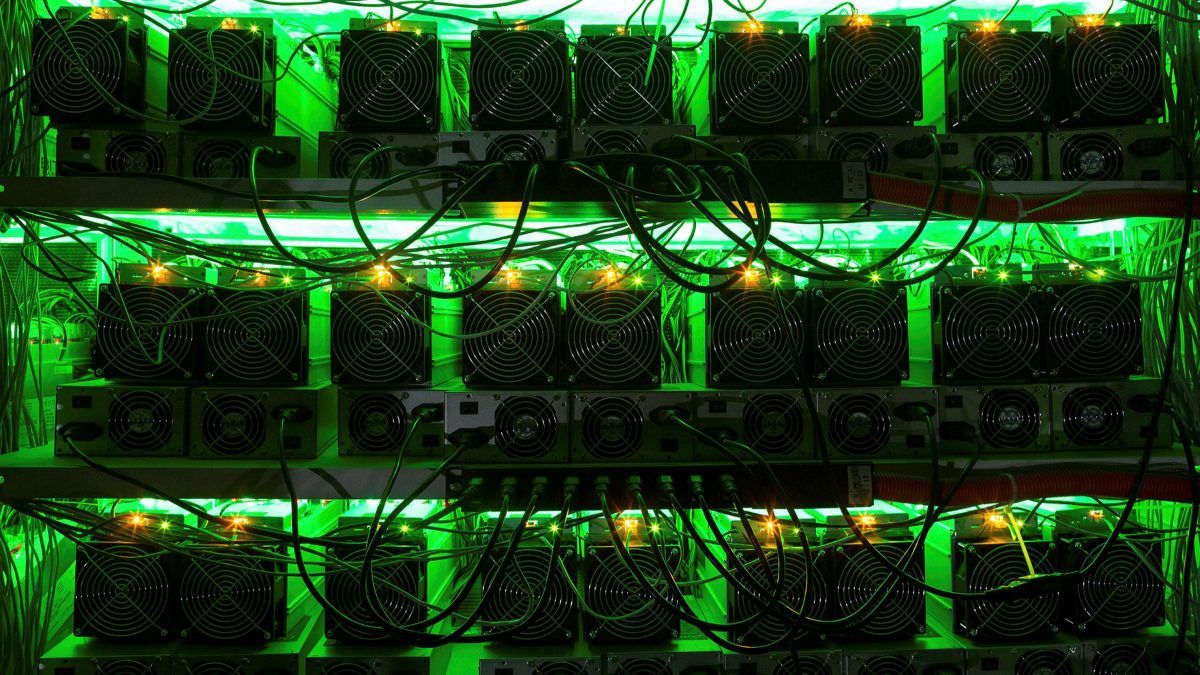

Riot Platforms Buys Block Mining to Expand Bitcoin Mining Capacity

24.07.2024 19:00 1 min. read Alexander Stefanov

Riot Platforms, a major player in Bitcoin mining, has acquired Block Mining, a miner based in Kentucky, in a deal valued at $92.5 million.

This acquisition is set to enhance Riot’s mining capabilities significantly.

The company announced that the purchase will immediately add 60 megawatts (MW) to its operational capacity, with plans to expand Block Mining’s two facilities to a total of 110 MW by the end of 2024. This expansion would increase Riot’s overall potential capacity to 2 gigawatts.

Riot CEO Jason Les highlighted that the acquisition will diversify the company’s operations across the U.S. and accelerate growth in Kentucky. The deal includes $18.5 million in cash and $74 million in Riot common stock.

Despite the acquisition, Riot reported a decline in Bitcoin production, mining 255 BTC in June, a decrease from both May and June of the previous year. Riot’s stock fell by 5.31% on Tuesday and has decreased by nearly 25% year-to-date.

-

1

Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read

Charles Schwab to Launch Bitcoin and Ethereum Trading Soon, CEO Confirms

Charles Schwab is preparing to roll out spot Bitcoin and Ethereum trading, according to CEO Rick Wurster during the firm’s latest earnings call.

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

According to data shared by Wu Blockchain, over $5.8 billion in crypto options expired today, with Ethereum leading the action.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

-

1

Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read