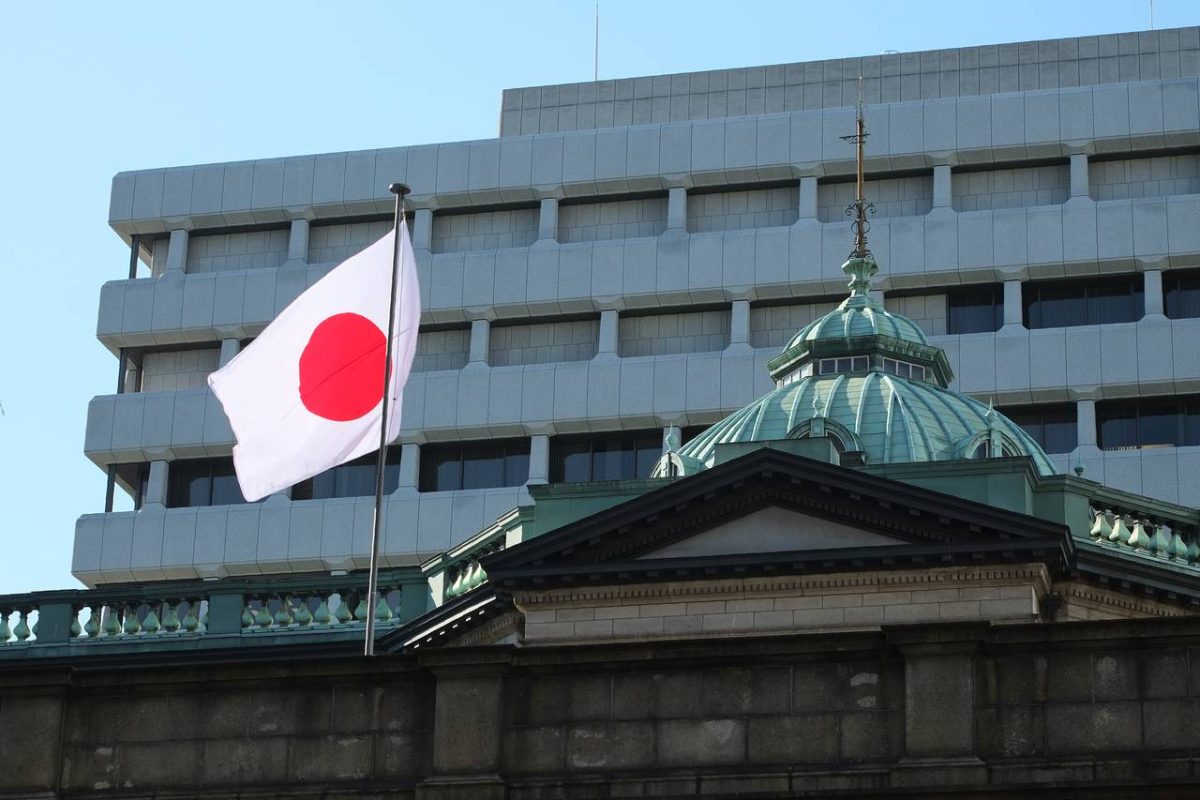

Japan’s Inflation Hits 3.5% as Food Prices Soar and Tariff Risks Loom

23.05.2025 21:00 1 min. read Alexander Stefanov

Japan’s core inflation rose to 3.5% in April, the highest since early 2023, fueled by rising domestic prices and lingering trade tensions with the U.S.

The increase surpasses forecasts and keeps inflation well above the Bank of Japan’s 2% target, complicating interest rate decisions.

A key driver has been the surge in rice prices, which hit a record 4,268 yen ($28) for a 5kg bag. Despite releasing stockpiles, only 41% of government-auctioned rice has reached wholesalers. Prime Minister Shigeru Ishiba vowed to bring prices below 4,000 yen.

The U.S. is set to impose a 24% reciprocal tariff in July, escalating pressure on Japan’s economy unless a deal is reached. Earlier tariffs on steel, autos, and aluminum continue to weigh on trade.

Some economists expect inflation to ease with a stronger yen and energy subsidies, but others, like Marcel Thieliant of Capital Economics, believe the BOJ could hike rates in October.

Markets showed muted reaction: the yen ticked up to 143.80, equities rose slightly, and bond yields dipped following the data.

-

1

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

2

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

3

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

4

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

U.S. inflation accelerated in June, dealing a potential setback to expectations of imminent Federal Reserve rate cuts.

Gold Beats U.S. Stock Market Over 25 Years, Even With Dividends Included

In a surprising long-term performance shift, gold has officially outpaced the U.S. stock market over the past 25 years—dividends included.

U.S. Announces Sweeping New Tariffs on 30+ Countries

The United States has rolled out a broad set of new import tariffs this week, targeting over 30 countries and economic blocs in a sharp escalation of its trade protection measures, according to list from WatcherGuru.

Key U.S. Economic Events to Watch Next Week

After a week of record-setting gains in U.S. markets, investors are shifting focus to a quieter yet crucial stretch of macroeconomic developments.

-

1

Robert Kiyosaki Predicts When The Price of Silver Will Explode

28.06.2025 16:30 2 min. read -

2

Trump Targets Powell as Fed Holds Rates: Who Could Replace Him?

27.06.2025 9:00 2 min. read -

3

U.S. PCE Inflation Rises for First Time Since February, Fed Rate Cut Likely Delayed

27.06.2025 18:00 1 min. read -

4

Key U.S. Economic Events to Watch Next Week

06.07.2025 19:00 2 min. read -

5

US Inflation Heats Up in June, Fueling Uncertainty Around Fed Cuts

15.07.2025 16:15 2 min. read