Previous Crypto Week Sets New Record: $4.39 Billion in Fund Inflows

21.07.2025 14:00 2 min. read Kosta Gushterov

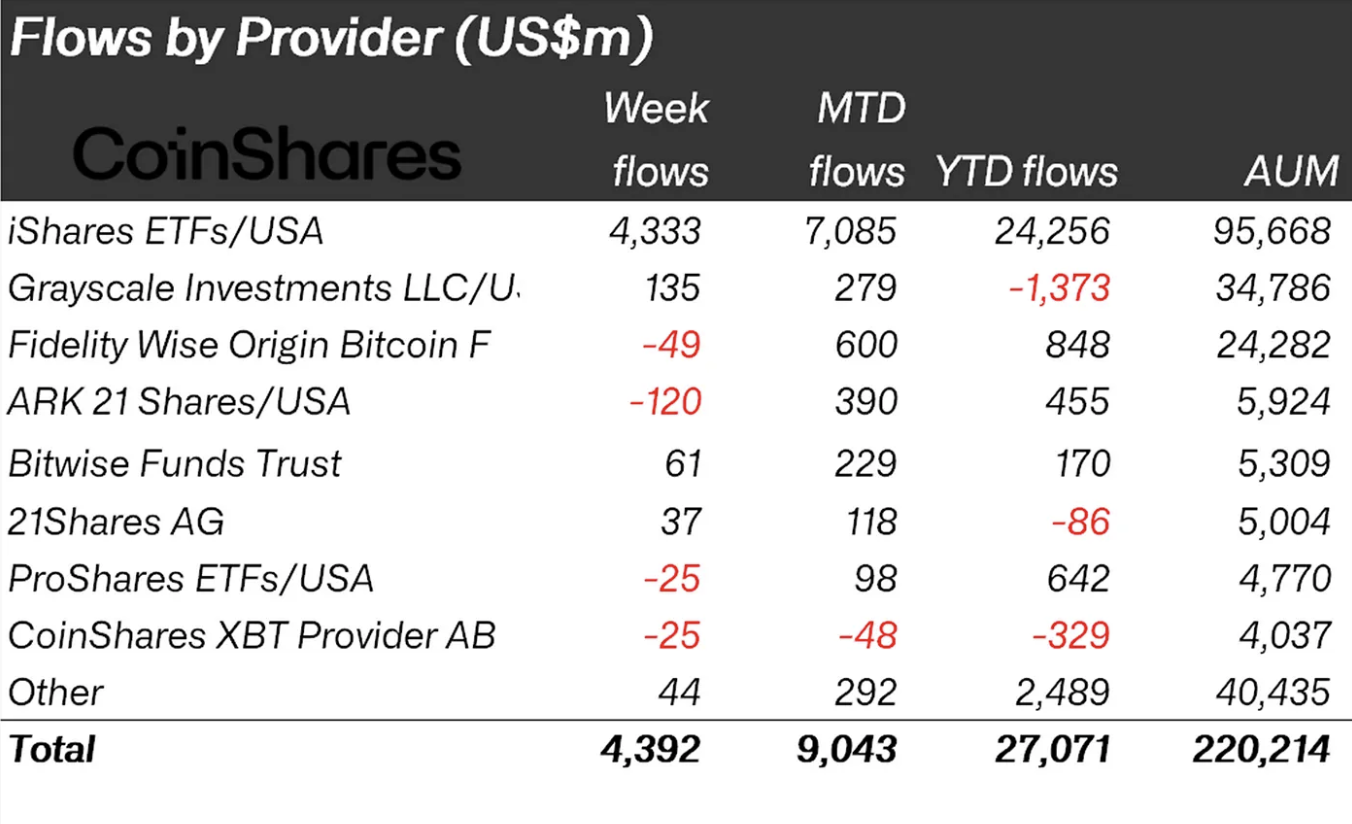

Global crypto investment products saw a historic $4.39 billion in inflows last week, setting a new all-time weekly record and driving total assets under management (AuM) to $220 billion.

According to the latest report by Coinshares, this marks the 14th consecutive week of inflows, bringing 2025’s year-to-date total to $27 billion. Exchange-traded product (ETP) turnover also hit a record $39.2 billion, reflecting surging investor appetite, especially for Bitcoin and Ethereum.

Ethereum inflows smash previous records

Ethereum led the market by a wide margin, pulling in $2.12 billion in new capital—nearly double its previous weekly record of $1.2 billion. That figure also means Ethereum’s 2025 inflows have now reached $6.2 billion, surpassing the entire 2024 total. Over the past 13 weeks, these inflows represent 23% of Ethereum’s total assets under management, signaling rapidly growing institutional demand ahead of its major tech upgrades.

Bitcoin followed with $2.2 billion in inflows, down from $2.7 billion the prior week. Still, Bitcoin ETPs made up 55% of all BTC spot exchange volume, underscoring their dominance in current trading activity.

U.S. drives volume, altcoins gain momentum

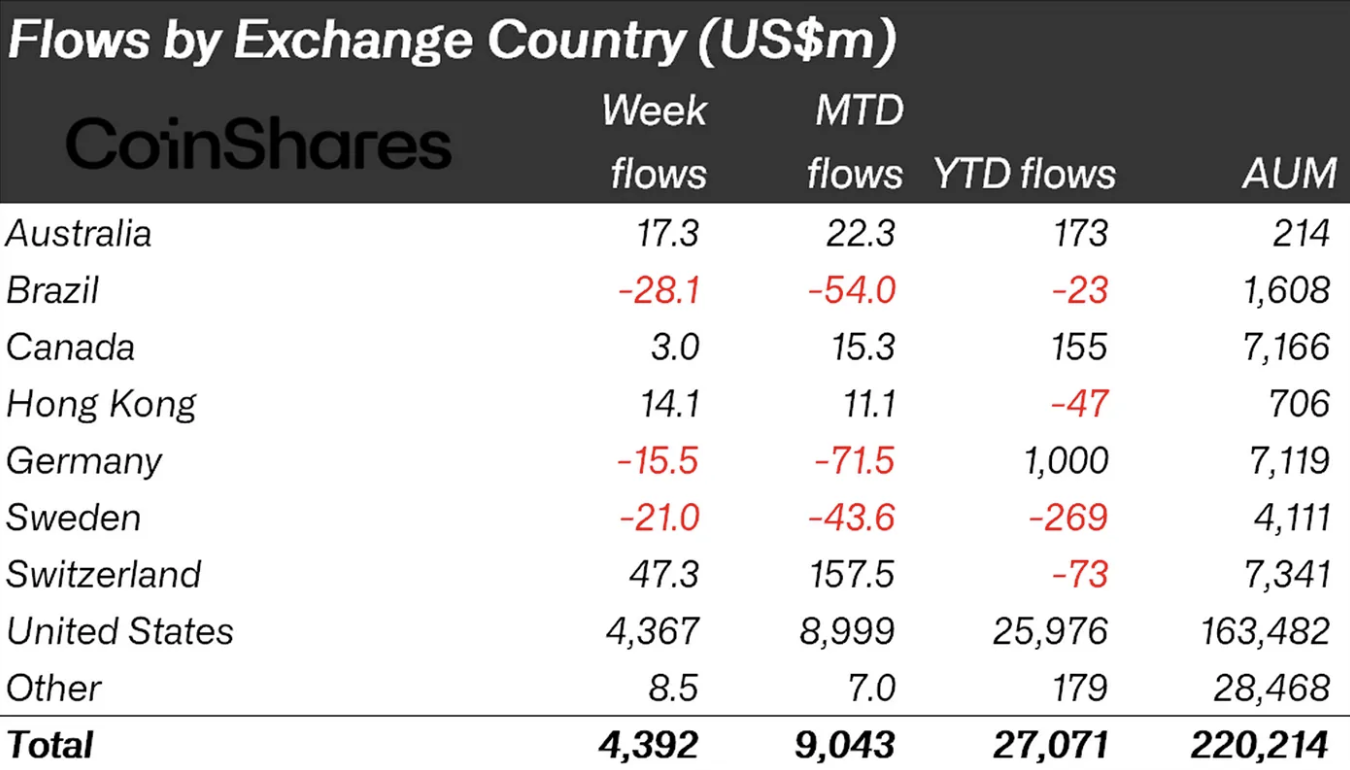

The United States accounted for the lion’s share of last week’s activity, recording $4.36 billion in inflows. Switzerland, Hong Kong, and Australia also saw modest gains, with inflows of $47.3 million, $14.1 million, and $17.3 million respectively. Brazil and Germany, by contrast, posted outflows of $28.1 million and $15.5 million.

Beyond Bitcoin and Ethereum, several altcoins also recorded strong interest. Solana brought in $39 million, XRP followed with $36 million, and Sui attracted $9.3 million. This continued altcoin inflow trend suggests investors are diversifying beyond just the top two assets as optimism builds across the broader digital asset market.

-

1

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read -

2

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

3

XRP Price Prediction: XRP Soars Over 30%, Can it Hit $10 in this Bull Run?

15.07.2025 0:49 5 min. read -

4

Solana Price Prediction: SOL Could Jump to $200 After This ‘Buy’ Signal

15.07.2025 23:39 3 min. read -

5

How Can You Tell When it’s Altcoin Season?

14.07.2025 14:07 2 min. read

Top trending tokens today: WEMIX, Drift and TRUMP Coin

CoinMarketCap’s momentum algorithm is flashing strong upside signals for several fast-moving tokens. WEMIX, Drift, and OFFICIAL TRUMP Coin top today’s trending list, each driven by unique catalysts—from GameFi upgrades and DeFi volume surges to political tailwinds.

Altcoin Season Signals Strengthen as Institutional Flows Accelerate

According to QCP Capital’s latest report, altcoin season may have finally arrived.

Solana Price Prediction: SOL Could be Ready to Move to $225 After Breakout

Solana (SOL) has gone up by 35% in the past 30 days as multiple tailwinds have lifted the price of this top altcoin above the $190 level. A breakout above this level favors a bullish Solana price prediction as it could anticipate a big move ahead, especially at a point when market conditions are favorable. […]

Altcoin Market at Key Resistance as Capital Rotation Begins

According to Swissblock, the altcoin market has reached a critical inflection point, with 75% of altcoins now sitting at resistance levels.

-

1

SEC Accelerates Spot Solana ETF Timeline as July Deadline Looms

07.07.2025 19:40 2 min. read -

2

What’s Ahead for Ethereum, According to Former Core Developer

05.07.2025 19:00 2 min. read -

3

XRP Price Prediction: XRP Soars Over 30%, Can it Hit $10 in this Bull Run?

15.07.2025 0:49 5 min. read -

4

Solana Price Prediction: SOL Could Jump to $200 After This ‘Buy’ Signal

15.07.2025 23:39 3 min. read -

5

How Can You Tell When it’s Altcoin Season?

14.07.2025 14:07 2 min. read