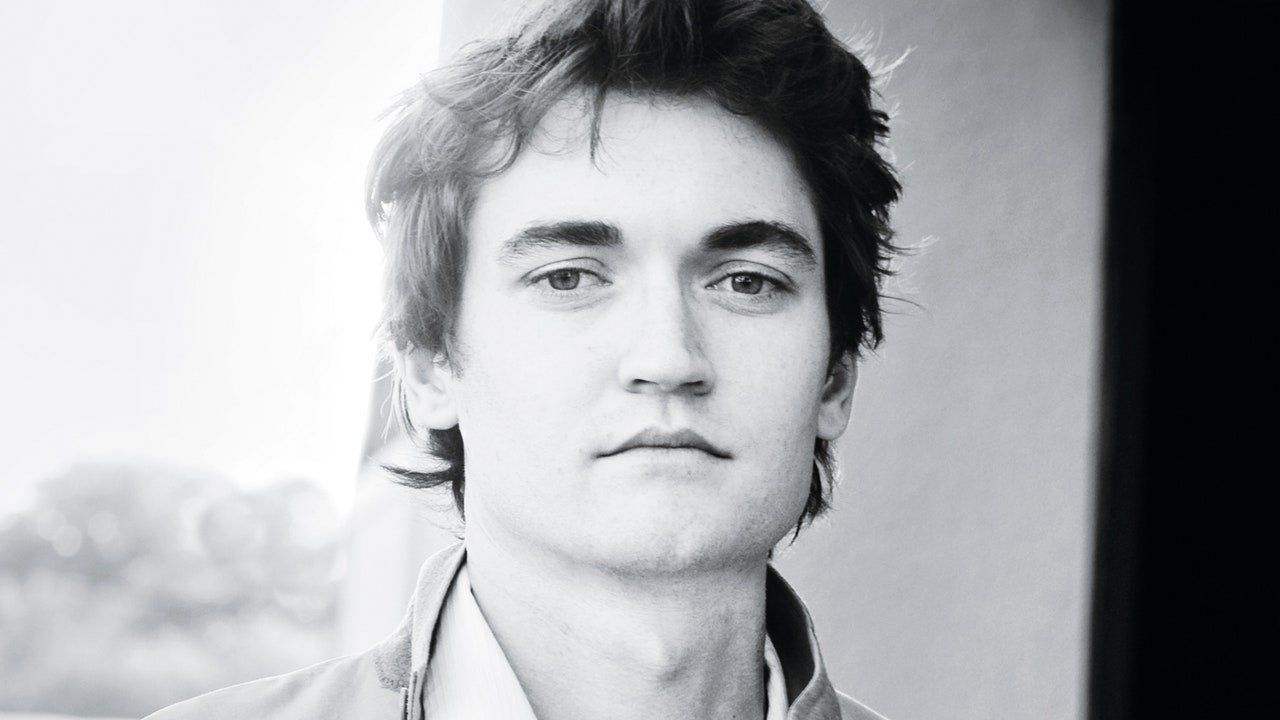

Ross Ulbricht Wallets Lose Millions After Fatal Liquidity Mistake

31.01.2025 14:00 2 min. read Alexander Zdravkov

A costly trading error has reportedly drained $12 million from crypto wallets linked to Ross Ulbricht, the recently pardoned founder of Silk Road.

The incident, detailed by blockchain analytics firm Arkham Intelligence, occurred when an attempt to provide liquidity for the memecoin ROSS backfired, allowing an automated trading bot to exploit the mistake.

Following Ulbricht’s release, supporters launched the ROSS token, intended as a tribute. However, when liquidity was added to the decentralized exchange Raydium, the transaction was misconfigured. As a result, a bot detected the mispricing, swiftly acquiring $1.5 million worth of tokens—around 5% of the total supply—and reselling them for profit.

Instead of recovering from the setback, another attempt was made, but the same error occurred on a larger scale. This time, the bot captured an additional $10.5 million worth of tokens, equivalent to 35% of the supply. The sudden influx of available tokens caused ROSS’s price to collapse by 90%.

Despite the heavy losses, Ulbricht-associated wallets still hold a portion of the remaining tokens, with around $200,000 in value. The affected wallets are listed for donations on FreeRoss.org, a campaign dedicated to his cause.

Ulbricht, once the mastermind behind Silk Road, operated the Bitcoin-fueled dark web marketplace until his arrest in 2013. He was sentenced to multiple life terms in 2015, but on January 22, former U.S. President Donald Trump granted him clemency, fulfilling a long-standing campaign pledge tied to the crypto community.

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

3

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

3

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read