MicroStrategy Outperforms Major Companies with 1,113% Growth Since 2020

26.08.2024 8:00 1 min. read Alexander Stefanov

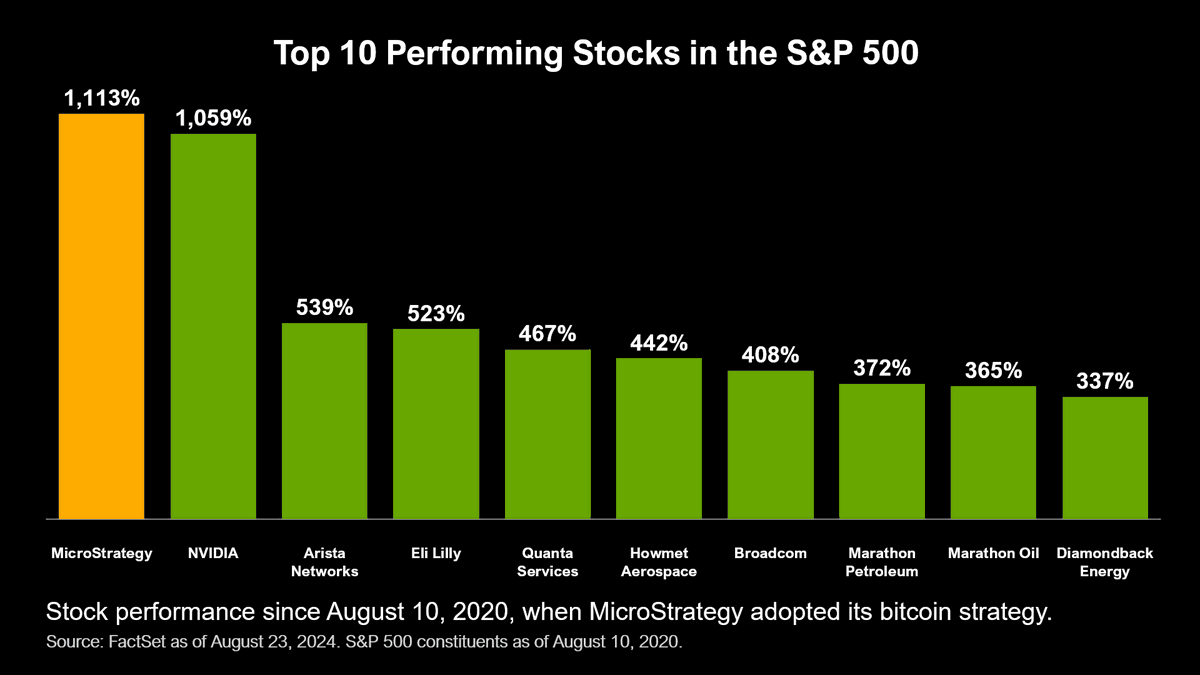

Michael Saylor, co-founder of MicroStrategy, recently shared a comparison on social media, showcasing how his company has performed against other major firms since August 2020.

MicroStrategy outshone the competition with an impressive growth of 1,113%. In comparison, Nvidia followed closely behind with a 1,059% rise, driven by the booming demand for artificial intelligence technologies. Nvidia’s ascent this year included surpassing Microsoft to become the most valuable company globally, thanks to its AI chips that support popular tools like ChatGPT.

Arista Networks, a leader in computer networking from Santa Clara, claimed the third spot with a 539% increase, benefiting from the expanding AI hardware sector. Earlier this year, the company announced a strategic partnership with Nvidia to further its growth.

Other notable companies that made the list of top performers include Eli Lilly with a 523% gain, Quanta Services at 467%, Howmet Aerospace at 442%, Broadcom at 408%, and Marathon Petroleum with 372%.

Cantor Fitzgerald, a major financial services firm, has set an optimistic price target of $194 for MicroStrategy’s stock, viewing it as a strong leveraged bet on Bitcoin.

Additionally, the SEC recently approved a fund that increases exposure to MicroStrategy. Earlier this year, MicroStrategy’s stock (MSTR) joined the MSCI World Index, which tracks large and mid-sized companies worldwide, although it has not yet been included in the S&P 500.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

5

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read

Top Crypto Sectors in July: Meme, Staking, Gaming Lead

Meme coins are dominating the crypto market in July, outperforming all other sectors with a staggering 30.06% return so far this month, according to the latest data from CoinDesk.

Coinbase Strengthens DeFi Push With Opyn Leadership Acquisition

Coinbase has taken a major step toward expanding its decentralized finance (DeFi) presence by bringing onboard the leadership team behind Opyn Markets, a prominent name in the DeFi derivatives space.

Grayscale Urges SEC to Allow Multi-Crypto ETF to Proceed

Grayscale Investments has called on the U.S. Securities and Exchange Commission (SEC) to allow the launch of its multi-crypto ETF—the Grayscale Digital Large Cap Fund—arguing that further delays violate statutory deadlines and harm investors.

Robinhood Launches Ethereum and Solana Staking for U.S. Users

Robinhood has officially introduced Ethereum (ETH) and Solana (SOL) staking services for its U.S. customers, offering a new way for users to earn rewards on their crypto holdings.

-

1

FTX Pushes to Dismiss Billion-Dollar Claim from 3AC

23.06.2025 15:00 1 min. read -

2

BIS Slams Stablecoins, Calls Them Ill-Suited for Modern Monetary Systems

26.06.2025 9:00 1 min. read -

3

ARK Invest Cashes In on Circle Rally as Stock Soars Past $60B Valuation

24.06.2025 19:00 1 min. read -

4

Trump’s ‘Big, Beautiful Bill’ Approved: What It Means for Crypto Markets

04.07.2025 7:00 3 min. read -

5

FTX Pushes Back Against $1.5B Claim From Defunct Hedge Fund 3AC

23.06.2025 11:00 1 min. read