Robinhood Halted 24-Hour Trading In Response to Market Volatility

05.08.2024 10:15 1 min. read Kosta Gushterov

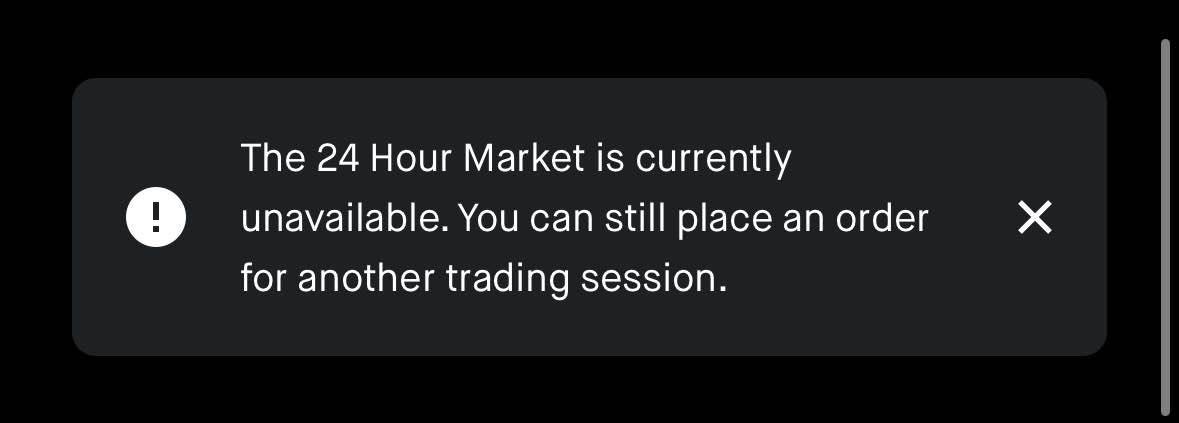

Robinhood has suspended its 24-hour trading feature in response to increased market volatility.

The decision itself was most likely prompted by the fact that financial analysts say fears of a global recession have increased following the dramatic $2.9 trillion drop in the value of stock markets.

The drop, reported on August 2, 2024, is the biggest since March 16, 2020, when the COVID pandemic sparked similar concerns.

The move aims to stabilize trading conditions and prevent excessive risk for investors. Robinhood’s suspension of round-the-clock trading highlights the ongoing challenges in managing market volatility and ensuring a balanced trading environment for consumers.

This is not the first time the company has decided to suspend trading activities.

On previous occasions, such as during the GameStop stock short squeeze in January 2021, the platform took similar measures.

-

1

Big Funds Sell $51B in May, But Buybacks Cushion U.S. Stock Market

20.06.2025 10:00 2 min. read -

2

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

3

Canton Network Developer Secures $135M to Expand Institutional Blockchain Use

25.06.2025 12:00 1 min. read -

4

Reddit Might Embrace Worldcoin’s Iris Scan to Verify Users Without Doxxing

21.06.2025 14:00 2 min. read -

5

AI Revolution Could Send Nasdaq Soaring, Says Market Expert

19.06.2025 14:00 1 min. read

Ripple Selects BNY Mellon as Custodian for RLUSD Stablecoin Reserves

Ripple has chosen global banking giant BNY Mellon to act as the primary custodian for reserves backing its enterprise-grade stablecoin, Ripple USD (RLUSD).

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

Goldman Sachs now expects the Federal Reserve to begin cutting interest rates sooner than previously anticipated, forecasting the first reduction as early as September 2025.

Robinhood Faces Scrutiny from European Bank Over Tokenized Stock Offerings

Lithuania’s central bank has reached out to Robinhood for further details regarding its newly launched stock token products, following a public distancing by OpenAI from the initiative.

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

As President Trump accelerates his tariff strategy ahead of the August 1 deadline, new White House letters reveal formal trade warnings sent to multiple nations, including Tunisia, Cambodia, Indonesia, and others.

-

1

Big Funds Sell $51B in May, But Buybacks Cushion U.S. Stock Market

20.06.2025 10:00 2 min. read -

2

BlackRock’s Bitcoin ETF Now Out-Earning Its $624B S&P 500 Fund

03.07.2025 10:00 1 min. read -

3

Canton Network Developer Secures $135M to Expand Institutional Blockchain Use

25.06.2025 12:00 1 min. read -

4

Reddit Might Embrace Worldcoin’s Iris Scan to Verify Users Without Doxxing

21.06.2025 14:00 2 min. read -

5

AI Revolution Could Send Nasdaq Soaring, Says Market Expert

19.06.2025 14:00 1 min. read