How Much Cryptocurrency Binance Holds, According to Their Latest Report

08.10.2024 15:00 2 min. read Alexander Stefanov

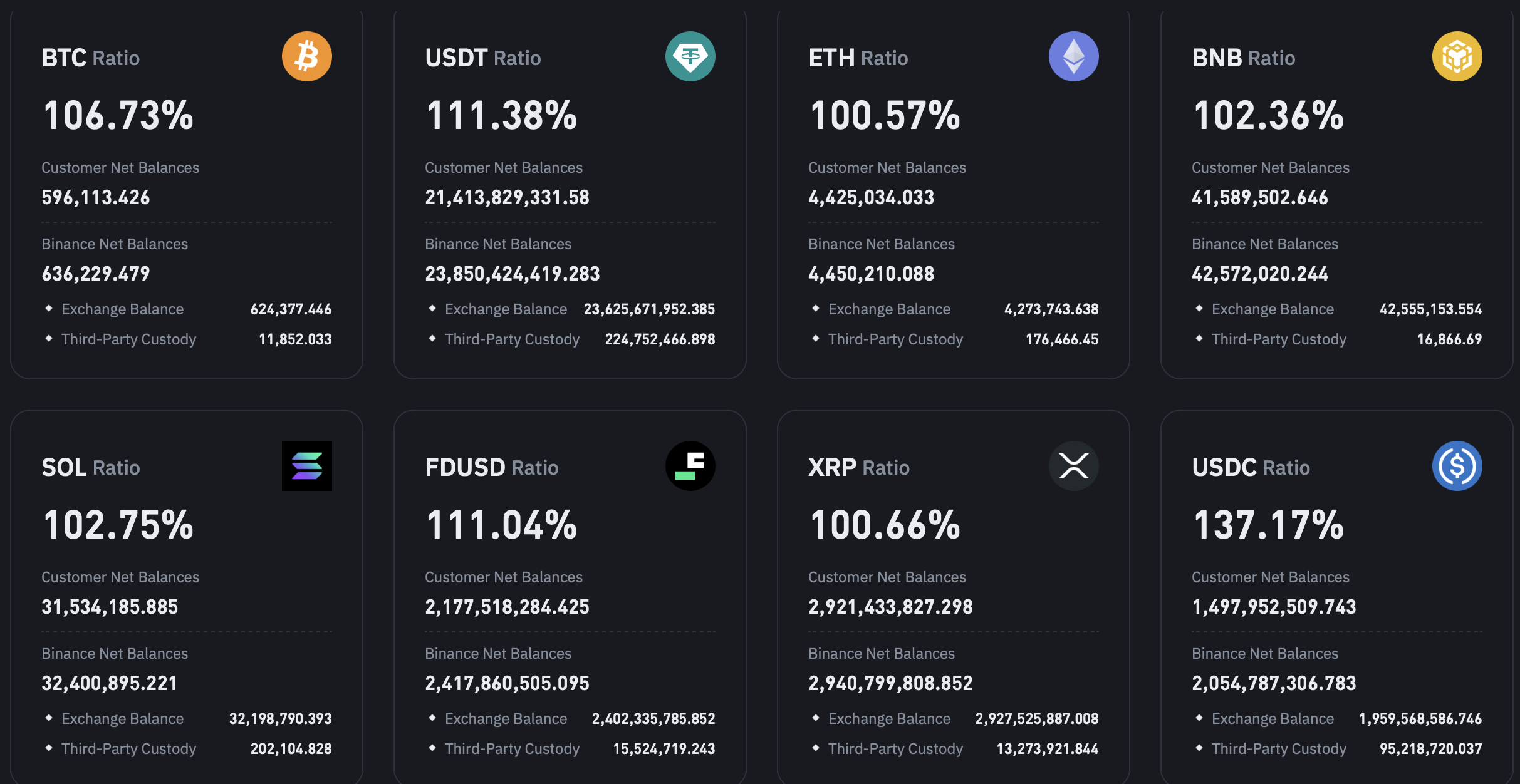

The October 2024 report offers a detailed snapshot of Binance's financial situation at a turbulent time for the crypto market.

Bitcoin (BTC), Ethereum (ETH) and USDT declined, while Binance’s native token, BNB, saw an increase, reflecting changes in the platform’s approach to asset management.

Between September and October 2024, Binance’s Bitcoin reserves showed a 1.58% decline, a decrease of 9,577 BTC, leaving the platform with 596,000 BTC.

Binance released the 23rd proof of reserves (snapshot date October 1). User BTC assets are 596k, down 1.58% from September 1; user ETH assets are 4.425 million, down 1.37%; user USDT assets are 21.41 billion, down 3.16%.https://t.co/jGCPnwd2PR pic.twitter.com/aHJq4Nd3Tj

— Wu Blockchain (@WuBlockchain) October 8, 2024

Similarly, Ethereum’ s holdings are down 1.37%, amounting to a drop of over 61,000 ETH. The most significant decrease was seen in USDT, with a decrease of 3.16%, equating to $698 million.

These declines may indicate a rebalancing or withdrawal phase by clients, reflecting the broader volatility in the cryptocurrency market.

On the other hand, Binance’s BNB reserves grew by 2.17%, which equates to an additional 882,454 tokens. This increase highlights Binance’s focus on its native token as part of its long-term vision. BNB plays a key role in the Binance ecosystem, contributing to everything from transaction fee payments to governance, and the growth in inventory reflects confidence in the token amid market uncertainty.

These changes in asset reserves highlight Binance’s flexibility in responding to market conditions. The decline in BTC, ETH and USDT, along with the increase in BNB stocks, suggests that Binance may adjust its strategy to prioritize its native token, while taking into account changing user demands for other cryptocurrencies.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read

Ethereum ETFs Signal Strong July Surge

Ethereum exchange-traded funds are gaining momentum, with recent inflows ranking among the top ten ever recorded.

Coinbase Strengthens DeFi Push With Opyn Leadership Acquisition

Coinbase has taken a major step toward expanding its decentralized finance (DeFi) presence by bringing onboard the leadership team behind Opyn Markets, a prominent name in the DeFi derivatives space.

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Grayscale Urges SEC to Allow Multi-Crypto ETF to Proceed

Grayscale Investments has called on the U.S. Securities and Exchange Commission (SEC) to allow the launch of its multi-crypto ETF—the Grayscale Digital Large Cap Fund—arguing that further delays violate statutory deadlines and harm investors.

-

1

Nasdaq Firm Makes First Crypto Move With Bittensor Acquisition

26.06.2025 14:00 1 min. read -

2

Coinbase Brings Cardano and Litecoin to DeFi via New Wrapped Tokens on Base

26.06.2025 18:00 1 min. read -

3

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Altcoin Market May Be on the Verge of Major Rally, Analyst Suggests

27.06.2025 14:00 2 min. read