Raydium Surpasses Uniswap in Monthly Trading Volumes for Second Consecutive Month

11.12.2024 13:30 2 min. read Alexander Zdravkov

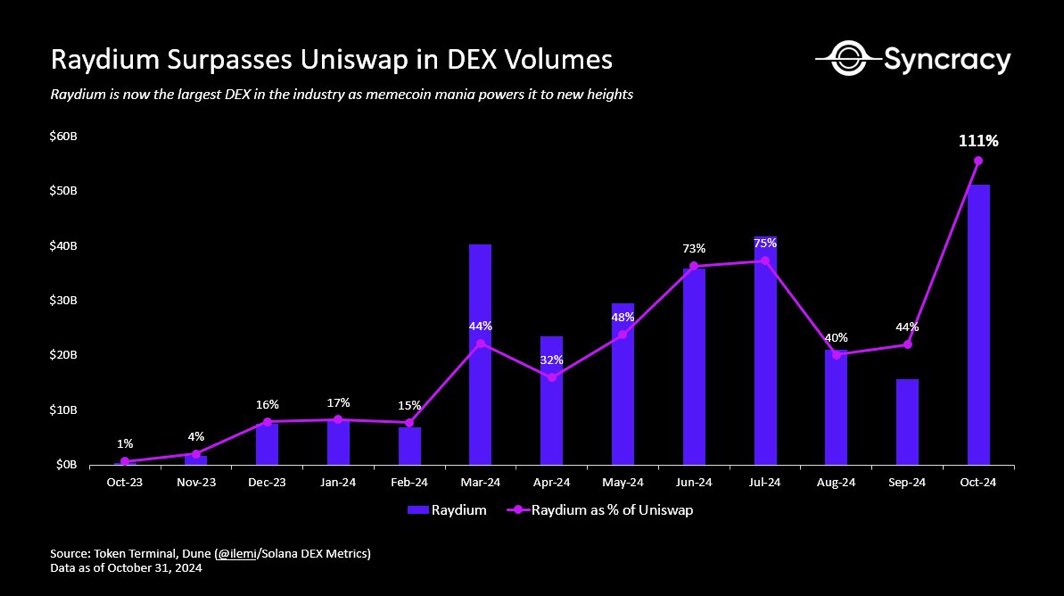

Raydium, a decentralized exchange (DEX) built on the Solana network, has outpaced Uniswap in monthly trading volumes for the second consecutive month, according to a Dec. 10 report from Messari.

In November, Raydium surpassed Uniswap by approximately 30%, reaching around $30 billion in volume, following a smaller victory in October with a 10% lead.

This performance is primarily attributed to Raydium’s strong foothold within the Solana ecosystem, where it captures over 60% of the daily DEX volume. The DEX has gained significant traction, especially due to the popularity of memecoins, which accounted for a record 65% of its monthly volume in November.

Memecoin trading, fueled by venture capital and growing interest, has contributed to the rising market cap of these assets, now valued at around $130 billion. Solana, emerging as a key player in memecoin trading, hosts platforms like Pump.fun, which mint and launch memecoins, many of which are traded on Raydium.

READ MORE:

JPMorgan Raises Bitcoin Miner Price Targets

This surge in memecoin activity has helped boost Solana’s total value locked (TVL), which has seen significant growth this year, although it still trails behind Ethereum.

Raydium’s focus on Solana contrasts with Uniswap, which operates across 18 different blockchain networks. The growth of Solana’s DeFi ecosystem is driven by its technical advantages, such as high transaction throughput and low costs, attracting users seeking a more efficient DeFi experience. Meanwhile, Uniswap has expanded its reach with the launch of its layer-2 network, Unichain, in October.

-

1

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read -

2

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

3

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Toncoin Launches UAE Golden Visa Program Through $100,000 Staking Offer

06.07.2025 12:04 2 min. read

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

-

1

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read -

2

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

3

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Toncoin Launches UAE Golden Visa Program Through $100,000 Staking Offer

06.07.2025 12:04 2 min. read