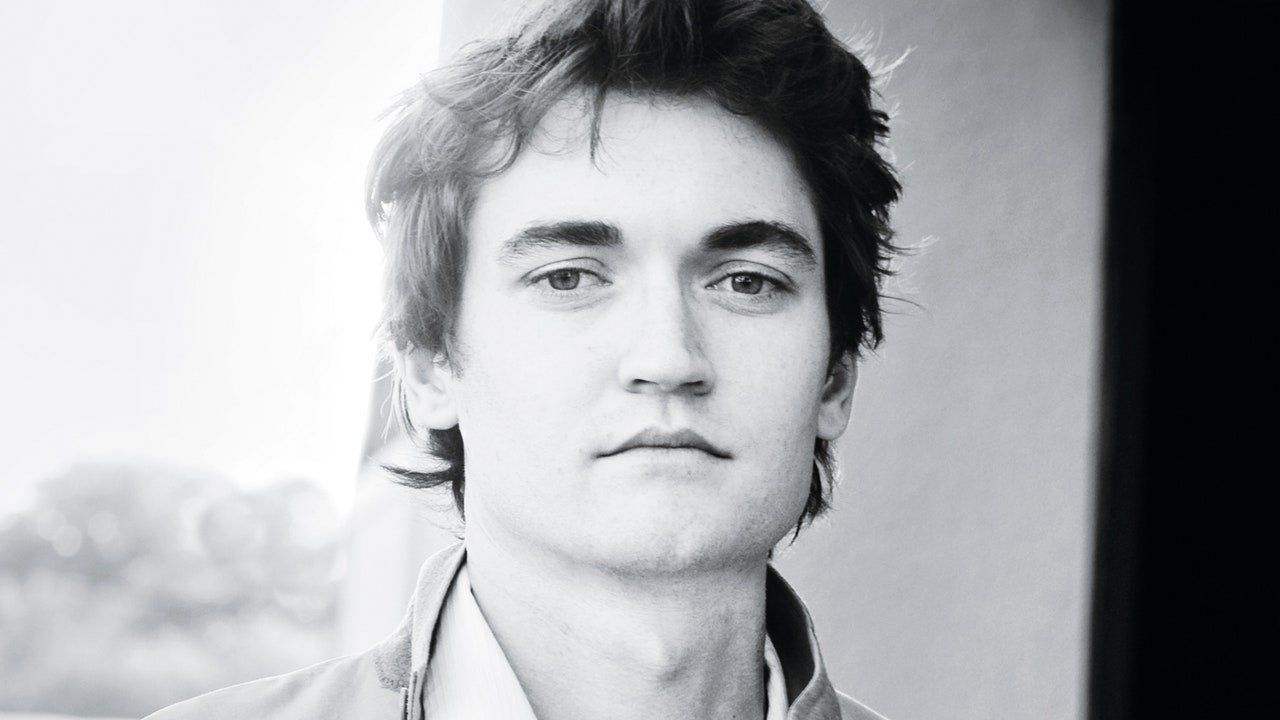

Ross Ulbricht Reunites with Family as Support Pours In

24.01.2025 18:00 2 min. read Alexander Zdravkov

Silk Road founder Ross Ulbricht, once sentenced to life without parole, is now a free man after receiving a full pardon from former U.S. President Donald Trump.

Speaking publicly for the first time since his release, Ulbricht expressed his gratitude, calling the pardon a transformative moment that restored his life and future after 11 years in prison.

In a video shared on January 23, Ulbricht described the experience as surreal, highlighting his deep appreciation for Trump’s decision. Supporters of Ulbricht have shared heartfelt accounts of his reunion with family, describing the past few days as a whirlwind of joy and disbelief.

Following his release, Ulbricht received overwhelming support, with donations pouring into a wallet tied to the “Free Ross” campaign. Contributions have exceeded $270,000, including a $111,111 donation from crypto exchange Kraken and smaller amounts in cryptocurrencies like Ethereum, Solana, and Dogecoin. Ulbricht stated he plans to use this time to reconnect with loved ones and heal from his years behind bars.

While supporters have rallied behind him, it’s believed Ulbricht may have access to a significant Bitcoin fortune. Coinbase executive Conor Grogan revealed that 430 BTC, worth $47 million, remains untouched in wallets linked to Ulbricht, with some dormant for over 13 years. These funds were never seized by authorities, sparking speculation about his financial future.

Ulbricht views his release as a testament to the power of redemption and hopes to use his newfound freedom to rebuild his life while advocating for second chances.

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

3

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

3

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read