Is XRP’s Bullish Breakout a Sign of Confidence Amid SEC Uncertainty?

29.09.2024 21:00 1 min. read Alexander Stefanov

XRP has recently broken through the symmetrical triangle resistance at $0.605, signaling a bullish trend in the altcoin's price movement, despite ongoing speculation about potential SEC appeals.

This breakout reflects a surge in buying momentum as investors seize the opportunity to capitalize on the upward shift.

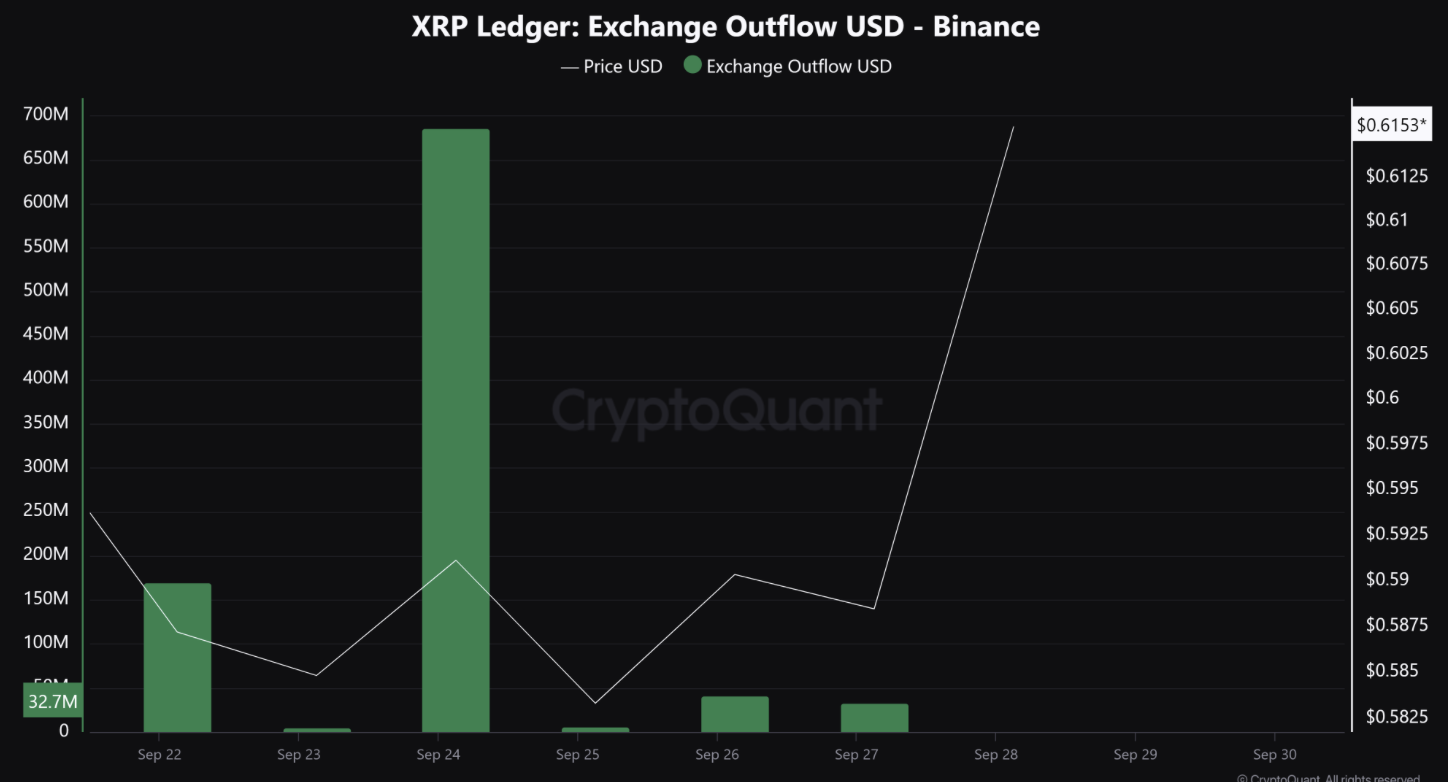

The cryptocurrency has witnessed a notable outflow of assets from exchanges, suggesting a shift in market sentiment. This trend reversal indicates that XRP holders are increasingly confident and prefer to retain their assets instead of withdrawing them. This reduced supply may further bolster the current price rally by alleviating selling pressure.

Additionally, following a significant asset outflow on September 24, XRP has gained traction on social media, with its discussion volume rising steadily.

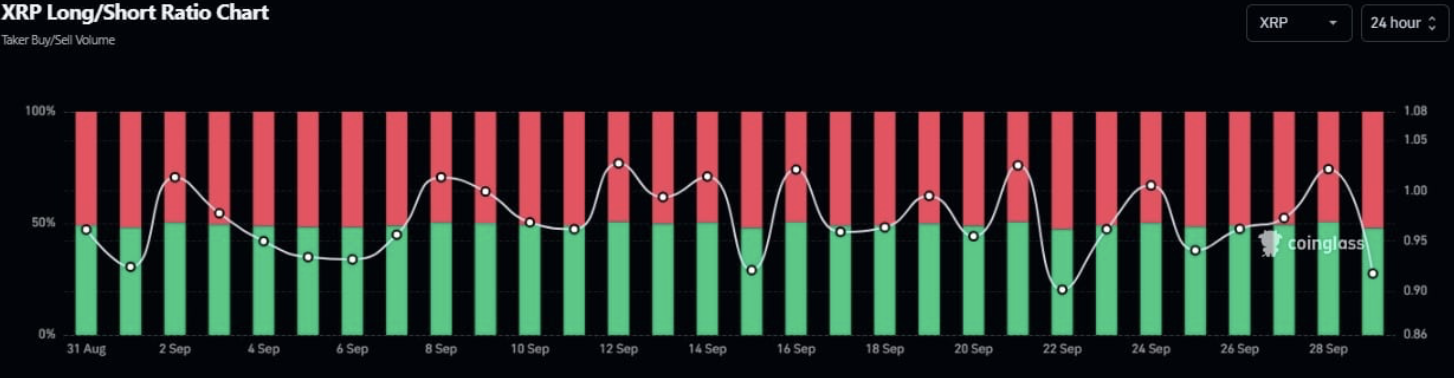

However, not all market indicators are favorable, as the ratio of long to short positions has seen a substantial decline. This drop suggests that fewer traders are choosing to take long positions on XRP, likely due to the uncertainty surrounding the SEC appeal outcome.

The market currently reflects mixed signals, with the price rally occurring alongside a more cautious outlook among traders. While this unexpected rally continues amidst regulatory ambiguity and technical hurdles, investor sentiment remains split. The sustainability of this upward movement will hinge on both technical developments and the unfolding SEC case in the weeks ahead.

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

3

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

4

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

5

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read

Standard Chartered: Ethereum Treasury Firms Now Form a Distinct Investment Class

A new report from Standard Chartered highlights that publicly traded companies holding Ethereum (ETH) as a treasury asset have emerged as a unique and fast-evolving asset class, distinct from traditional crypto vehicles such as ETFs or private funds.

Fartcoin Price Prediction: Trader Expects Big Bounce as FARTCOIN Nears $1

Fartcoin (FARTCOIN) has gone down by 17.3% in the past 24 hours and currently sits at $1.14. As the token approaches $1, one trader favors a bullish Fartcoin price prediction. DevKhabib, a pseudonymous trader whose X account is followed by nearly 46,000 users, says that he expects a big bounce off the $1 support after […]

Whale Activity Spikes as Smart Money Eyes Reversal Zones

Amid current market volatility, blockchain analytics firm Santiment has reported a notable rise in whale activity targeting a select group of altcoins.

Binance to Launch PlaysOut (PLAY) Trading on July 31 With Airdrop

Binance has officially announced the launch of PlaysOut (PLAY), a new token debuting on Binance Alpha, with trading scheduled to begin on July 31, 2025, at 08:00 UTC.

-

1

Grayscale Reveals Which Altcoins Are Next in Line for Onclusion

11.07.2025 10:00 1 min. read -

2

Cardano Surges Past $0.74 — Is a $1 Rally Next?

13.07.2025 18:00 2 min. read -

3

Ethereum Sparks Altcoin Season as FOMO Shifts Away From Bitcoin

17.07.2025 18:30 2 min. read -

4

Arthur Hayes Predicts Monster Altcoin Season: Here is Why

12.07.2025 10:46 1 min. read -

5

List of Altcoins Seeing Strong Outflows as Binance Signals Shift

13.07.2025 11:00 2 min. read