List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read Kosta Gushterov

Altcoins are being pulled off the world’s largest exchange in droves, signaling a wave of institutional accumulation and long-term holding, according to new data from CryptoQuant.

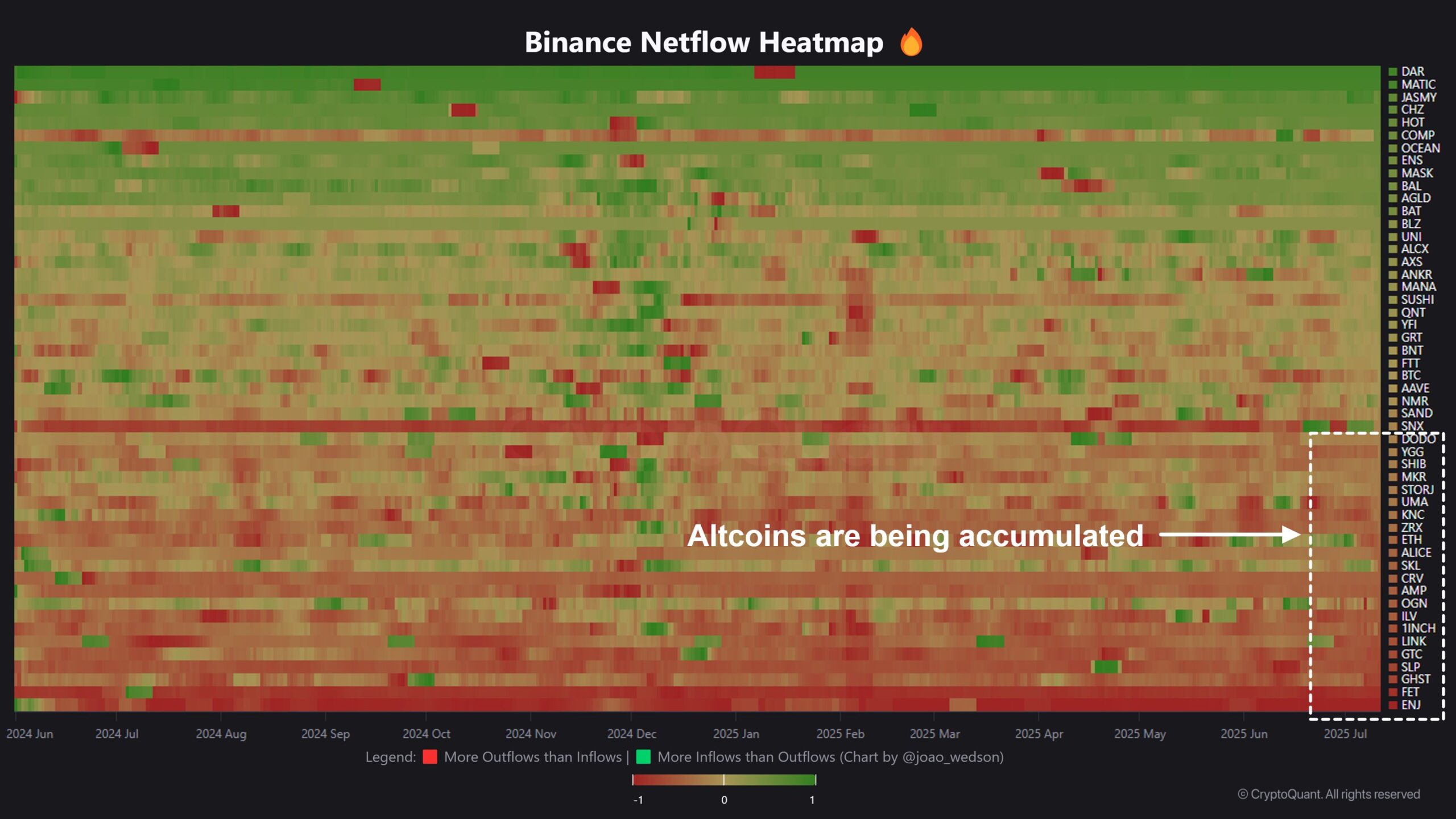

A heatmap of Binance’s netflow activity reveals that numerous altcoins are experiencing significantly more outflows than inflows. This trend typically marks a bullish accumulation phase—where large holders, or “smart money,” are moving tokens into cold storage rather than keeping them on trading platforms.

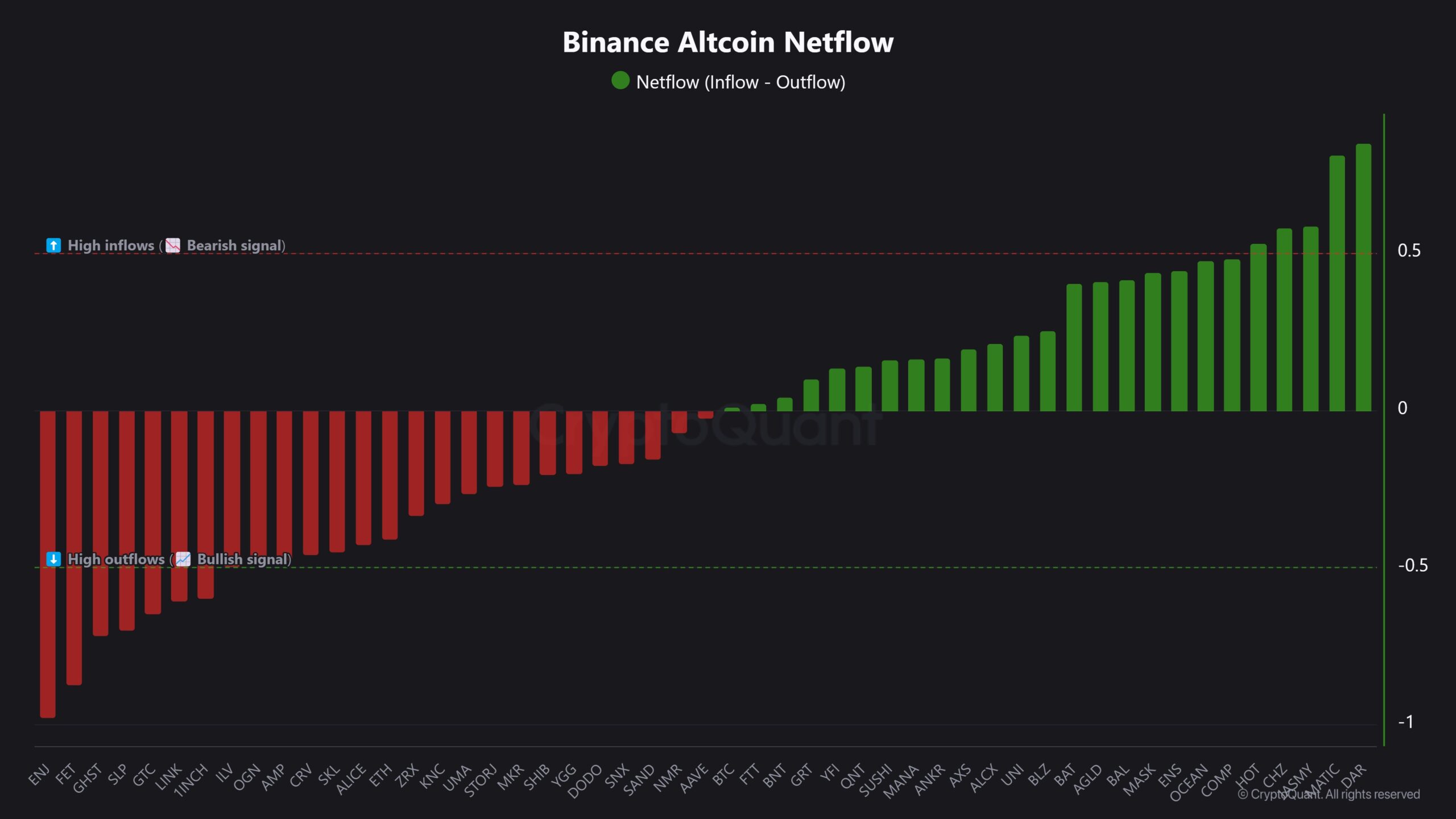

Altcoins showing the strongest accumulation include:

- Blue-chip tokens: ETH, LINK, AAVE, SNX, CRV, 1INCH

- AI and gaming projects: FET, GHST, ILV, SLP

- Meme coins and stable assets: SHIB, DOGE, MKR

- Others: ENJ, UMA, SKL, GTC, ALICE

The red signal on CryptoQuant’s heatmap indicates that outflows exceed inflows, often a precursor to supply shocks when demand spikes.

What does this mean for the market?

Large-scale withdrawals from Binance usually suggest:

- Long-term holding strategies

- Reduced circulating supply (supply shock)

- Institutional-level accumulation

These factors combined can drive up prices as demand meets reduced available supply on exchanges.

Why Binance netflows matter

As the world’s most liquid and globally dominant crypto exchange, Binance remains the epicenter of trading activity for both retail and institutional investors. It is trusted for its compliance infrastructure, wide token listings, and massive daily volumes—making outflow data a reliable signal of broader market trends.

Final takeaway

“Follow the flow. On-chain doesn’t lie,” Wedson advises. The latest data points to rising confidence in altcoins across categories—from DeFi and Layer 1s to meme and AI tokens. If the trend continues, these withdrawals could set the stage for a major altcoin rally in the coming weeks.

-

1

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

2

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

3

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

01.07.2025 20:59 4 min. read -

4

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

5

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read

Ethereum Reclaims $3,000: What’s Driving the Renewed Bullish Momentum?

Ethereum is once again trading above the key $3,000 level after a 2.4% price jump brought it to $3,044 on July 14.

ProShares XRP ETF Set to Launch on July 18, Boosting Institutional Access

ProShares is set to launch its long-awaited XRP ETF on July 18, 2025, marking a major milestone for Ripple’s token amid rising institutional demand for regulated crypto products.

Ethereum nears key resistance as analysts predict $3,500 surge

Ethereum (ETH) has climbed 1.8% in the past 24 hours, reaching $2,987 on July 13, as strong technical momentum, ETF inflows, and forced short liquidations contribute to the upward move.

Altcoin Supercycle? Analysts Signal ‘Banana Zone 2.0’ as Market Erupts

The altcoin market is heating up fast — and some crypto analysts say we may be entering a full-blown “Banana Zone” similar to the explosive rally of 2020–2021.

-

1

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read -

2

Trump-Linked Crypto Project WLFI Prepares for Token Listing and Stablecoin Audit

27.06.2025 11:00 2 min. read -

3

New Meme Coin to Watch: TOKEN6900 Presale Tipped as Next SPX6900

01.07.2025 20:59 4 min. read -

4

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

30.06.2025 13:00 2 min. read -

5

Altcoin Market: In Which Stage are we Now, According to Top Crypto Expert

06.07.2025 18:00 2 min. read