Major Altseason May Be Incoming: Bullish Signals Strengthen as Q3 Begins

07.07.2025 15:13 2 min. read Kosta Gushterov

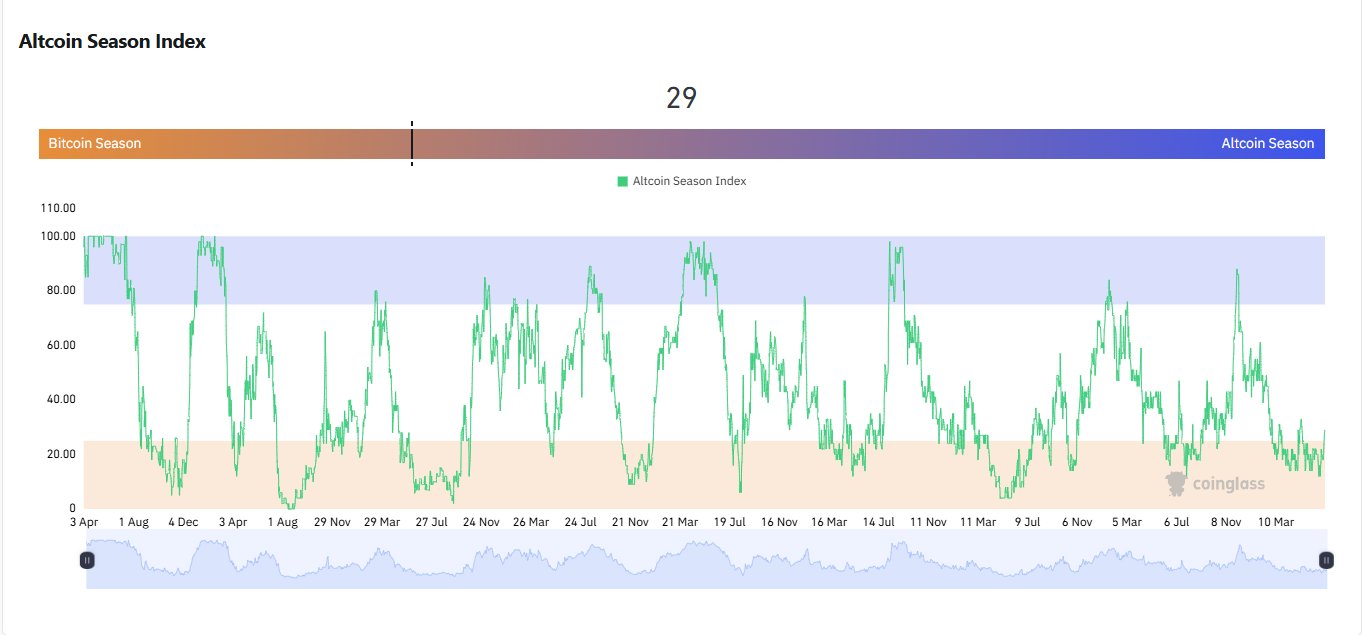

Crypto strategist Michaël van de Poppe recently highlighted a striking pattern in the Altcoin Season Index, signaling a potential surge in altcoin markets.

According to him, the index typically bottoms out in early summer—especially in June—and has consistently led to strong altcoin rallies in the latter half of the year. Now, amid what appears to be a continued bull cycle and the unwinding of quantitative easing, the likelihood of a more pronounced move than that seen in Q4 2023 is growing.

Why This Matters

Analysts from CoinGecko, a respected crypto analytics firm, echoed van de Poppe’s observations. They noted that many blue-chip altcoins saw extended periods of consolidation over the summer months, with significant upward momentum kicking in around July–August. If history repeats, we could be entering a period marked by rapid growth and widespread market rotation away from Bitcoin.

Recent data supports this shift. Over the past two days, Ethereum’s daily on-chain activity has climbed by 8%, while trading volume across DeFi tokens increased by 12%, according to a Messari report—suggesting renewed investor interest in non-BTC assets.

Drivers Behind the Surge

- Macro & Liquidity Dynamics

As central banks worldwide step back from aggressive asset-buying programs, markets seek new injection points. Van de Poppe suggests that this shifting liquidity could fuel altcoin capital flows in the months ahead. - Capital Rotation Pattern

When Bitcoin stabilizes or enters a sideways trend, capital often migrates to top-performing altcoins. With Bitcoin holding firm above $105K, attention increasingly turns to high-beta alt assets. - Emerging Trends & Product Launches

The debut of new altcoin ETFs—including Solana and XRP staking vehicles—has intensified engagement. Santiment’s July data shows these products as among the most-discussed topics in crypto circles, underscoring growing institutional interest.

What Investors Should Monitor

- Altcoin Season Index – Sustained values above 60–70 typically mark the onset of a genuine altseason.

- Trading Volume Spike – Watch for rising activity in top-tier altcoins, which reinforces market momentum.

- Macro Liquidity Updates – Future central bank communications could impact broader asset distribution.

Conclusion

All signs point to the early stages of altseason, potentially stronger than 2023’s. With bullish patterns, increased liquidity, and renewed investor appetite, the final two quarters could bring outsized returns in altcoin markets—provided broader macro conditions remain favorable. Now may be the time for investors to reassess their portfolio stance as the altcoin cycle gains momentum.

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read -

3

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

4

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

5

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read