Spot Ethereum ETFs Trading Volume Surpassed $1 Billion on the First Day

23.07.2024 22:47 1 min. read Alexander Stefanov

The first day of trading for spot Ethereum ETFs has gone beyond expectations with incredible volume and inflows.

At first market analysts and experts forecasted that spot Ethereum ETFs will not attract that much investments.

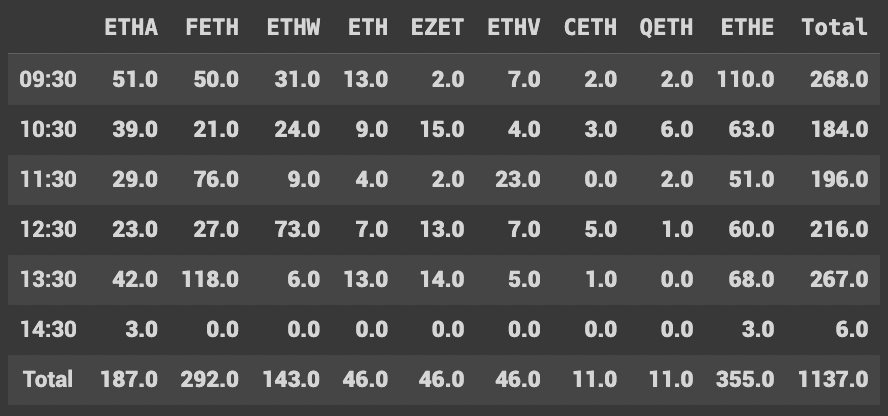

However, this is not the case, as the daily inflows reached over $885.3 million with a trading volume $1.137 billion. Grayscale Ethereum Trust (ETHE) and the Fidelity Ethereum Fund (FETH) recorded the highest inflows out of all 9 instruments.

In comparison during the first day of trading for spot Bitcoin ETFs, the trading volume reached $4.66 billion with a $655 million daily inflows.

READ MORE:

Is the Altcoin Season Approaching?

At the time of writing Ethereum is trading at $3,488 after a 1.35% surge in the past hour and hasa trading volume of around $23.6 billion

-

1

BNB Chain Overtakes Solana as Top Blockchain for Memecoin Trading

16.06.2025 10:00 2 min. read -

2

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read -

3

Shiba Inu Hangs by a Thread as Chart Signals 50% Breakdown

21.06.2025 15:00 2 min. read -

4

Mass Liquidations and Wallet Dumps Sink ZKJ

17.06.2025 15:00 1 min. read -

5

USDC Poised for Futures Collateral Role in Coinbase–Nodal Clear Initiative

19.06.2025 16:00 1 min. read

Russia’s Rostec to Launch Ruble-Backed Stablecoin on Tron Blockchain

Russian state-owned defense and technology giant Rostec has unveiled plans to launch a ruble-pegged stablecoin and digital payments platform by the end of 2025, marking one of the country’s most significant moves yet toward blockchain-based financial infrastructure.

What’s Ahead for Ethereum, According to Former Core Developer

Former Ethereum core developer Eric Conner has outlined a compelling bullish thesis for Ethereum (ETH), pointing to a convergence of on-chain data and institutional flows that could set the stage for a significant price surge.

Pepe Price Prediction: One-Month Trend Line Resistance Breakout Could Push PEPE to $0.000015

Pepe (PEPE) has been trending lower in the past few days and has underperformed some of its peers as investors seem to have been increasingly drawn to Solana-based tokens. The launch of the first Solana ETF in the United States along with key paperwork submissions for a Pudgy Penguins (PENGU) ETF has pushed PEPE temporarily […]

Top 10 Trending Cryptocurrencies Today, According to CoinGecko

As digital assets continue to dominate financial headlines, traders are closely watching which coins are gaining the most momentum.

-

1

BNB Chain Overtakes Solana as Top Blockchain for Memecoin Trading

16.06.2025 10:00 2 min. read -

2

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read -

3

Shiba Inu Hangs by a Thread as Chart Signals 50% Breakdown

21.06.2025 15:00 2 min. read -

4

Mass Liquidations and Wallet Dumps Sink ZKJ

17.06.2025 15:00 1 min. read -

5

USDC Poised for Futures Collateral Role in Coinbase–Nodal Clear Initiative

19.06.2025 16:00 1 min. read