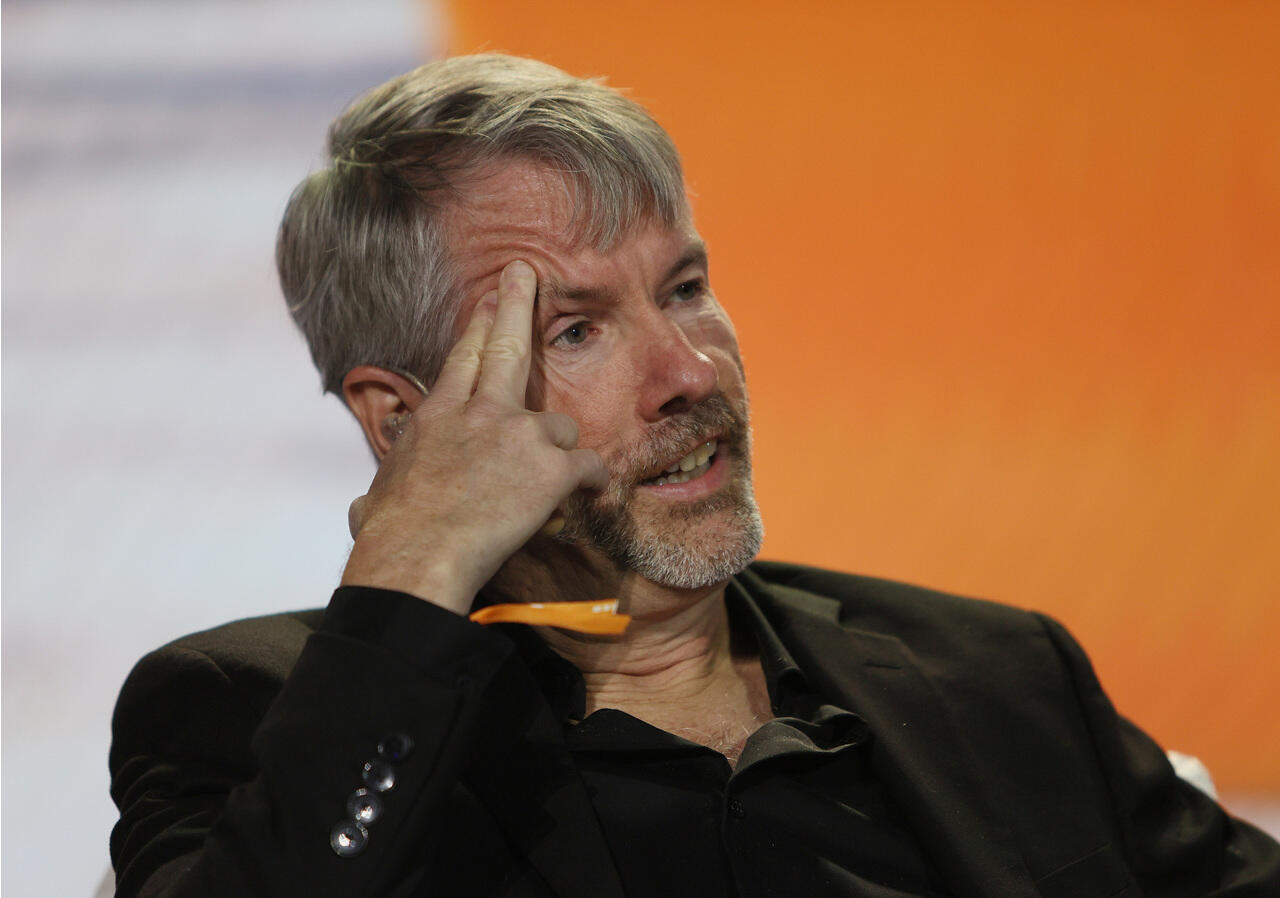

Michael Saylor Reveals What’s Behind MicroStrategy’s Success in the Bitcoin Sector

03.11.2024 19:00 2 min. read Alexander Stefanov

Michael Saylor, founder of MicroStrategy, recently shared the core principles that guide his company's BTC investment strategy.

MicroStrategy’s approach revolves around a “buy and hold” policy where Bitcoin (BTC) is considered a permanent and core asset in the company’s portfolio. This commitment underscores the company’s long-term belief in BTC’s role as a global reserve asset, seeking to hold BTC regardless of market volatility.

$MSTR is in an exclusive relationship with $BTC. pic.twitter.com/JNOIz98iuO

— Michael Saylor⚡️ (@saylor) November 1, 2024

Saylor’s strategy involves responsible expansion by adapting to market dynamics and seeking positive returns from Bitcoin through consistent acquisitions.

Another pillar of the strategy involves strengthening MicroStrategy’s balance sheet by issuing BTC-backed fixed income securities, thereby expanding its asset holdings without diluting shareholder value.

READ MORE:

China Central Bank Official Highlights Challenges for Bitcoin and Digital Currency Adoption

An important goal for MicroStrategy is to encourage global adoption of Bitcoin as a viable reserve asset for the Treasury. Saylor envisions Bitcoin as an alternative for global reserves, highlighting its potential to bring stability and innovation to financial systems. MicroStrategy’s commitment is paying off; the company currently holds over 252,220 BTC worth approximately $18 billion, making it one of the largest institutional holders of Bitcoin in the world.

Instead of diluting its equity, MicroStrategy finances its BTC purchases through bonds and debentures, ensuring that shareholder value remains intact as Bitcoin holdings grow. This approach has resulted in impressive returns that outperform many traditional assets and even leading tech stocks. Going forward, Saylor aims for MicroStrategy’s returns on BTC to increase steadily, targeting annual growth of 6-10%, underscoring his confidence in Bitcoin’s future as an investment and financial innovation.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read

Ethereum Spot ETFs Dwarf Bitcoin with $1.85B Inflows: Utility Season in Full Swing

Ethereum is rapidly emerging as the institutional favorite, with new ETF inflow data suggesting a seismic shift in investor focus away from Bitcoin.

Ethereum Flashes Golden Cross Against Bitcoin: Will History Repeat?

Ethereum (ETH) has just triggered a golden cross against Bitcoin (BTC)—a technical pattern that has historically preceded massive altcoin rallies.

Bitcoin Banana Chart Gains Traction as Peter Brandt Revisits Parabolic Trend

Veteran trader Peter Brandt has reignited discussion around Bitcoin’s long-term parabolic trajectory by sharing an updated version of what he now calls the “Bitcoin Banana.”

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read -

5

Bitcoin Reaches New All-Time High Above $116,000

11.07.2025 7:56 1 min. read