Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read Kosta Gushterov

Veteran trader Peter Brandt has weighed in on Bitcoin’s recent price structure, offering a nuanced take that blends cautious skepticism with long-term conviction.

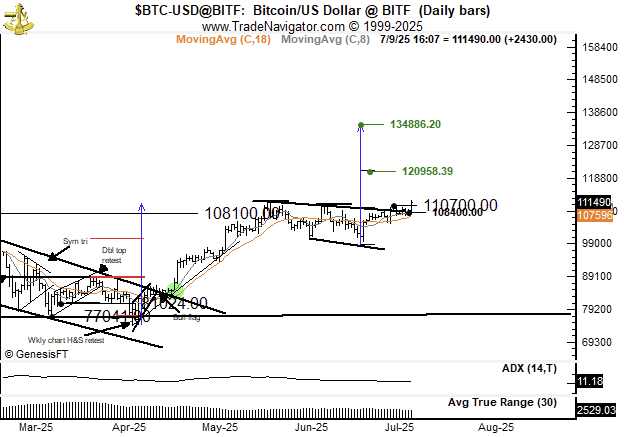

In a post shared on July 10, Brandt noted that the current chart pattern—a broadening inverted triangle—is not inherently bullish and often exhibits instability. He remarked, “An expanding inverted triangle has a higher rate of morphing or mortality than a pattern such as a horizontal pennant.” Despite that, Brandt confirmed he remains long BTC, suggesting confidence in Bitcoin’s larger trend.

Key level: $107,000 as structural support

Brandt highlighted the $107,000 level as a crucial support zone. A breakdown below this threshold would, in his view, “suggest morphology”—a term he uses to describe pattern breakdowns or evolving market structures. For now, BTC is trading near $111,490, just above the $110,700 resistance-turned-support line.

Price targets: $120K to $135K still in sight

Despite his reservations about the pattern’s reliability, Brandt’s chart outlines potential bullish targets. The next major upward projections are $120,958 and $134,886.20—levels that align with the measured move from the previous breakout zone around $108,100.

Brandt’s position: Long but alert

Known for his no-nonsense approach to technical analysis, Brandt’s latest commentary signals a mix of optimism and caution. While he maintains a long position in Bitcoin, he warns traders not to place blind faith in chart patterns, especially those with a high rate of failure. His broader message seems clear: bullish continuation is possible, but price structure integrity remains key.

As Bitcoin navigates the mid-$110K range, traders and analysts alike are watching closely to see whether this triangle resolves upward or confirms Brandt’s warnings with a deeper correction.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

Analysis Firm Explains Why Bitcoin’s Breakout Looks Different This Time

Bitcoin’s surge to new all-time highs is playing out differently than previous rallies, according to a July 11 report by crypto research and investment firm Matrixport.

Bitcoin Reaches New All-Time High Above $116,000

Bitcoin surged past $116,000 on July 11, marking a new all-time high amid intense market momentum.

-

1

Metaplanet Raises $515M in First Step Toward Massive Bitcoin Accumulation

25.06.2025 20:00 1 min. read -

2

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

3

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

4

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

5

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read