Nearly Half of Bitcoin’s Supply Remains Flat: What It Means for Investors

14.08.2024 18:30 1 min. read Alexander Stefanov

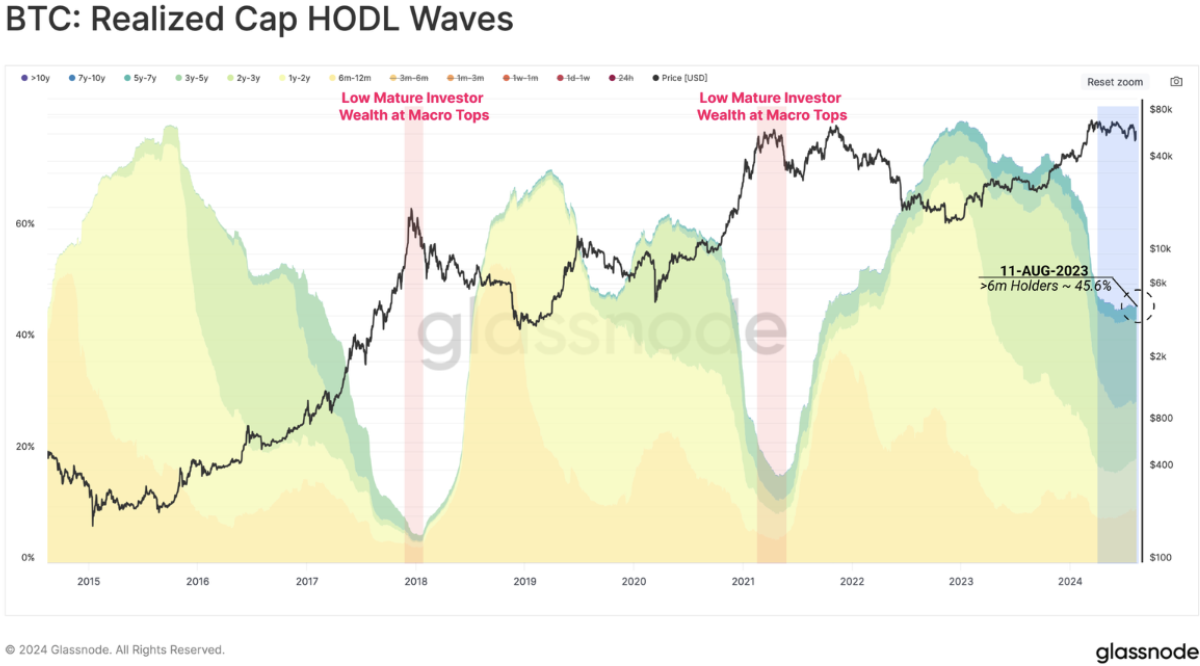

According to data from Glassnode, nearly half of Bitcoin's total supply has remained flat over the past six months, reflecting strong investor confidence.

Despite significant market volatility and a new all-time high reached five months ago, many Bitcoin holders have opted not to sell.

Glassnode’s findings indicate that over 45% of all BTC have been inactive in their portfolios for at least six months. This trend suggests that many long-term holders (LTH) – those who have held their coins for a minimum of 155 days – are keeping their investments rather than cashing them in during price spikes.

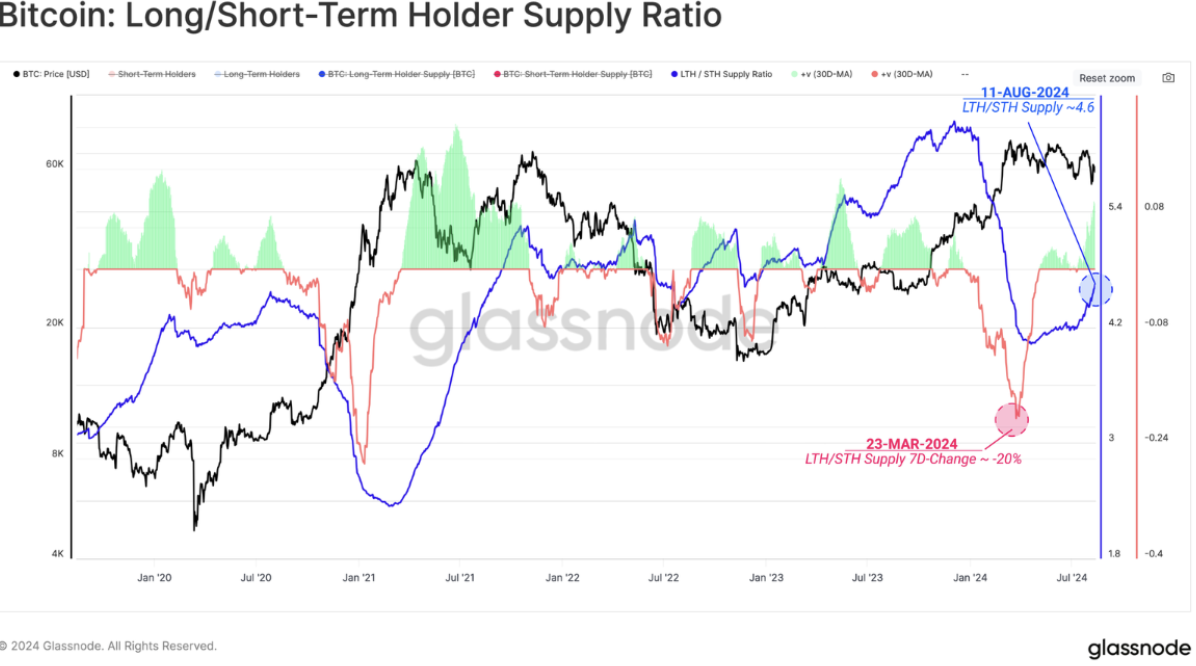

Traditionally, LTH have been known to sell off their coins in periods leading up to historic highs, such as the run-up to the March peak. However, recent data suggests a change, with LTH increasingly choosing to hold onto their coins.

This has contributed to the stabilisation and subsequent increase in the proportion of the network’s wealth controlled by them.

The company’s report points to a significant slowdown in LTH selling pressure, allowing wealth held by long-term investors to remain at historically high levels compared to previous all-time peaks. This shows that despite the selling pressure, many Bitcoin investors are confident in the asset’s long-term prospects.

While market sentiment remains cautious due to concerns about potential sell-offs and retests of recent lows, some analysts see reasons for optimism.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read

Peter Schiff Warns of Dollar Collapse, Questions Bitcoin Scarcity Model

Gold advocate Peter Schiff issued a stark warning on monetary policy and sparked fresh debate about Bitcoin’s perceived scarcity. In a pair of high-profile posts on July 12, Schiff criticized the current Fed rate stance and challenged the logic behind Bitcoin’s 21 million supply cap.

Bitcoin Price Hits Record Highs as Exchange Balances Plunge

A sharp divergence has emerged between Bitcoin’s exchange balances and its surging market price—signaling renewed long-term accumulation and supply tightening.

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

Bitcoin touched a new all-time high of $118,000, but what truly fueled the rally?

Bitcoin Lesson From Robert Kiyosaki: Buy Now, Wait for Fear

Robert Kiyosaki, author of Rich Dad Poor Dad, has revealed he bought more Bitcoin at $110,000 and is now positioning himself for what macro investor Raoul Pal calls the “Banana Zone” — the parabolic phase of the market cycle when FOMO takes over.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read