Michael Saylor Fires Up the Crypto Community With His Latest Tweet

01.10.2024 14:30 2 min. read Kosta Gushterov

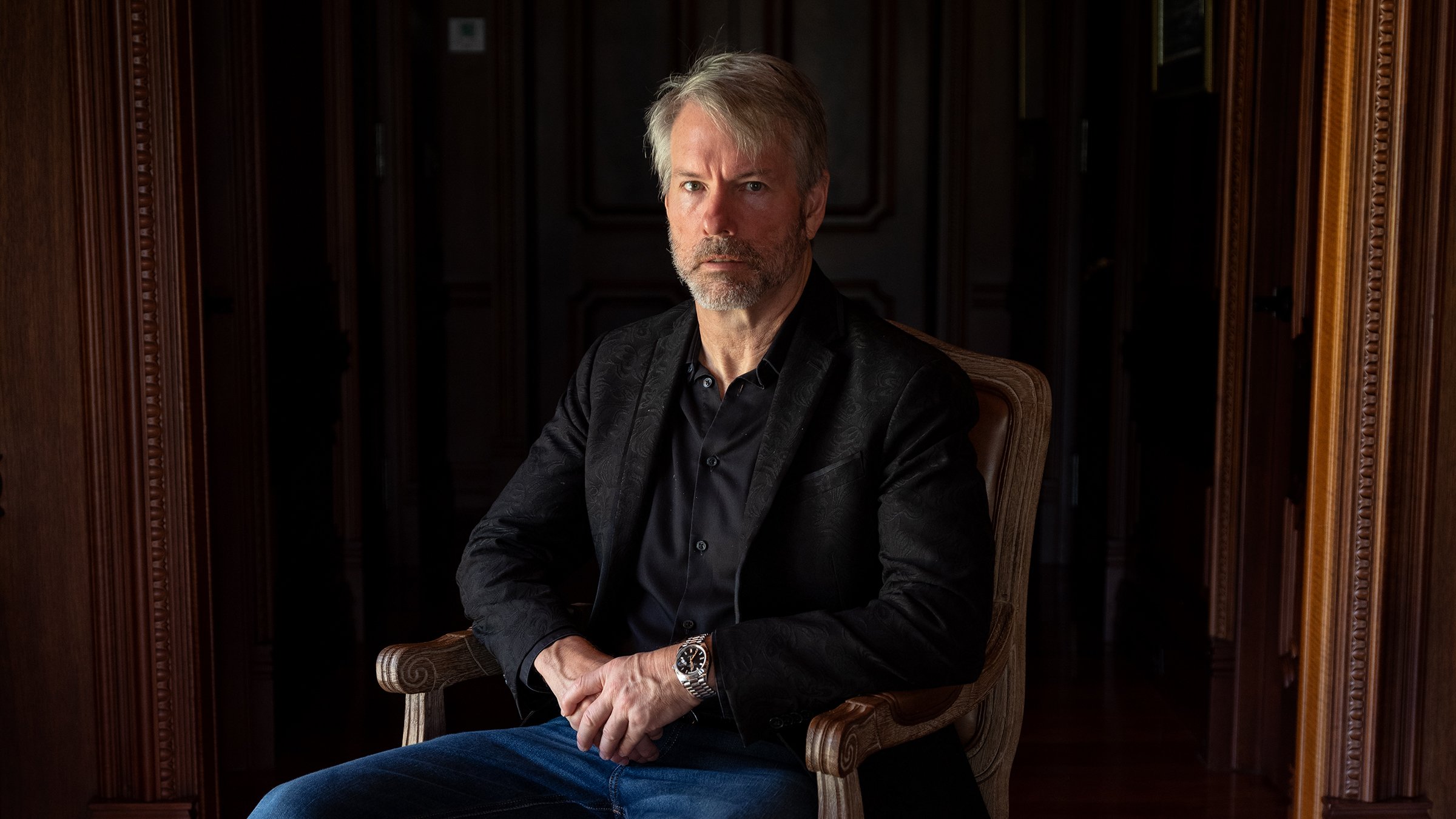

MicroStrategy's Michael Saylor stirred excitement in the cryptocurrency community with a recent post titled "Hodl On."

In this viral infographic, Saylor showcased the price trends of various assets, including Bitcoin (BTC), MicroStrategy’s stock (MSTR), and the S&P 500, following the company’s decision to adopt a Bitcoin-centric strategy on August 20.

The data revealed that MicroStrategy’s stock emerged as the standout performer over the past four years, soaring by an impressive 1,325%. Bitcoin secured the second spot, delivering a remarkable 451% return to its investors. Since summer 2020, Bitcoin reached a peak of $69,000, plummeted to $15,500 during the FTX collapse, and subsequently climbed back to a record high of $74,000.

In contrast, the S&P 500 index showed a modest gain of 71% during the same period. While this increase is notable, it pales in comparison to the extraordinary returns from MicroStrategy and Bitcoin.

Saylor’s post isn’t merely a display of pride but rather an affirmation of his unwavering belief in Bitcoin’s potential. Recently, Bitcoin’s price briefly rose above $65,000, but a subsequent dip brought it down to $63,500. Although the fluctuations are not drastic, they have sparked concerns among traders, raising fears that Bitcoin might test critical support levels around $62,300 or even $58,000.

Whether this scenario unfolds remains uncertain, but Saylor’s perspective indicates that he focuses on the long-term potential of Bitcoin rather than short-term market movements.

-

1

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

4

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

5

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read

Robert Kiyosaki Warns: ETFs Aren’t The Real Thing

Renowned author and financial educator Robert Kiyosaki has issued a word of caution to everyday investors relying too heavily on exchange-traded funds (ETFs).

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

Bitcoin Scarcity Deepens: Less Than 5.3% Left to Mine

Bitcoin has reached a critical milestone in its programmed supply timeline—only 5.25% of the total BTC that will ever exist remains to be mined.

-

1

Bitcoin Price Prediction: As BTC Hits New All-Time High Is $200K In Sight?

14.07.2025 21:56 3 min. read -

2

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

3

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

4

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

5

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read