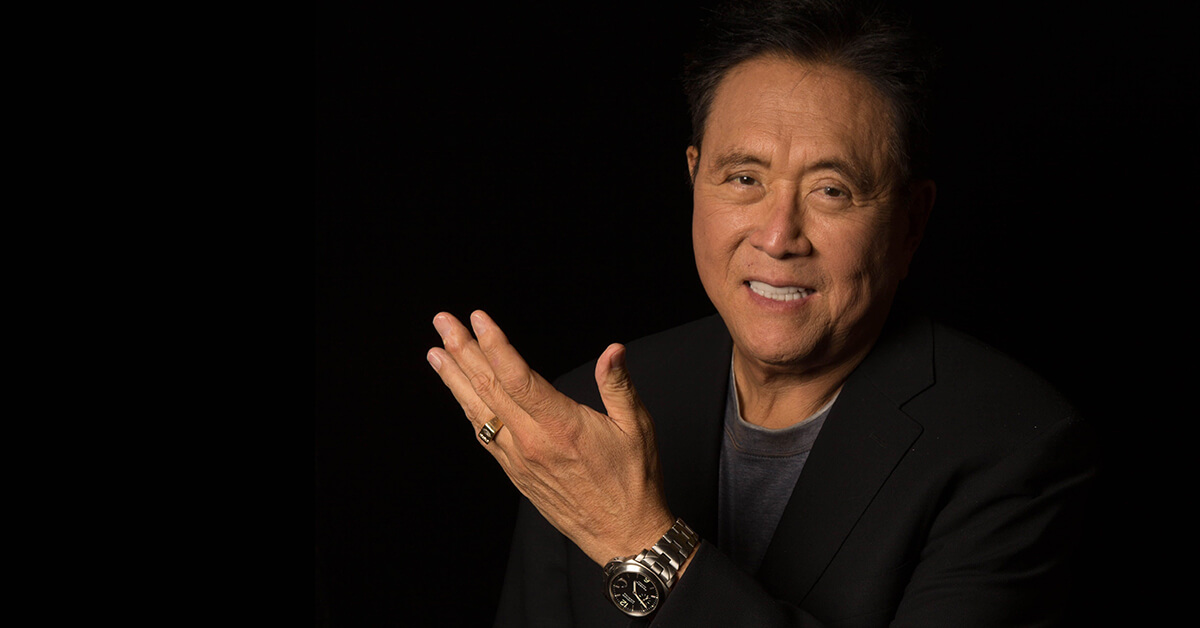

Robert Kiyosaki Warns of US Financial Risks and CBDC Threats

17.07.2024 7:00 1 min. read Alexander Stefanov

Robert Kiyosaki, renowned investor and author of 'Rich Dad Poor Dad,' continues to voice stark criticisms of the US financial system.

In a recent episode of his podcast, he discussed profound concerns about the economy and the implications of central bank digital currencies (CBDCs).

Highlighting the bailout of Silicon Valley Bank (SVB) last year, Kiyosaki criticized banks for using clients’ funds to invest in risky assets, leading to collapses and subsequent bank runs. He referred to top figures in US banking as “banksters,” a term echoing concerns raised by other financial analysts.

Regarding CBDCs like Fedcoin and FedNow, Kiyosaki expressed Orwellian fears about privacy invasion, likening the potential tracking capabilities to George Orwell’s ‘1984.’ He warned that such technologies could enable pervasive monitoring of financial transactions, eroding personal privacy.

Questioning the safety of banks amidst ongoing financial instability, Kiyosaki condemned the Federal Deposit Insurance Corporation’s (FDIC) bailout practices as undermining capitalism. He described the current economic situation as a “big mess,” emphasizing the loss of public trust in financial institutions.

-

1

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

2

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

3

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

4

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read

Robert Kiyosaki Predicts When The Price of Silver Will Explode

Robert Kiyosaki, author of Rich Dad Poor Dad, has issued a bold prediction on silver, calling it the “best asymmetric buy” currently available.

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

Fresh data on Personal Consumption Expenditures (PCE) — the Federal Reserve’s preferred inflation gauge — shows inflation ticked higher in May, potentially delaying the long-awaited Fed rate cut into September or later.

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

Federal Reserve Chair Jerome Powell is once again under fire, this time facing renewed criticism from Donald Trump over the Fed’s decision to hold interest rates steady in June.

U.S. National Debt Surge Could Trigger a Major Crisis, Says Ray Dalio

Billionaire investor Ray Dalio has sounded the alarm over America’s soaring national debt, warning of a looming economic crisis if no action is taken.

-

1

Robert Kiyosaki Predicts 2025 “Super-Crash,” Urges Hoarding Gold, Silver, and Bitcoin

23.06.2025 13:31 2 min. read -

2

Billionaire Slams Meme Stock Hype and Sounds Alarm on U.S. Fiscal Health

15.06.2025 18:00 2 min. read -

3

Nassim Taleb Says Global Trust Is Shifting from the Dollar to Gold

22.06.2025 17:00 1 min. read -

4

Billionaire Investor Sees Dollar Crash If Key Support Breaks

18.06.2025 15:00 1 min. read -

5

Geopolitical Shockwaves Hit Ethereum Hard While Bitcoin Stays Resilient

22.06.2025 16:21 1 min. read