Raoul Pal Predicts Bitcoin Could Follow 2016 Patterns for Major Gains

14.01.2025 9:30 1 min. read Kosta Gushterov

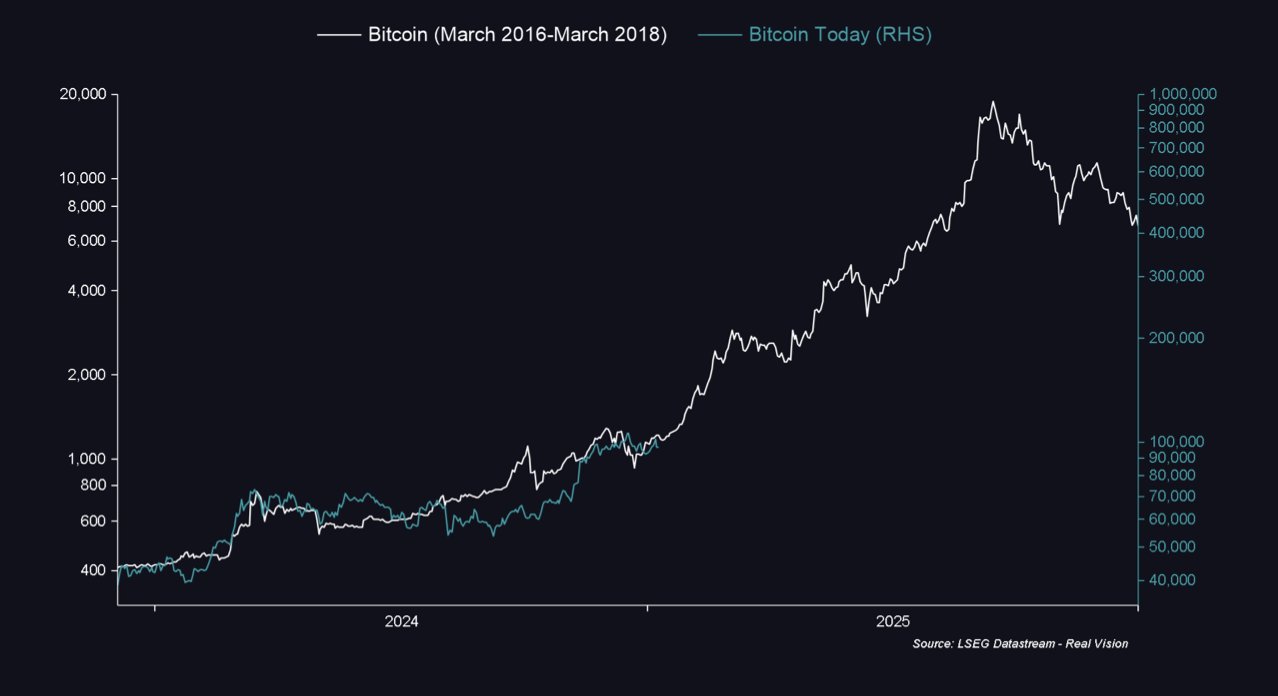

Macro strategist and ex-Goldman Sachs executve Raoul Pal believes Bitcoin may be on the cusp of a significant surge, drawing parallels to its behavior in 2016.

The macro expert pointed out similarities in market conditions, suggesting Bitcoin could see a dramatic move upward, though not an exact replay of past events.

Pal noted that while the trajectory might not mirror 2016 perfectly, the overall pattern indicates upward momentum for Bitcoin. Back in 2016, the cryptocurrency traded near $1,000 before skyrocketing to $20,000 in 2017. He advised investors to remain patient and focus on the long-term trend, adding, “Don’t expect an exact repeat but a rhyme. Valhalla waits.”

The global M2 money supply, a broad measure of liquidity in the global economy, is another key metric Pal is monitoring. He highlighted that M2 is following a pattern similar to the 2016-2017 period, which coincided with Bitcoin’s historic rally. This alignment, according to Pal, could signal another significant move for the cryptocurrency.

Pal also emphasized the importance of building personal conviction about market trends rather than relying solely on external opinions, encouraging investors to focus on Bitcoin’s long-term potential amidst short-term volatility.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

A sharp divergence has emerged between Bitcoin’s exchange balances and its surging market price—signaling renewed long-term accumulation and supply tightening.

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

Bitcoin touched a new all-time high of $118,000, but what truly fueled the rally?

Bitcoin Lesson From Robert Kiyosaki: Buy Now, Wait for Fear

Robert Kiyosaki, author of Rich Dad Poor Dad, has revealed he bought more Bitcoin at $110,000 and is now positioning himself for what macro investor Raoul Pal calls the “Banana Zone” — the parabolic phase of the market cycle when FOMO takes over.

-

1

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin Hits New All-Time High Above $112,000 as Short Squeeze and Tariffs Fuel Rally

10.07.2025 0:35 2 min. read