Stablecoins Now Used in Credit Cards, Putting Bank Deposits at Risk

22.07.2025 20:00 2 min. read Kosta Gushterov

Stablecoins are no longer just a crypto-native tool—they’re reshaping financial access, payments, and even central banking dynamics.

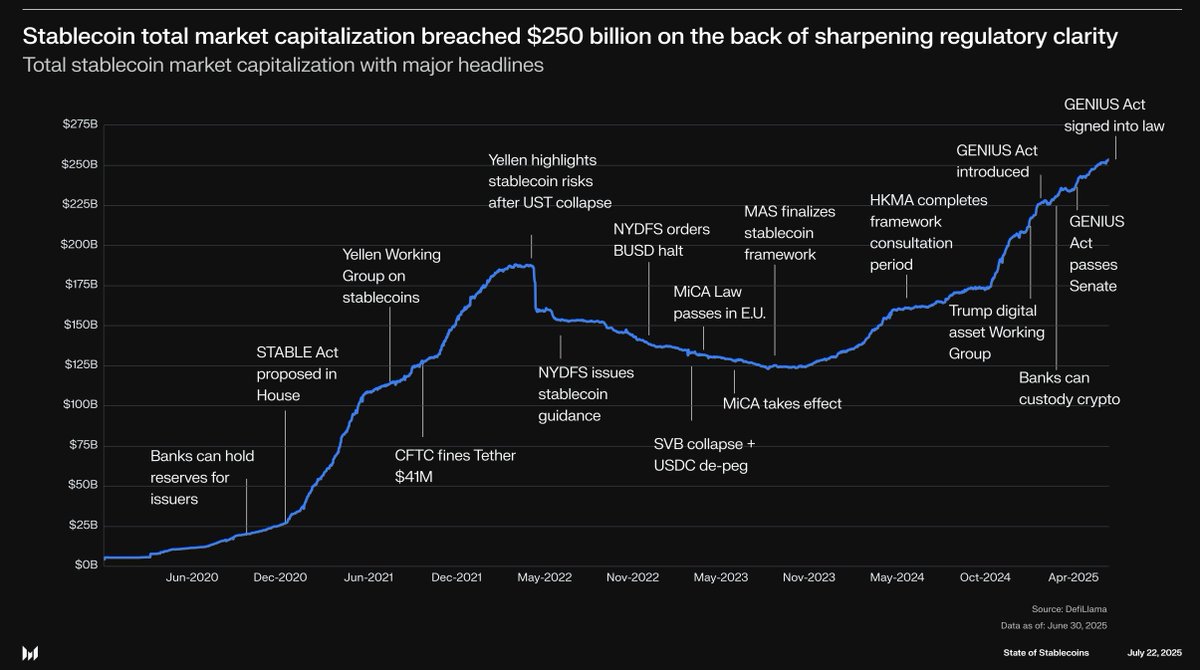

Recent insights shared by Messari highlight how dollar-pegged stablecoins are seeing record adoption globally, driven by inflation, cross-border demand, and advancing regulatory clarity.

A lifeline in high-inflation economies

In more than 22 countries, inflation exceeded 10% in 2024. Nations like Argentina, Venezuela, Turkey, and Nigeria, long plagued by currency instability, saw some of the largest surges in stablecoin adoption. According to Chainalysis, Turkey recorded the highest stablecoin purchasing volume relative to GDP. Dollar-pegged digital assets are increasingly seen as stable savings tools in regions where local currencies rapidly lose value.

Real-world spending and financial infrastructure

DeFi protocols like Hyperbeat are bridging the gap between blockchain assets and daily finance. Built on Hyperliquid, Hyperbeat enables users to load USDC or USDT and spend directly via a Visa card powered by Rain. Unspent funds can even earn yield or cashback rewards in HYPE. This blend of on-chain assets and real-world utility creates flexible, yield-generating spending lines backed by crypto.

Stablecoin market now rivals traditional financial rails

With a total market capitalization exceeding $250 billion, stablecoins are closing in on legacy payment giants like Visa and PayPal. Regulatory advancements, including the GENIUS Act, have helped solidify their position. Cross-border payment volume is projected to surpass $320 trillion by 2032, and stablecoins present a powerful solution to reduce friction and costs in that process.

Threat to traditional banking?

The U.S. Treasury has warned that the rise of tokenized money market funds and yield-bearing stablecoins could undermine traditional bank deposits. Funds held in savings, time deposits, and transactional accounts may flow into higher-yield, blockchain-based alternatives.

Dominance and profitability

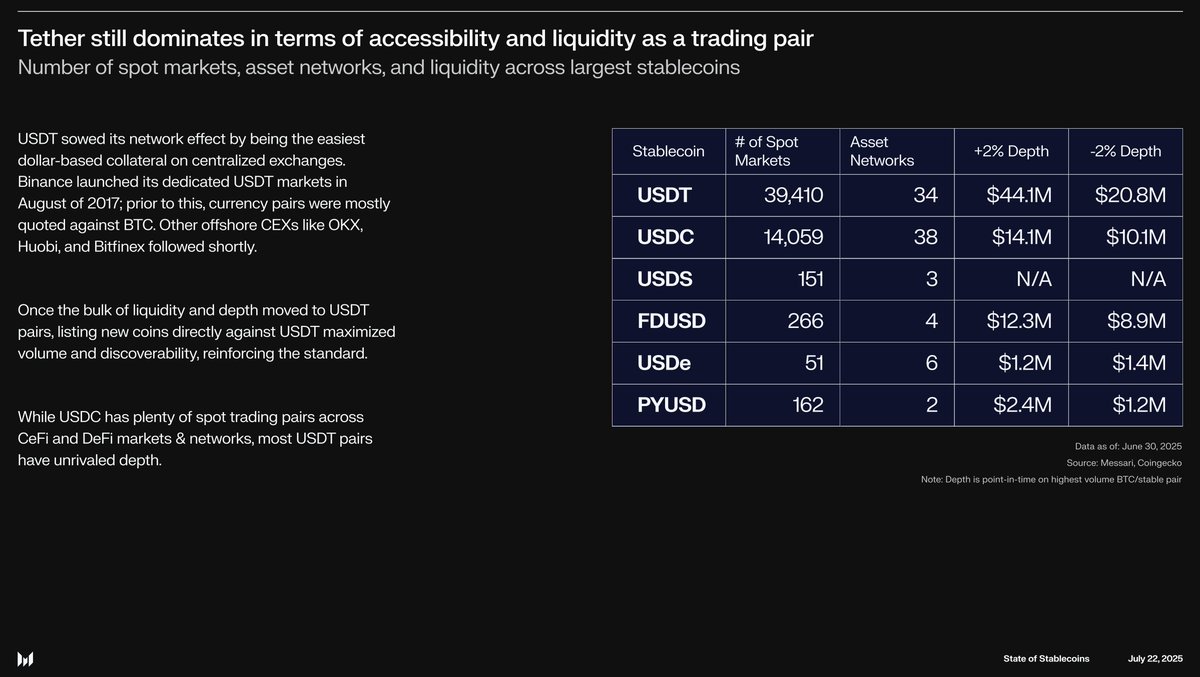

Tether (USDT) remains the most widely used stablecoin, with over 39,000 trading pairs and unmatched depth across centralized exchanges. It now generates profits on par with the largest ETFs, solidifying its dominance in both crypto markets and emerging financial systems.

-

1

Robinhood Faces Scrutiny from European Bank Over Tokenized Stock Offerings

08.07.2025 12:10 2 min. read -

2

At Least Five Law Firms Target Former Strategy Over Misleading BTC Risk Disclosures

28.06.2025 10:30 2 min. read -

3

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

4

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

5

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read

CoinShares Becomes First MiCA-Authorized Crypto Asset Manager in Europe

CoinShares, Europe’s top digital asset investment firm with over $9 billion in AUM, has secured full authorisation under the EU’s new Markets in Crypto-Assets (MiCA) regulation.

Fear & Greed Index Climbs to 70 as Altcoin Rotation Nears

The crypto market is entering a more bullish phase as sentiment pushes into “Greed” territory.

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

-

1

Robinhood Faces Scrutiny from European Bank Over Tokenized Stock Offerings

08.07.2025 12:10 2 min. read -

2

At Least Five Law Firms Target Former Strategy Over Misleading BTC Risk Disclosures

28.06.2025 10:30 2 min. read -

3

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

4

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

5

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read