MicroStrategy’s Bitcoin Bet Yields Explosive Return, Surpassing Crypto Gains

30.09.2024 15:00 1 min. read Kosta Gushterov

MicroStrategy’s early investment in Bitcoin has proven highly successful, delivering a 36-fold return and cementing its status as the largest public holder of the cryptocurrency.

While Bitcoin has surged by around 150% over the past year, MicroStrategy’s stock (MSTR) has seen an even steeper rise, nearly doubling that percentage with a 300% gain.

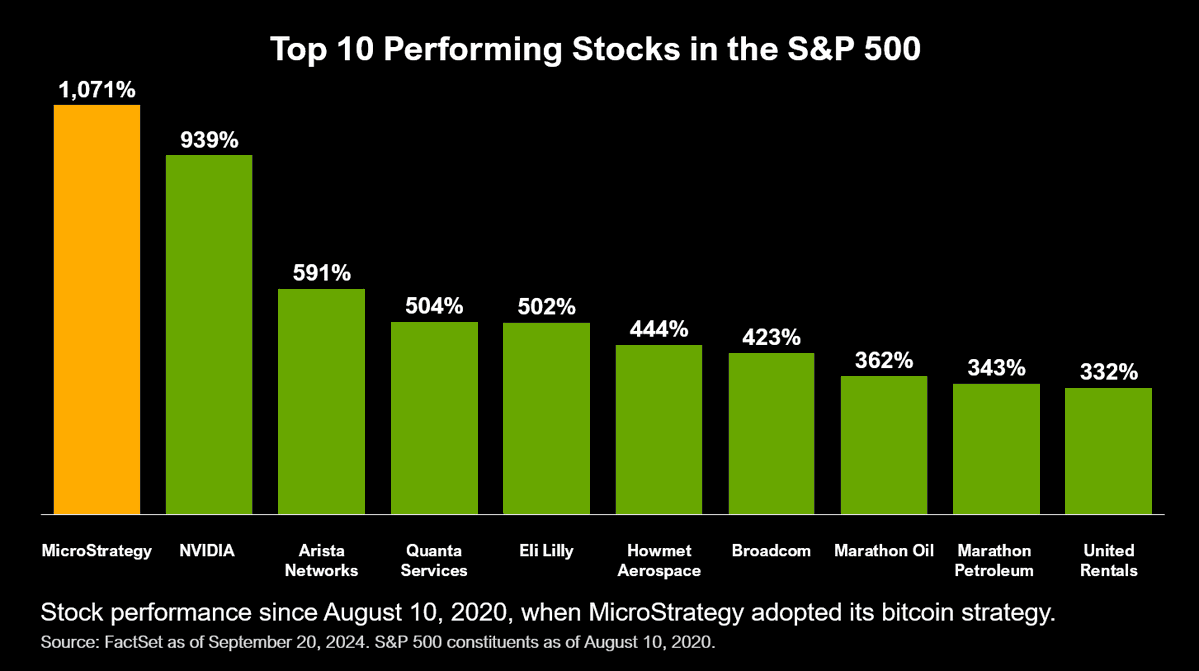

Despite its high volatility, MSTR’s stock has outperformed Bitcoin in terms of risk-adjusted returns, according to investment metrics. The company’s BTC holdings have contributed significantly to its growth, with a return of over 1,000% since adopting a Bitcoin-focused strategy.

MicroStrategy’s substantial Bitcoin reserves, totaling 252,220 BTC, are worth about $458 million and account for nearly half of its market capitalization. The company has led performance in the S&P 500, outpacing competitors like Nvidia, while mining firms such as Marathon and Riot also rank high.

Even though Bitcoin remains slightly below its all-time high of $73K, MicroStrategy’s stock has continued to rise, buoyed by new Bitcoin purchases. With institutional investors increasingly interested in Bitcoin—74% handling it in some capacity—the outlook for both the company and the cryptocurrency remains positive.

CEO Phong Le attributes the company’s success to Bitcoin adoption and growing business in AI and cloud solutions, reinforcing its strong market position moving forward.

-

1

Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read

Charles Schwab to Launch Bitcoin and Ethereum Trading Soon, CEO Confirms

Charles Schwab is preparing to roll out spot Bitcoin and Ethereum trading, according to CEO Rick Wurster during the firm’s latest earnings call.

Over $5.8 Billion in Ethereum and Bitcoin Options Expired Today: What to Expect?

According to data shared by Wu Blockchain, over $5.8 billion in crypto options expired today, with Ethereum leading the action.

BlackRock Moves to Add Staking to iShares Ethereum ETF Following SEC Greenlight

BlackRock is seeking to enhance its iShares Ethereum Trust (ticker: ETHA) by incorporating staking features, according to a new filing with the U.S. Securities and Exchange Commission (SEC) submitted Thursday.

IMF Disputes El Salvador’s Bitcoin Purchases, Cites Asset Consolidation

A new report from the International Monetary Fund (IMF) suggests that El Salvador’s recent Bitcoin accumulation may not stem from ongoing purchases, but rather from a reshuffling of assets across government-controlled wallets.

-

1

Bitcoin: Is the Cycle Top In and How to Spot It?

09.07.2025 16:00 2 min. read -

2

Crypto Inflows hit $1B Last Week as Ethereum Outshines Bitcoin in Investor Sentiment

07.07.2025 20:30 2 min. read -

3

Public Companies Outpace ETFs in Bitcoin Buying: Here is What You Need to Know

02.07.2025 12:30 2 min. read -

4

Robert Kiyosaki Buys More Bitcoin, Says He’d Rather Be a ‘Sucker Than a Loser’

02.07.2025 22:00 1 min. read -

5

This Week in Crypto: Whale Accumulation, Ethereum Signals, and a Sentiment Shake-Up

05.07.2025 21:00 3 min. read