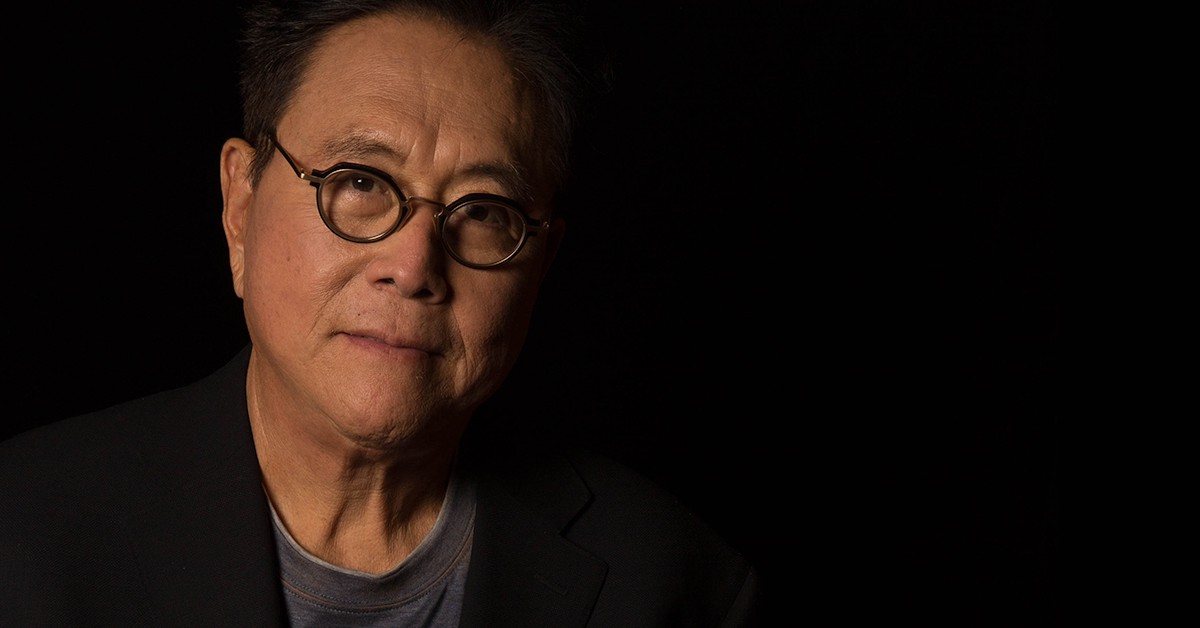

Robert Kiyosaki Reacts to Bitcoin’s Surge Past $120K: “I’m Buying One More”

14.07.2025 17:00 1 min. read Kosta Gushterov

Famed author of Rich Dad Poor Dad, Robert Kiyosaki, has once again thrown his support behind Bitcoin following its recent surge above $120,000, calling it a win for those who already hold the asset—and a wake-up call for those who don’t.

In a statement on X, Kiyosaki described the milestone as “great news” for Bitcoin holders, while expressing regret for those who hesitated to invest. “Bad news for those who never pulled the trigger. They own nothing,” he said.

Quoting one of his earlier warnings—”Pigs get fat… Hogs get slaughtered”—Kiyosaki noted that he is adding one more coin to his holdings. However, he also made clear that he won’t overextend himself until there’s more clarity on the direction of the economy.

Despite the temptation of projections showing Bitcoin hitting $200K to $1 million, Kiyosaki cautioned against becoming overconfident, advising newcomers to start small—“even with a Satoshi.” His message was part caution, part encouragement, reflecting a strategy built on discipline, not emotion.

READ MORE:

How Can You Tell When it’s Altcoin Season?

He also referenced Warren Buffett’s $350 billion cash position, speculating that Buffett is waiting for a global crash before buying top-tier assets. For Kiyosaki, this underlines the importance of preparing before the storm, not after.

Kiyosaki ended his message with a stark warning: “Millions are about to become poorer.” His advice? Study, be patient, and stay aware. “The best time to get rich is when others aren’t paying attention,” he hinted.

For Kiyosaki, Bitcoin remains the ultimate hedge in uncertain times.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

Bitcoin treasury firm Strategy—formerly known as MicroStrategy—has expanded its already-massive BTC holdings with a fresh $472.5 million acquisition.

Bitcoin Blasts Past $121,000 [Live blog schema]

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

Bitcoin has officially broken through the $121,000 level, rising 2.84% in the past 24 hours to hit $121,400, according to CoinMarketCap data.

Bitcoin Reaches $119,000 Milestone as Corporate Demand and ETF Inflows Rise

Bitcoin soared to a new all-time high above $119,000 on July 13, extending its bullish momentum on the back of institutional accumulation, shrinking exchange reserves, and technical breakout patterns.

-

1

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read -

2

Bitcoin ETF Inflows Explode Past $3.9B as BlackRock’s IBIT Leads the Charge

26.06.2025 18:08 1 min. read -

3

Bitcoin Surpasses Alphabet (Google) to Become 6th Most Valuable Asset Globally

27.06.2025 14:39 2 min. read -

4

Is Bitcoin a Missed Opportunity? This Billionaire Begins to Wonder

27.06.2025 12:00 1 min. read -

5

Bitcoin Price Prediction for the End of 2025 From Standard Chartered

02.07.2025 18:24 1 min. read