Investors Withdraw $2 Billion from Grayscale’s Ethereum ETF

01.08.2024 13:30 1 min. read Alexander Stefanov

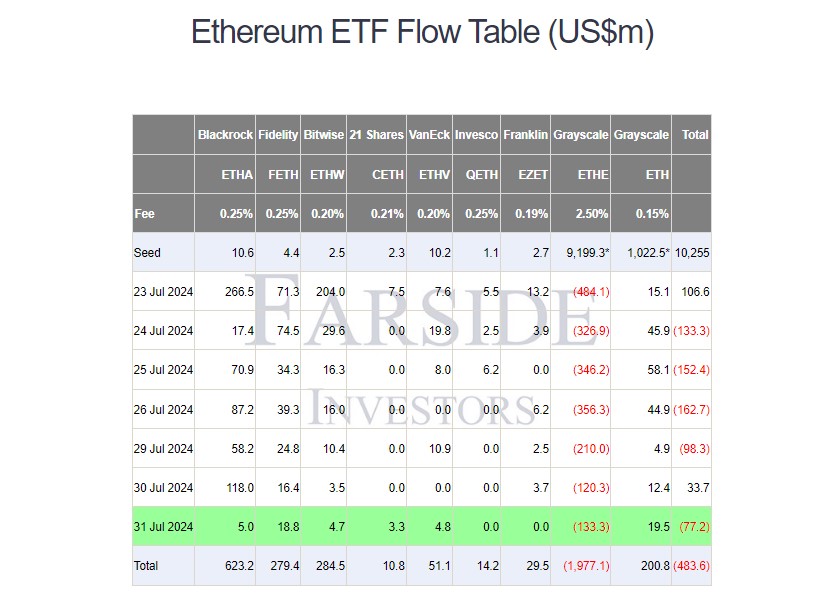

Investors have pulled nearly $2 billion from Grayscale's Ethereum ETF (ETHE) since it transitioned from a trust, with the fund's value now at $6.7 billion due to declining Ethereum prices.

On Wednesday alone, ETHE saw $133 million in withdrawals, though this wasn’t its largest single-day outflow, which was $484 million on its debut.

In contrast, the Grayscale Ethereum Mini Trust (ETH) has seen a positive inflow trend, with $19.5 million added on Wednesday, bringing total inflows to over $200 million.

ETH offers a lower management fee of 0.15%, compared to ETHE’s 2.5%, positioning it as the most cost-effective Ethereum ETF.

Grayscale’s new Bitcoin Mini Trust (BTC), launched yesterday and has already attracted $18 million.

This fund, which also has a 0.15% fee, aims to offer a cheaper alternative to the existing Bitcoin Trust (GBTC) and alleviate some of the selling pressure on GBTC by reallocating some of its assets.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read

XRP Eyes Next Target as Bullish Crossover Sparks 560% Surge

XRP is back in the spotlight after crypto analyst EGRAG CRYPTO highlighted a powerful historical pattern on the weekly timeframe—the bullish crossover of the 21 EMA and 55 SMA.

Top 5 Most Trending Cryptocurrencies Today: Zora, Pudgy Penguins, SUI and More

Crypto markets are buzzing with momentum as several altcoins post double-digit gains and surging volumes.

Sui Price Jumps 14% to $4.26 amid ETF Hopes

Sui (SUI) surged 14% in the past 24 hours, reaching $4.26 as bullish technical patterns, Bitcoin’s rebound, and renewed ETF speculation pushed the altcoin higher.

HBAR Mirrors 2021 Cycle as Key Breakout Test Approaches

Hedera Hashgraph (HBAR) is closely tracking its 2021 price behavior, according to crypto analyst Rekt Capital.

-

1

Fartcoin Price Prediction: FARTCOIN Could Rise to $2.74 After Major Breakout

17.07.2025 16:01 3 min. read -

2

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

17.07.2025 8:05 2 min. read -

3

Binance to Launch 2 New Contracts with 50x Leverage: Everything You Need to Know

10.07.2025 12:00 2 min. read -

4

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

5

ProShares Ultra XRP ETF Gets Green Light from NYSE Arca

15.07.2025 19:00 2 min. read