Mt. Gox Has Once Again Transferred Billions of Dollars Worth of Bitcoins

24.07.2024 9:27 1 min. read Kosta Gushterov

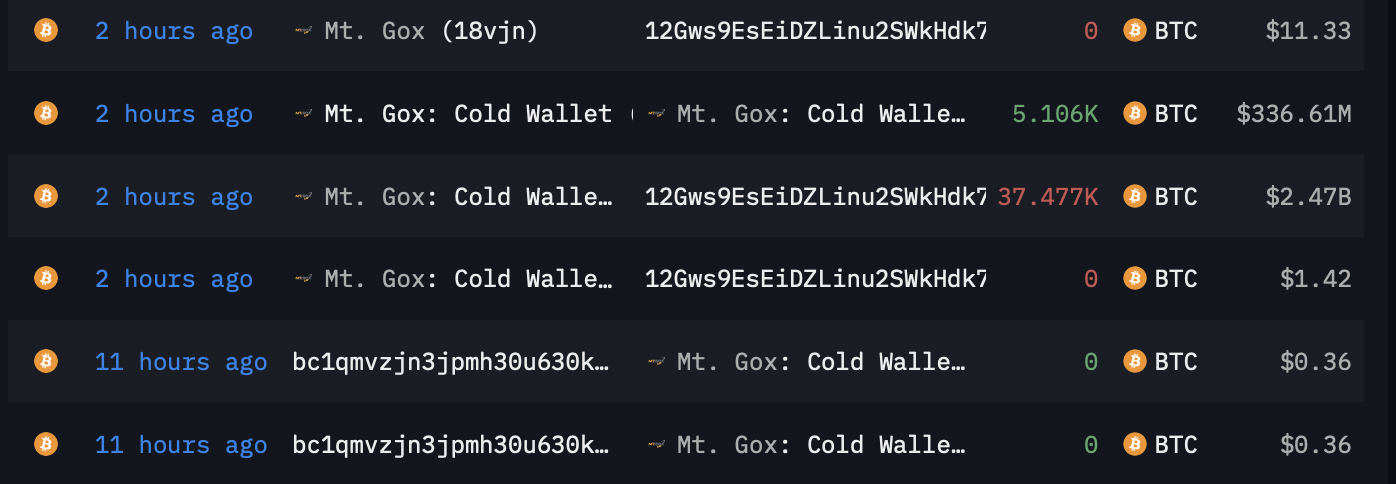

On July 24 the defunct Japanese crypto exchange Mt. Gox transferred 37,477 BTC, equivalent to $2.5 billion at the time of the transaction, to an unknown crypto address.

According to Arkham Intelligence, a blockchain analytics company, out of the total amount, 5,106 BTC were additionally transferred to another cold wallet owned by Mt. Gox.

This transaction took place after the exchange transferred $2.8 billion in BTC to various wallets on July 22. Of that, $340 million was sent to four wallets linked to the Bitstamp crypto exchange.

According to CryptoQuant, aroud 40% of the amounts owed to Mt. Gox’s creditors have been paid at the time of publication. This indicates that 60%, or $5.6 billion, is still in the process of being distributed to creditors.

36% of the Mt. Gox Bitcoin has been distributed to creditors

“The trustee holds 141,686 $BTC, which will be distributed over time. With yesterday’s transaction, 36% of the Bitcoin has been moved to their former users.” – By @JA_Maartun

Link 👇https://t.co/SwU1ufNoQr pic.twitter.com/LMUBPrZBPN

— CryptoQuant.com (@cryptoquant_com) July 17, 2024

-

1

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

2

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

5

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

-

1

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

2

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

3

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

4

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

5

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read