The Silent Bull Run: Bitcoin Climbs, Retail Stays Quiet

18.04.2025 9:00 2 min. read Alexander Stefanov

Bitcoin has soared to new heights in 2024, yet the excitement that once accompanied these milestones is strangely missing. Instead of wild rallies and viral trading crazes, the current market feels almost businesslike—more calm than chaos.

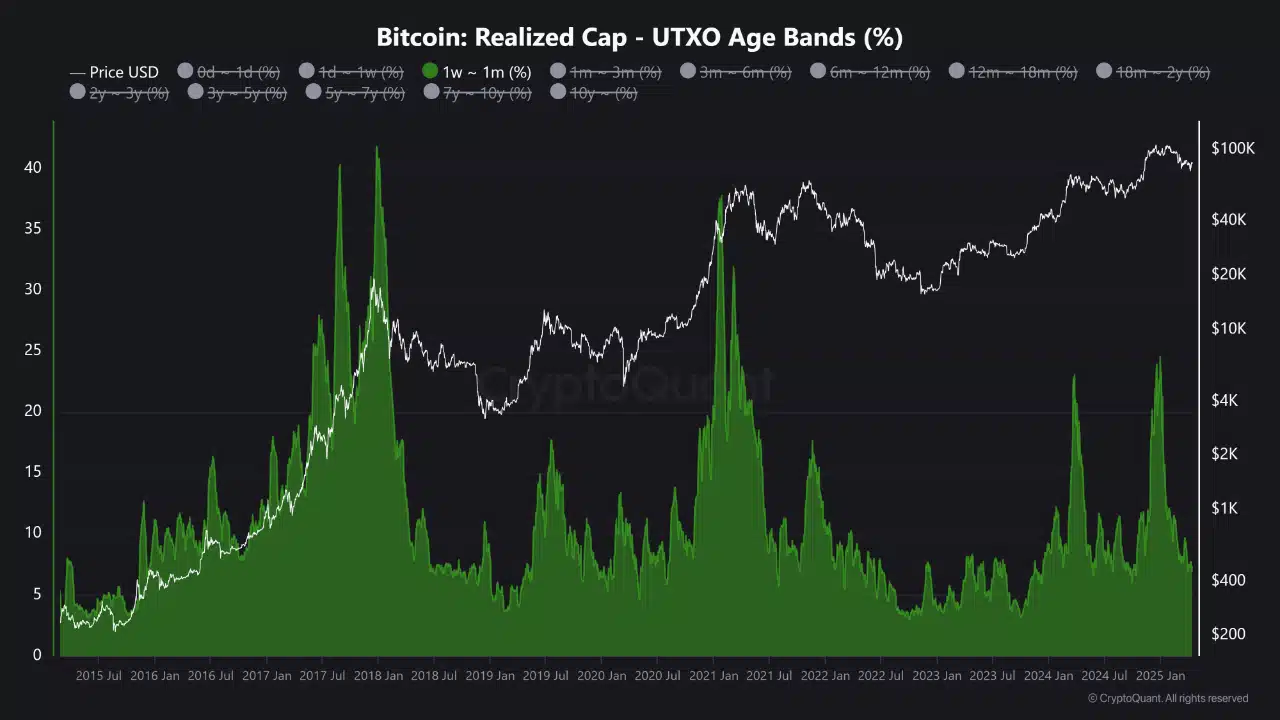

Gone are the days when a flood of small investors would send prices parabolic at every new high. On-chain trends confirm that the retail crowd, usually represented by short-term holders chasing quick profits, is nowhere to be seen this time around.

What’s changed? Unlike the wild days of easy stimulus and rock-bottom interest rates that fueled the last major bull run, today’s environment is shaped by tighter monetary policy and more cautious capital. Interest rates remain elevated, central banks are pulling back support, and money is flowing much more selectively into the crypto space.

Meanwhile, the real force behind this year’s rally has come from institutional players. The launch of spot Bitcoin ETFs opened the doors for large funds and professional investors to quietly take the reins. Their approach is a far cry from the impulsive trades of retail buyers; institutions deploy capital in measured tranches and focus on long-term positioning rather than short-term hype.

This transition is obvious in how Bitcoin is moving. The manic energy that once defined crypto rallies has given way to a more measured, even subdued advance. There’s less drama—fewer spikes in volatility, but also fewer waves of panic-selling or buying. Price moves feel deliberate, and the bull run is progressing with a kind of quiet confidence.

Blockchain data reinforces the story. In previous cycles, big jumps in coins moving within the 1-week to 1-month range signaled frenzied retail activity near market tops. In 2024, that pattern is largely absent—most of the supply is held by experienced, long-term holders who aren’t rushing to sell.

Rather than a frenzied crowd chasing every tick, Bitcoin’s new era looks more like a boardroom than a stadium. And for some, this patient, disciplined atmosphere could be the healthiest sign yet for the digital asset’s maturity.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read

Metaplanet Now Holds 13,350 BTC Worth $1.4 Billion

Metaplanet has expanded its Bitcoin treasury with a new acquisition of 1,005 BTC valued at approximately $108.1 million, further cementing its status as one of the largest corporate holders of the digital asset.

Bitcoin Averages 37% Rebound After Crises, Binance Research Finds

Despite common fears that global crises spell disaster for crypto markets, new data from Binance Research suggests the opposite may be true — at least for Bitcoin.

Bitcoin Mining Faces Profit Crunch, But No Panic Selling

A new report by crypto analytics firm Alphractal reveals that Bitcoin miners are facing some of the lowest profitability levels in over a decade — yet have shown little sign of capitulation.

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

Bitcoin’s network hashrate has fallen 3.5% since mid-June, marking the sharpest decline in computing power since July 2024.

-

1

Bitcoin to Track Global Economy, Not Dollars, Says Crypto Expert

09.06.2025 18:00 2 min. read -

2

Blockchain Group Bets Big on Bitcoin With Bold €300M Equity Deal

09.06.2025 22:00 2 min. read -

3

Bitcoin on a Path to $1 Million as Wall Street Embraces Digital Gold – Mike Novogratz

14.06.2025 19:00 1 min. read -

4

Bank of America Compares Bitcoin to History’s Most Disruptive Inventions

17.06.2025 14:00 1 min. read -

5

Here is What to Expect From Bitcoin by End of 2025

17.06.2025 19:00 2 min. read