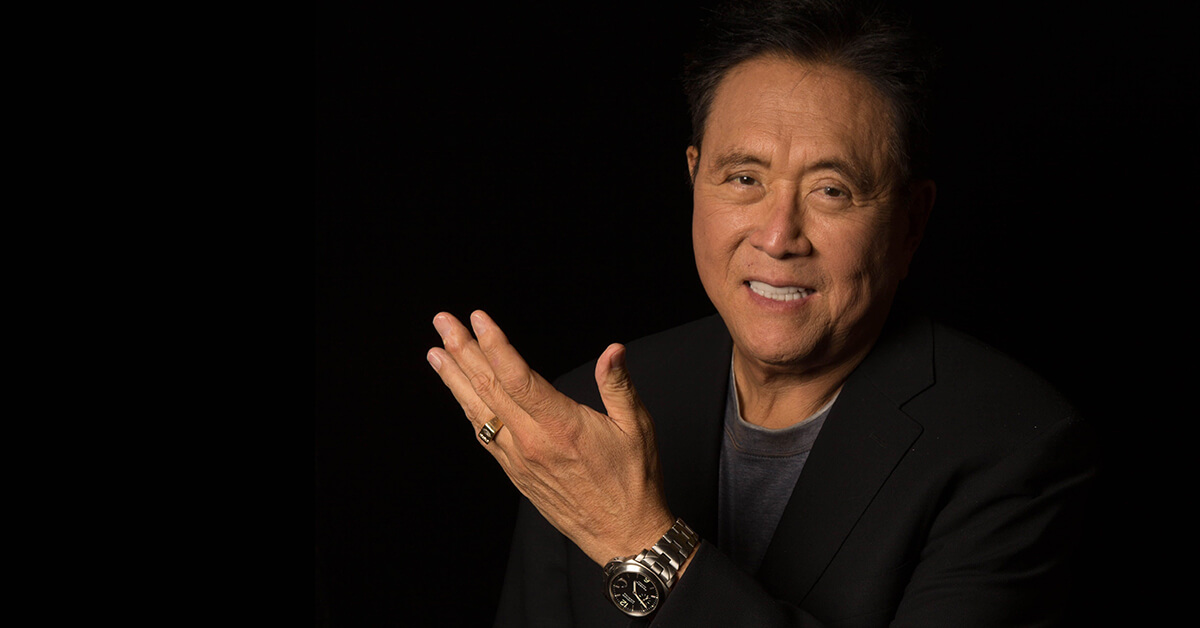

Robert Kiyosaki Warns of US Financial Risks and CBDC Threats

17.07.2024 7:00 1 min. read Alexander Stefanov

Robert Kiyosaki, renowned investor and author of 'Rich Dad Poor Dad,' continues to voice stark criticisms of the US financial system.

In a recent episode of his podcast, he discussed profound concerns about the economy and the implications of central bank digital currencies (CBDCs).

Highlighting the bailout of Silicon Valley Bank (SVB) last year, Kiyosaki criticized banks for using clients’ funds to invest in risky assets, leading to collapses and subsequent bank runs. He referred to top figures in US banking as “banksters,” a term echoing concerns raised by other financial analysts.

Regarding CBDCs like Fedcoin and FedNow, Kiyosaki expressed Orwellian fears about privacy invasion, likening the potential tracking capabilities to George Orwell’s ‘1984.’ He warned that such technologies could enable pervasive monitoring of financial transactions, eroding personal privacy.

Questioning the safety of banks amidst ongoing financial instability, Kiyosaki condemned the Federal Deposit Insurance Corporation’s (FDIC) bailout practices as undermining capitalism. He described the current economic situation as a “big mess,” emphasizing the loss of public trust in financial institutions.

-

1

Recession Fears Linger as Economic Signal Flashes Long-Term Warning

25.06.2025 9:00 2 min. read -

2

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

3

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

4

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

5

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

Robert Kiyosaki Predicts When The Price of Silver Will Explode

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

-

1

Recession Fears Linger as Economic Signal Flashes Long-Term Warning

25.06.2025 9:00 2 min. read -

2

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

3

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

4

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

5

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read