Top 30 Altcoin Plummets, Leaving Investors in Limbo

14.04.2025 9:00 1 min. read Alexander Stefanov

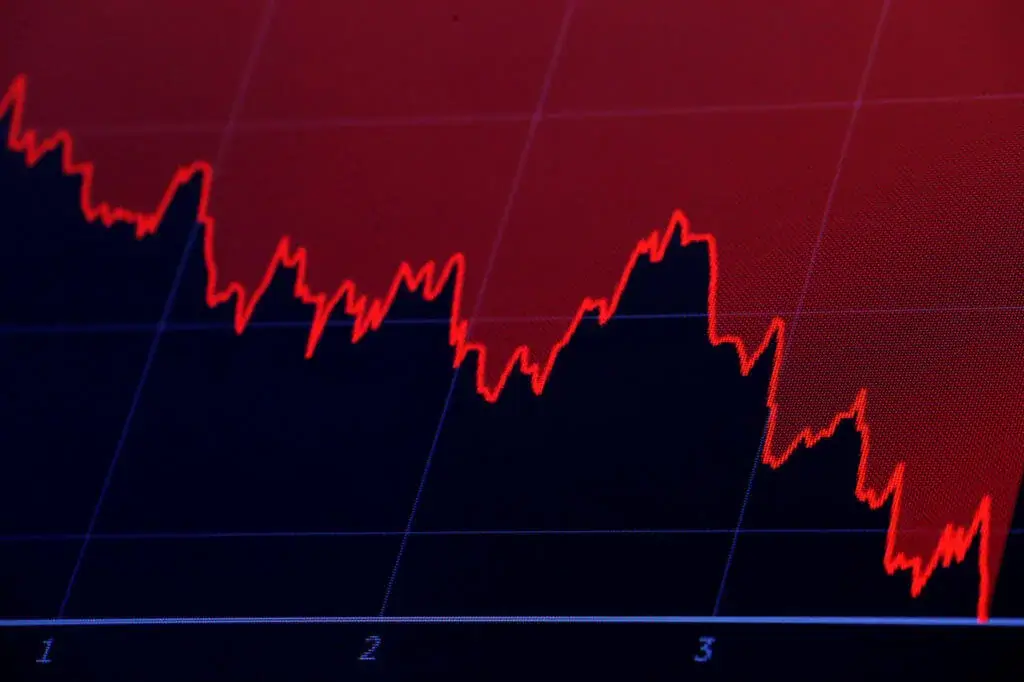

The cryptocurrency market was rocked today after Mantra (OM), once ranked among the top 30 altcoins, saw its value evaporate in a flash crash that erased over 90% of its price within hours.

Speculation quickly spread that members of the project’s own development team may have triggered the collapse through large-scale sell-offs. However, the Mantra team has firmly denied any involvement, attributing the dramatic plunge to what they described as “reckless purges” unrelated to any internal actions.

“We want to make it absolutely clear—this wasn’t us,” the team stated in an official message to the community. “Mantra remains a fundamentally strong project. What happened today was unexpected and not connected to any decisions or actions from within our organization. We’re currently investigating the situation and will provide updates once we have more clarity.”

The statement was issued in response to mounting community frustration, especially after a comment from one of Mantra’s community leaders stirred backlash. The representative claimed that developers had no immediate awareness of the crash because it occurred during nighttime hours in Hong Kong—a remark that didn’t sit well with investors searching for accountability.

As uncertainty lingers around OM, crypto traders and holders are being urged to approach the token with extreme caution. With no clear explanation yet and volatility still high, the situation remains fluid and potentially risky for those looking to engage with the asset.

-

1

BNB Chain Overtakes Solana as Top Blockchain for Memecoin Trading

16.06.2025 10:00 2 min. read -

2

Shiba Inu Hangs by a Thread as Chart Signals 50% Breakdown

21.06.2025 15:00 2 min. read -

3

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

4

Mass Liquidations and Wallet Dumps Sink ZKJ

17.06.2025 15:00 1 min. read -

5

Binance to Delist Three Spot Trading Pairs on June 20

18.06.2025 19:00 1 min. read

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

According to the latest Santiment report, the crypto market is entering a critical phase, with a mix of bullish on-chain signals and cautionary sentiment indicators.

Russia’s Rostec to Launch Ruble-Backed Stablecoin on Tron Blockchain

Russian state-owned defense and technology giant Rostec has unveiled plans to launch a ruble-pegged stablecoin and digital payments platform by the end of 2025, marking one of the country’s most significant moves yet toward blockchain-based financial infrastructure.

What’s Ahead for Ethereum, According to Former Core Developer

Former Ethereum core developer Eric Conner has outlined a compelling bullish thesis for Ethereum (ETH), pointing to a convergence of on-chain data and institutional flows that could set the stage for a significant price surge.

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

Pepe (PEPE) has been trending lower in the past few days and has underperformed some of its peers as investors seem to have been increasingly drawn to Solana-based tokens. The launch of the first Solana ETF in the United States along with key paperwork submissions for a Pudgy Penguins (PENGU) ETF has pushed PEPE temporarily […]

-

1

BNB Chain Overtakes Solana as Top Blockchain for Memecoin Trading

16.06.2025 10:00 2 min. read -

2

Shiba Inu Hangs by a Thread as Chart Signals 50% Breakdown

21.06.2025 15:00 2 min. read -

3

Ethereum Loses Retail Momentum as Bitcoin Pulls Ahead

20.06.2025 21:00 1 min. read -

4

Mass Liquidations and Wallet Dumps Sink ZKJ

17.06.2025 15:00 1 min. read -

5

Binance to Delist Three Spot Trading Pairs on June 20

18.06.2025 19:00 1 min. read