MicroStrategy Outperforms Major Companies with 1,113% Growth Since 2020

26.08.2024 8:00 1 min. read Alexander Stefanov

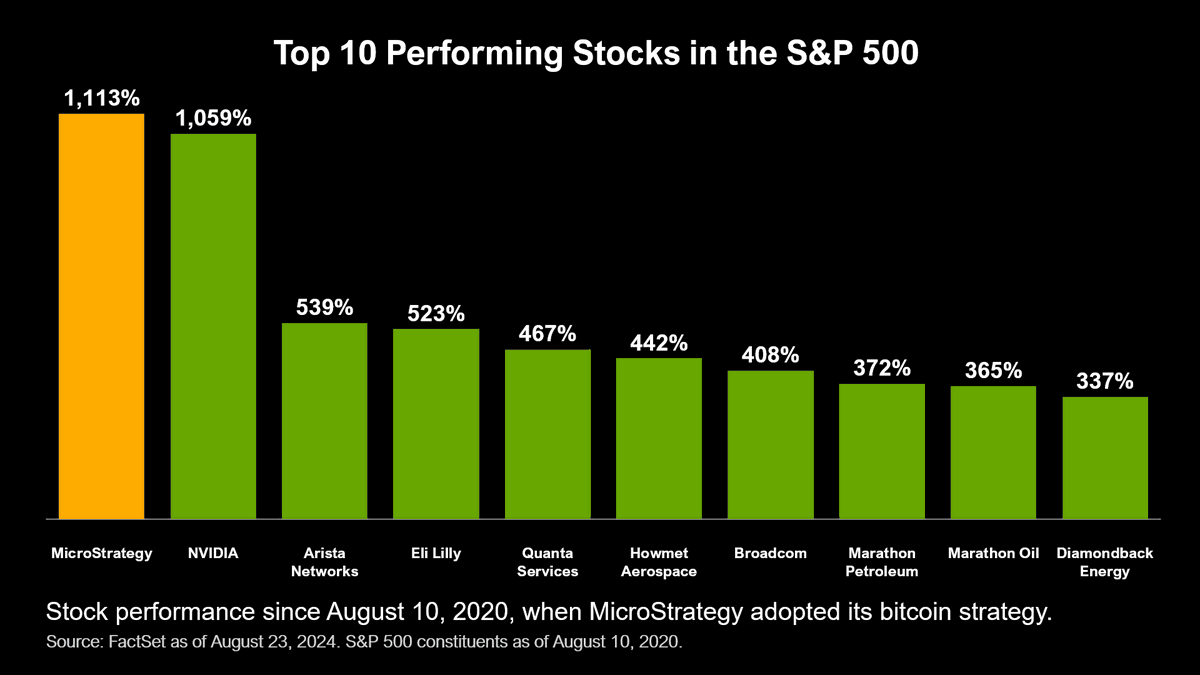

Michael Saylor, co-founder of MicroStrategy, recently shared a comparison on social media, showcasing how his company has performed against other major firms since August 2020.

MicroStrategy outshone the competition with an impressive growth of 1,113%. In comparison, Nvidia followed closely behind with a 1,059% rise, driven by the booming demand for artificial intelligence technologies. Nvidia’s ascent this year included surpassing Microsoft to become the most valuable company globally, thanks to its AI chips that support popular tools like ChatGPT.

Arista Networks, a leader in computer networking from Santa Clara, claimed the third spot with a 539% increase, benefiting from the expanding AI hardware sector. Earlier this year, the company announced a strategic partnership with Nvidia to further its growth.

Other notable companies that made the list of top performers include Eli Lilly with a 523% gain, Quanta Services at 467%, Howmet Aerospace at 442%, Broadcom at 408%, and Marathon Petroleum with 372%.

Cantor Fitzgerald, a major financial services firm, has set an optimistic price target of $194 for MicroStrategy’s stock, viewing it as a strong leveraged bet on Bitcoin.

Additionally, the SEC recently approved a fund that increases exposure to MicroStrategy. Earlier this year, MicroStrategy’s stock (MSTR) joined the MSCI World Index, which tracks large and mid-sized companies worldwide, although it has not yet been included in the S&P 500.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read

Kazakhstan May Invest Gold Reserves in Crypto Sector

Kazakhstan is considering allocating a portion of its gold and foreign currency reserves, along with National Fund assets, into crypto-related investments.

Grayscale Confidentially Files for New SEC-registered Offering Amid Growing Crypto Market demand

Grayscale Investments announced today that it has confidentially submitted a draft registration statement on Form S-1 to the U.S.

Here is How to Read the Crypto Fear and Greed Index

In the volatile world of cryptocurrency, investor psychology is one of the most powerful forces behind price movement.

Bank of England Governor Warns Against Stablecoins, Backs Tokenized Deposits Instead

Bank of England Governor Andrew Bailey has voiced strong concerns about the rising push for stablecoin adoption, calling on banks to steer clear of issuing their own digital currencies.

-

1

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

2

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

3

Whales Buy the Dip as Retail Panics: This Week in Crypto

29.06.2025 14:00 3 min. read -

4

History Shows War Panic Selling Hurts Crypto Traders

28.06.2025 18:30 3 min. read -

5

Ripple Faces Legal Setback as Court Rejects Bid to Ease Penalties

26.06.2025 16:54 1 min. read