Metaplanet Shares Skyrocket After Bitcoin Purchase Announcement

09.08.2024 11:00 1 min. read Kosta Gushterov

An investment company plans to obtain a 1 billion yen loan, equivalent to $6.8 million, to bolster its Bitcoin holdings, according to an August 8 announcement.

Earlier this week, Metaplanet announced its intention to raise 10.08 billion yen (approximately $70 million) by issuing an 11th series of rights to all common shareholders.

This offering allows shareholders to purchase one stock acquisition right per common share, with an option to purchase shares at a price of 555 yen (approximately $4) between September 6 and October 15.

The company believes these acquisitions are critical to its long-term strategy.

They stated:

Our primary policy is to hold Bitcoin for the long term; however, if Bitcoin is used in operations, the applicable Bitcoin balance will be classified as a current asset on the balance sheet.

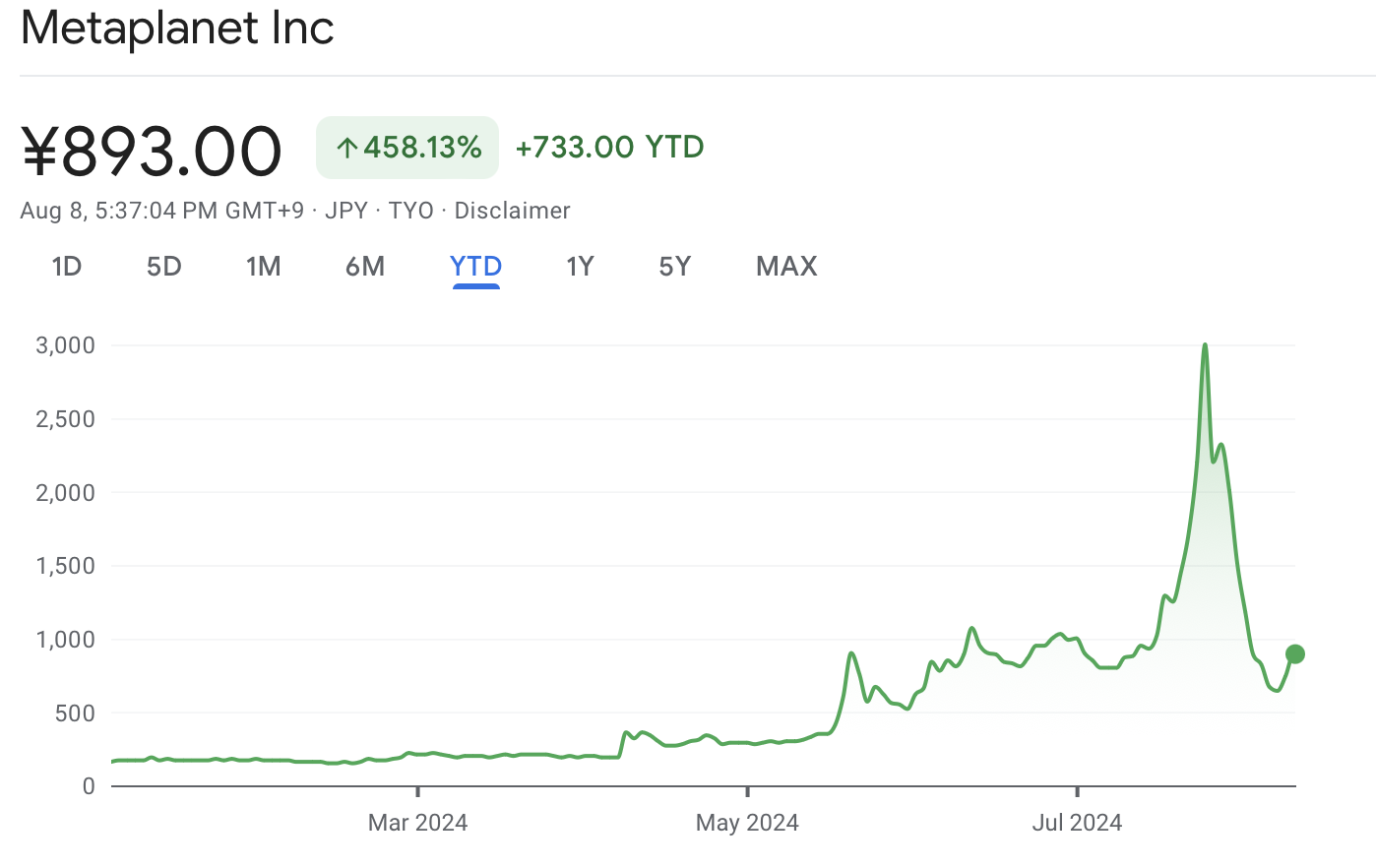

This news reportedly boosted the company’s share price by over 20%, reaching 893 yen at the time of writing.

This is a continuation of the upward trend seen since the company shifted its focus to Bitcoin, with its shares up more than 458.13% since the beginning of the year.

As for the loan, Metaplanet plans to borrow the funds at an annual interest rate of 0.1% for six months.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read

Global Money Flow Rising: Bitcoin Price Mirrors Every Move

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

-

1

Esports Giant Moves Into Bitcoin Mining

05.07.2025 13:00 2 min. read -

2

Bitcoin Dominance Nears Key Resistance — Is Altseason Coming Next?

13.07.2025 17:00 2 min. read -

3

Elon Musk Unveils His Own ‘America Party,’ Signals Pro-Bitcoin Political Shift

07.07.2025 11:40 2 min. read -

4

Bitcoin Blasts Past $121,000 as Institutions Fuel Rally—Will Altcoins Follow?

14.07.2025 8:15 2 min. read -

5

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read