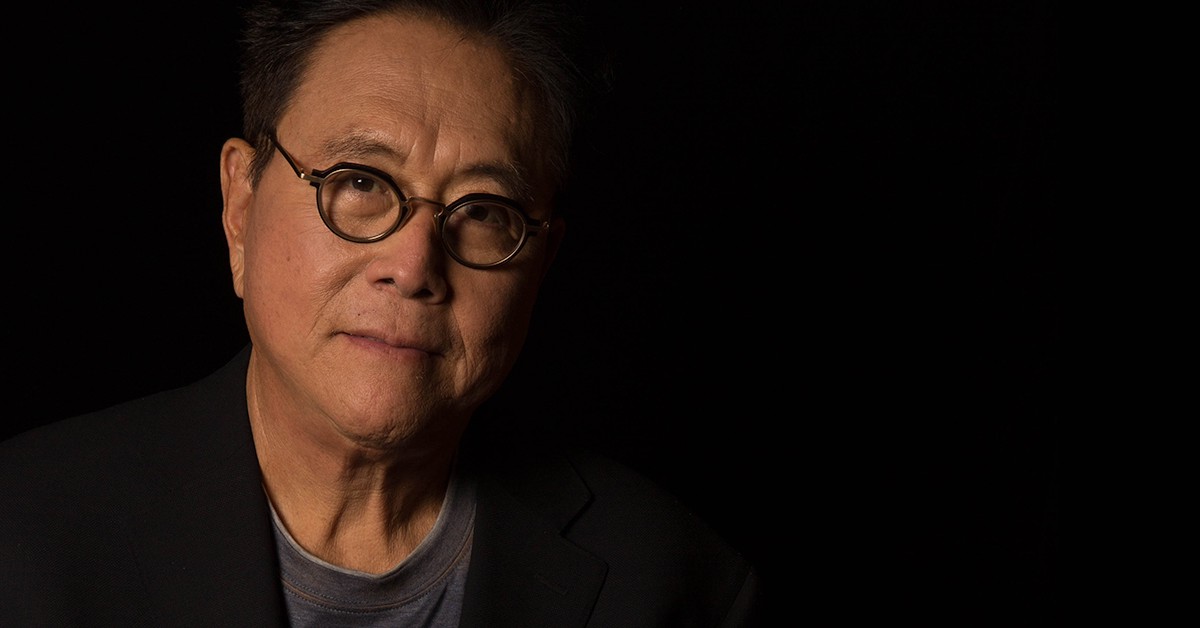

The Banking Crisis Has Already Begun – Robert Kiyosaki

03.11.2024 15:13 2 min. read Kosta Gushterov

Robert Kiyosaki, author of the book "Rich Dad, Poor Dad", issued a serious warning for the US banking sector, saying that the serious downturn has already begun.

Pointing to the recent closure of a bank in Oklahoma as a key indicator, Kiyosaki expressed concern that both the bond and commercial real estate markets are highly vulnerable to such downturns, echoing long-standing concerns about the state of the financial system.

Banking crash has begun. Oklahoma bank shuts its doors. Watch out bonds and commercial real estate markets next to go.

Take care

— Robert Kiyosaki (@theRealKiyosaki) November 2, 2024

Kiyosaki has consistently expressed skepticism about the U.S. banking and economic systems, which he says are heavily influenced by what he describes as a “fake” U.S. dollar – the product of a corrupt and unsustainable monetary system.

READ MORE:

Interest Rate Cuts and Election Speculation Set to Boost Bitcoin Prices, Claims WonderFi CEO

In his view, the dollar’s diminishing value and dependence on flawed financial practices set the stage for the worst economic crisis since the Great Depression of 1929.

As a means of guarding against these risks, Kiyosaki has long recommended investing in assets with intrinsic value and limited supply, such as gold, silver and Bitcoin.

He considers Bitcoin to be “thepeople’s money” because of its decentralized nature and limited supply, which contrasts sharply with traditional currency. In his view, these assets offer the best protection for people who want to preserve their wealth amid what he describes as an ongoing “firestorm” in financial markets.

-

1

Federal Reserve Chair Jerome Powell Reportedly Weighing Resignation

12.07.2025 21:00 2 min. read -

2

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

3

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

4

Toncoin Launches UAE Golden Visa Program Through $100,000 Staking Offer

06.07.2025 12:04 2 min. read -

5

What’s Driving July’s Crypto Conversations, According to Santiment

05.07.2025 22:00 2 min. read

Stablecoins Now Used in Credit Cards, Putting Bank Deposits at Risk

Stablecoins are no longer just a crypto-native tool—they’re reshaping financial access, payments, and even central banking dynamics.

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

-

1

Federal Reserve Chair Jerome Powell Reportedly Weighing Resignation

12.07.2025 21:00 2 min. read -

2

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

3

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

4

Toncoin Launches UAE Golden Visa Program Through $100,000 Staking Offer

06.07.2025 12:04 2 min. read -

5

What’s Driving July’s Crypto Conversations, According to Santiment

05.07.2025 22:00 2 min. read