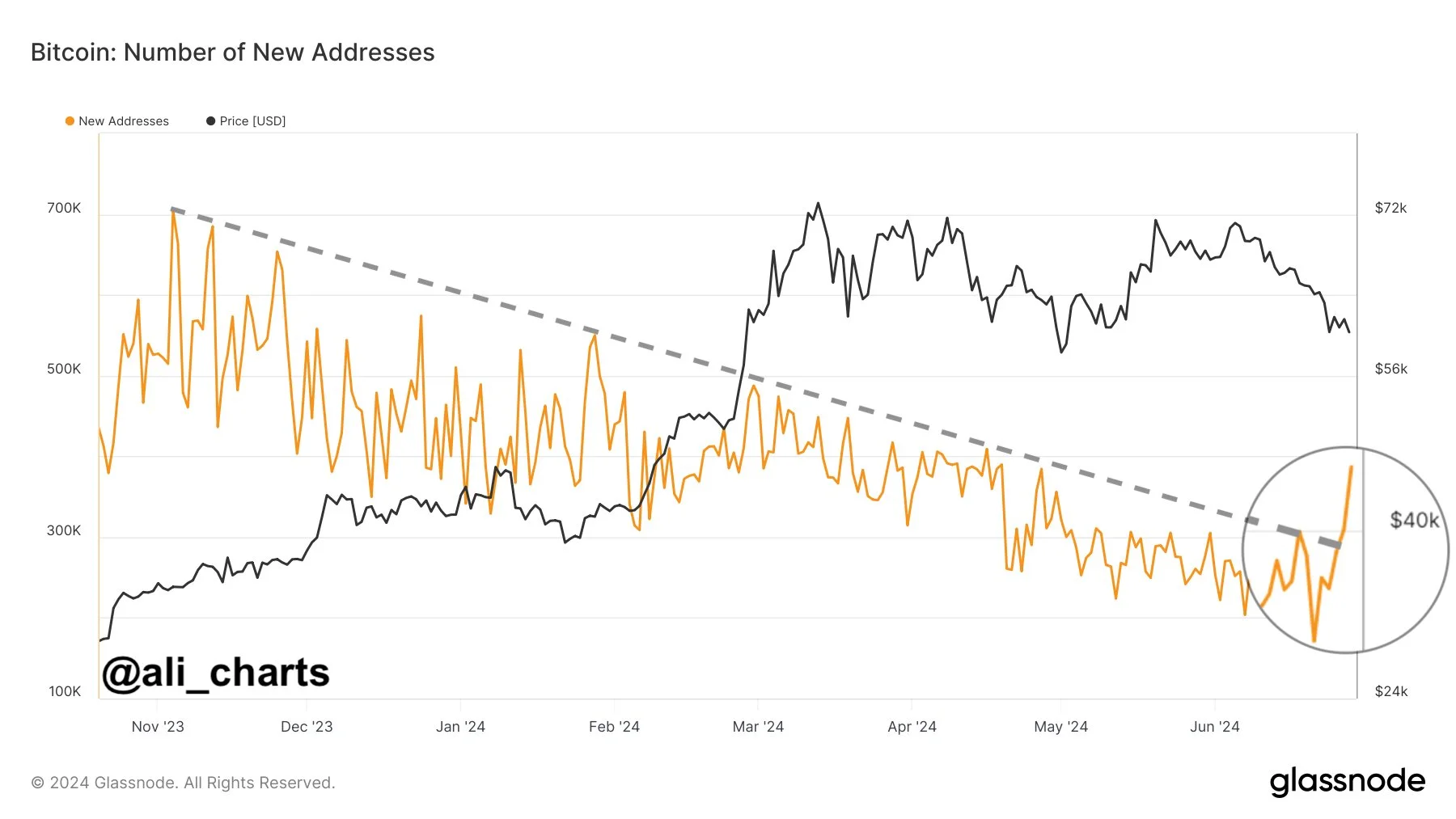

Additionally, Martinez highlighted a resurgence of individual investors in Bitcoin. The number of new BTC addresses on the network has risen to 352,124, marking its highest level since April.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

3

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

4

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

5

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

3

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

4

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

5

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read