Robinhood Halted 24-Hour Trading In Response to Market Volatility

05.08.2024 10:15 1 min. read Kosta Gushterov

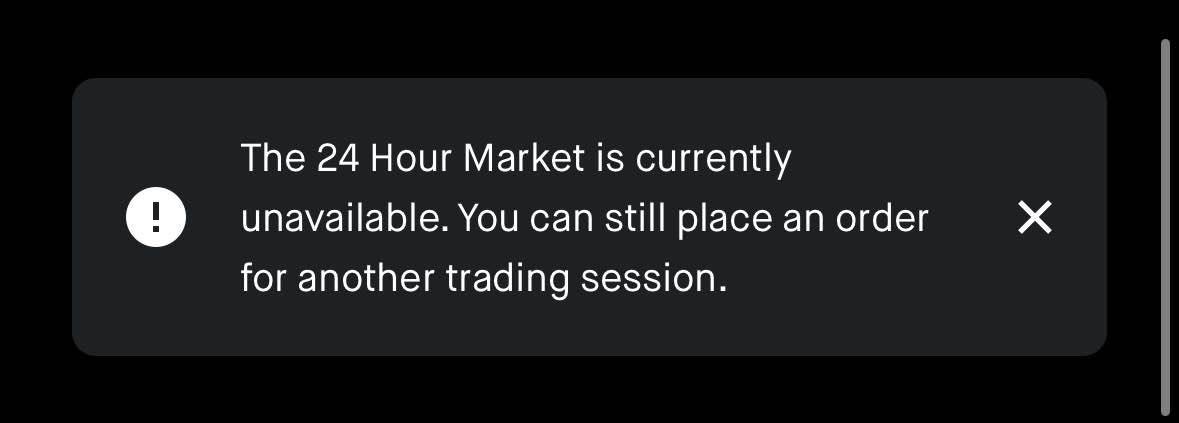

Robinhood has suspended its 24-hour trading feature in response to increased market volatility.

The decision itself was most likely prompted by the fact that financial analysts say fears of a global recession have increased following the dramatic $2.9 trillion drop in the value of stock markets.

The drop, reported on August 2, 2024, is the biggest since March 16, 2020, when the COVID pandemic sparked similar concerns.

The move aims to stabilize trading conditions and prevent excessive risk for investors. Robinhood’s suspension of round-the-clock trading highlights the ongoing challenges in managing market volatility and ensuring a balanced trading environment for consumers.

This is not the first time the company has decided to suspend trading activities.

On previous occasions, such as during the GameStop stock short squeeze in January 2021, the platform took similar measures.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read -

5

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read

History Shows War Panic Selling Hurts Crypto Traders

Geopolitical conflict rattles markets, but history shows panic selling crypto in response is usually the wrong move.

At Least Five Law Firms Target Former Strategy Over Misleading BTC Risk Disclosures

Bitcoin-focused investment firm Strategy Inc. (formerly MicroStrategy) is facing mounting legal pressure as at least five law firms have filed class-action lawsuits over the company’s $6 billion in unrealized Bitcoin losses.

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

Digital banking platform SoFi Technologies is making a strong return to the cryptocurrency space, relaunching its crypto trading and blockchain services after stepping away from the sector in late 2023.

Chinese Tech Firms Turn to Crypto for Treasury Diversification

Digital assets are gaining ground in corporate finance strategies, as more publicly traded companies embrace cryptocurrencies for treasury diversification.

-

1

UK Regulators Unveil PISCES – A New Era for Private Share Trading

11.06.2025 15:00 2 min. read -

2

Trump Turns 79 With Billions in Crypto and a $45M Parade

14.06.2025 22:00 2 min. read -

3

Polygon Breaks from Decentralization as Sandeep Nailwal Assumes Full Control

11.06.2025 20:00 2 min. read -

4

Nvidia CEO Urges UK to Invest in AI Infrastructure or Risk Falling Behind

10.06.2025 9:00 1 min. read -

5

KuCoin Plants Its Flag in Bangkok With a Licensed Thai Exchange

14.06.2025 13:00 1 min. read