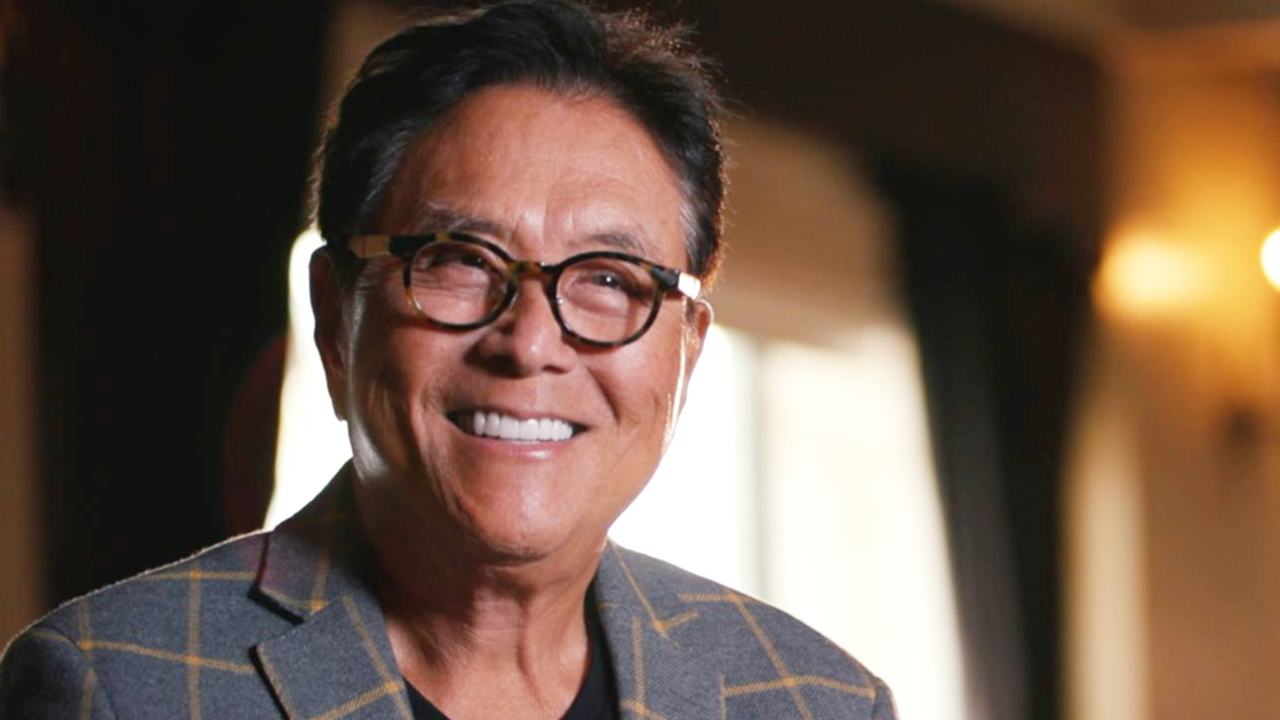

Robert Kiyosaki Warns of 1929-Style Crash, Urges Bitcoin Hedge

28.07.2025 10:00 2 min. read Kosta Gushterov

Financial author Robert Kiyosaki is once again sounding the alarm on America’s economic health.

In a recent social media post, he questioned the safety of traditional retirement portfolios packed with stocks and bonds, hinting at an imminent collapse resembling the 1929 Great Depression.

Kiyosaki pointed to legendary investors Warren Buffett and Jim Rogers, noting that both have significantly reduced their exposure to equities and bonds. According to him, their shift toward cash and silver isn’t accidental—it’s a signal that something deeper may be wrong.

Debt Concerns Fuel Flight to Hard Assets

Kiyosaki believes the root of the problem lies in the ballooning U.S. debt. He described America as the largest debtor nation in world history and warned that the current monetary system—propped up by continuous money printing—is unsustainable.

“The U.S. can only print money to pay its bills for so long,” he cautioned.

In light of these risks, Kiyosaki reaffirmed his trust in alternative stores of value. He’s holding firm with gold, silver, and Bitcoin as safe-haven assets. Unlike fiat currencies, he argues, these options offer long-term protection against inflation and systemic collapse.

Crisis or Correction? The Choice Is Yours

While some view Kiyosaki’s outlook as overly pessimistic, others see it as a necessary reminder to diversify beyond conventional assets. His message was clear: investors must do their own research and prepare for what he sees as a looming financial reset.

He ended with a sober note—advising caution, not panic. “Please take care,” Kiyosaki wrote, “and do your own research.”

-

1

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

2

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

3

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read

Bitcoin Risk Cycle Flips Again as Market Enters Safer Zone

Bitcoin’s market signal has officially shifted back into a low-risk phase, according to a new chart shared by Bitcoin Vector in collaboration with Glassnode and Swissblock.

Metaplanet Adds $92.5M in Bitcoin, Surpasses 17,000 BTC Holdings

Metaplanet Inc., a Tokyo-listed company, has just added 780 more Bitcoin to its treasury. The purchase, announced on July 28, cost around ¥13.666 billion or $92.5 million, with an average price of $118,622 per BTC.

China and U.S. Plan Trade Truce Extension Before Talks: How It Can Affect Bitcoin

The United States and China are expected to extend their trade truce by 90 days. The extension would delay new tariffs and create space for fresh negotiations in Stockholm.

Michael Saylor’s STRC IPO Tops U.S. Charts with $2.5B Raise

Michael Saylor, the high-profile Bitcoin advocate and executive chairman of MicroStrategy, has made headlines again—this time with the largest initial public offering (IPO) of 2025.

-

1

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

2

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read -

3

Canadian Bank Sees Bitcoin Hitting $155,000 by 2025

15.07.2025 10:00 1 min. read -

4

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

12.07.2025 20:00 1 min. read -

5

Strategy Claims It Can Weather a Bitcoin Crash to $20K Without Trouble

16.07.2025 14:08 1 min. read