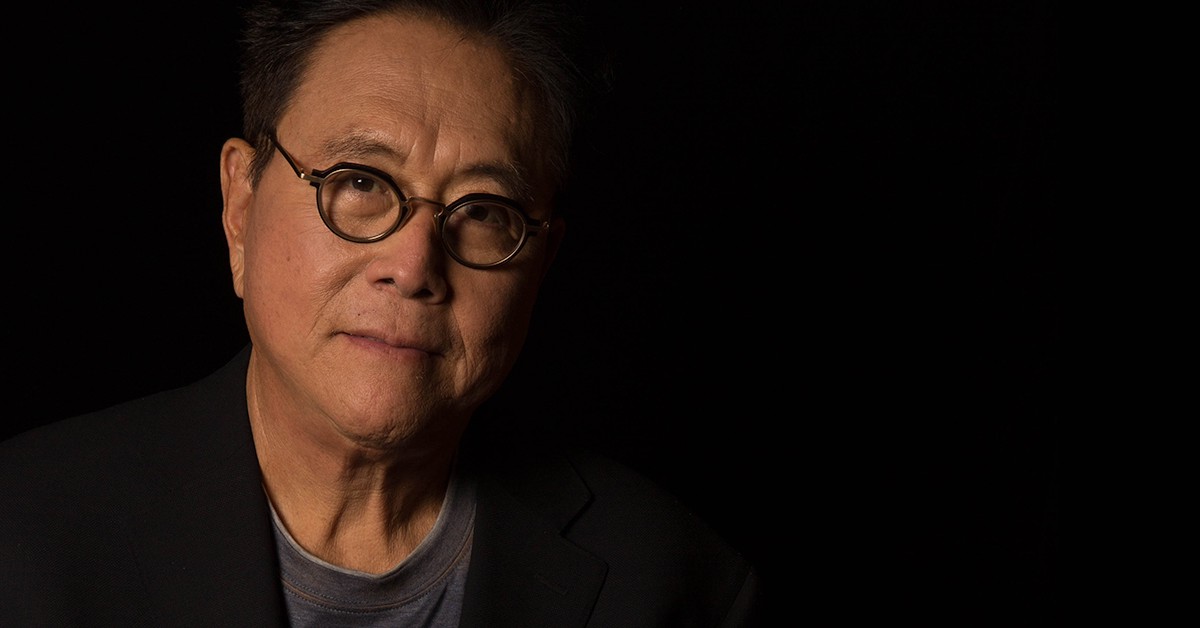

Robert Kiyosaki Faces Disappointment After Bitcoin Poll Falls Flat

28.04.2025 17:00 2 min. read Alexander Stefanov

Robert Kiyosaki, well-known for Rich Dad Poor Dad and his vocal support for Bitcoin, recently faced an unexpected lack of engagement from his X followers.

Over the weekend, Kiyosaki ran a Bitcoin-related poll, but the response was far quieter than he anticipated — a result he later apologized for in a post.

The poll, part of a broader discussion on financial habits, questioned why people tend to spend on wants rather than investing in long-term assets like Bitcoin, gold, or real estate.

Despite having 73,000 followers view the tweet, only about 1,000 users interacted with it, leading Kiyosaki to express disappointment and frustration at the silence. He hinted that this disconnect felt like a silent backlash from the investment community.

The tweet was tied to broader concerns Kiyosaki raised about inflation and economic hardship, noting that even fast-food giants like McDonald’s and Burger King are feeling the strain as lower-income consumers pull back spending. Despite the lukewarm response, Kiyosaki promised to continue engaging with followers, teasing a future question about what wealthy individuals tend to accumulate to grow richer.

Earlier this month, Kiyosaki maintained his bullish stance on Bitcoin’s future, forecasting a minimum price of $180,000 in 2025 and even suggesting that BTC could break past $1 million by 2035. He cited rapid advancements in artificial intelligence and its effects on finance as key factors that could fuel Bitcoin’s long-term rise.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

Tim Draper Predicts Bitcoin Will Replace U.S. Dollar

Tim Draper isn’t just betting on Bitcoin—he’s forecasting the death of the U.S. dollar.

UK to Sell Almost $7B in Seized Bitcoin as Treasury Eyes Crypto Boost

The United Kingdom’s Home Office is preparing to liquidate a massive cache of seized cryptocurrency—at least $7 billion worth of Bitcoin—according to a new report by The Telegraph.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read