Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read Alejandro Ar

Sui (SUI) has gone up by 3% today as trading volumes shot up despite the overall uncertainty caused by the latest events in the Middle East.

The market has started the week with a positive tone ahead of the upcoming meeting of the Federal Open Market Committee (FOMC) of the U.S. Federal Reserve.

The market’s consensus is that no changes will be made to the institution’s federal funds rate. However, comments from Chairman Jerome Powell will be scrutinized to predict what the central bank’s next move could be.

Market sentiment has been neutral despite the latest developments as the Fear and Greed Index currently sits at 52.

However, there are a few variables including the outcome of the negotiations between the U.S. and China on tariffs that could still ignite a spike in volatility in the crypto market.

Daily transactions on Sui have declined sharply in the past 30 days as demand for the token has dried up ever since it failed to retest the $5 level.

As a result, SUI has performed negatively in the past month, delivering losses of around 20% during this period. However, one technical pattern favors a bullish Sui price prediction and, in this article, we will share more details about this.

SUI Price Prediction: Another Push to $5 is Coming?

The daily price chart shows that SUI has formed a descending triangle pattern as the token has found strong support at $2.80.

The short-term exponential moving averages (EMAs) have been on a clear downtrend in this time frame after they made a ‘death cross’. However, they have not yet moved below the 200-day EMA, which means that the long-term trend is still bullish.

The market needed a pullback after the recent push above $4 as momentum indicators were flashing sell signals all over.

Now, the Relative Strength Index (RSI) seems poised to make a move above the 14-day moving average, which could be an early indication that positive momentum is picking up its pace again.

If SUI rises above its EMAs and breaks above the upper trend line shown in the chart, this would favor a bullish move that could lead to a retest of the $4 level and beyond.

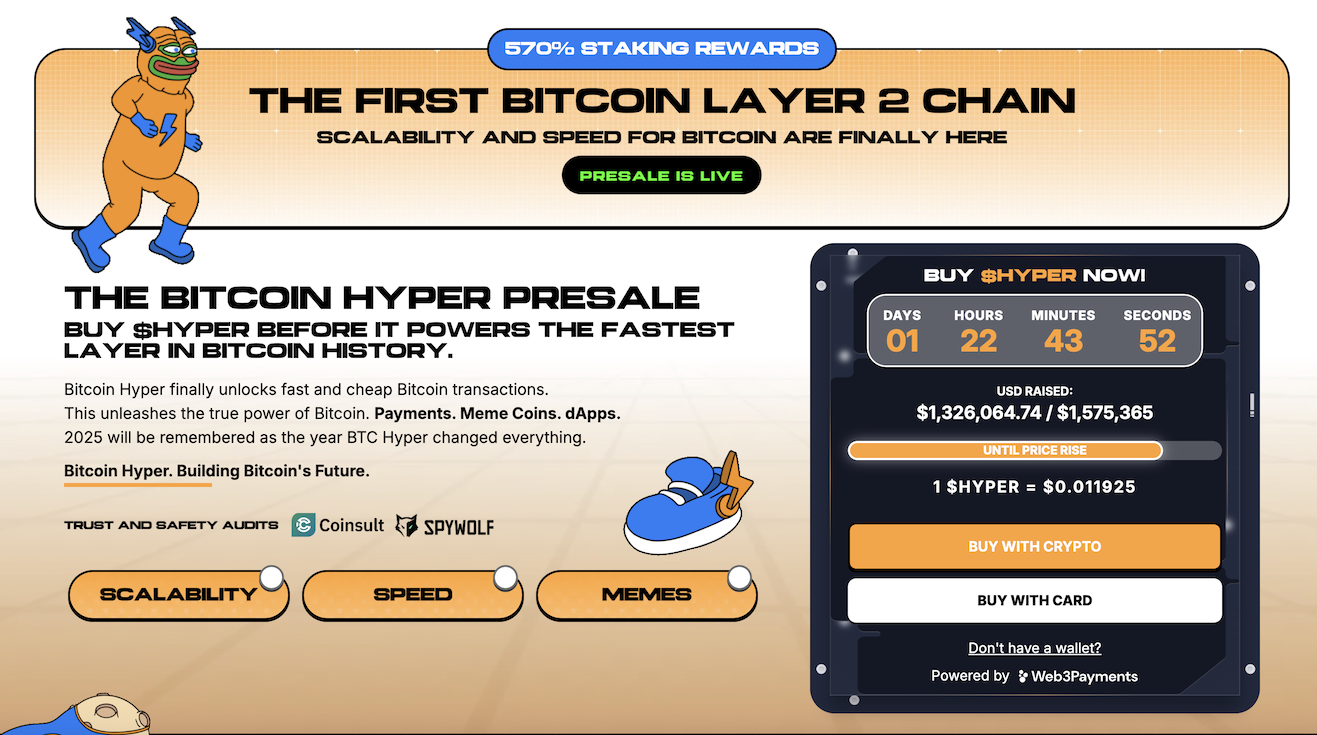

In the meantime, the presale event of a new layer-2 blockchain called Bitcoin Hyper (HYPER) has been attracting significant attention from investors. Here’s what you need to know.

Bitcoin Hyper (HYPER) Raises $1.3M Less Than 15 Days After Its Presale Kicked Off

Bitcoin Hyper (HYPER) aims to unlock the untapped potential of the Bitcoin network’s decentralized finance (DeFi) ecosystem by launching a scaling solution.

This layer-2 protocol will rely on the Solana Virtual Machine (SVM) to offer secure and efficient asset transfers within the Bitcoin blockchain to support the development of decentralized apps (dApps), meme coins, and and crypto payment platforms.

This solution could be the perfect substitute for the Lighting Network as the latter has failed to live up to the community’s expectations. Once it is adopted by wallets and exchanges, the demand for HYPER, its utility token, will likely explode.

To buy $HYPER at its discounted presale price, head to the Bitcoin Hyper website and connect your wallet (e.g. Best Wallet). You can either swap USDT or ETH for this token or use a bank card to make your investment.

-

1

Coinbase Expands 24/7 Futures to Solana, XRP, and Cardano Amid Rising Altcoin Demand

02.06.2025 11:00 2 min. read -

2

Altcoins Losing Steam as Market Momentum Tilts Toward Bitcoin, Says Analyst

03.06.2025 20:00 1 min. read -

3

Ethereum Begins Quiet Shift From Hype to Financial Backbone

09.06.2025 21:00 1 min. read -

4

Coinbase Adds ENA to Roadmap, Boosting Token’s Visibility

03.06.2025 12:00 1 min. read -

5

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read

Cardano Shows Signs of Recovery as Market Sentiment Turns Positive

Cardano is beginning to show fresh signs of strength, climbing just over 3% in the past day as the cryptocurrency market experiences a modest rebound.

Mass Liquidations and Wallet Dumps Sink ZKJ

Polyhedra Network says a mix of coordinated liquidity pulls, aggressive market-maker selling, and cascading liquidations drove its ZKJ token from $1.92 to $0.29 in a single afternoon on 15 June.

Canada Green-Lights First XRP ETF, Beating the U.S. to Market

Purpose Investments has received the green light to launch Canada’s first spot XRP ETF, with trading set to begin on June 18.

SEC Postpones Decision on Franklin Templeton Ethereum ETF Staking Proposal

The U.S. Securities and Exchange Commission has extended its review of Franklin Templeton’s proposed spot Ethereum ETF, which includes a staking component—adding to the growing list of delayed rulings on crypto-related funds.

-

1

Coinbase Expands 24/7 Futures to Solana, XRP, and Cardano Amid Rising Altcoin Demand

02.06.2025 11:00 2 min. read -

2

Altcoins Losing Steam as Market Momentum Tilts Toward Bitcoin, Says Analyst

03.06.2025 20:00 1 min. read -

3

Ethereum Begins Quiet Shift From Hype to Financial Backbone

09.06.2025 21:00 1 min. read -

4

Coinbase Adds ENA to Roadmap, Boosting Token’s Visibility

03.06.2025 12:00 1 min. read -

5

Crypto Enters a Make-or-Break Era, Says Industry Insider

04.06.2025 8:00 1 min. read