How Much Bitcoin You’ll Need to Retire in 2035

19.07.2025 19:09 2 min. read Kosta Gushterov

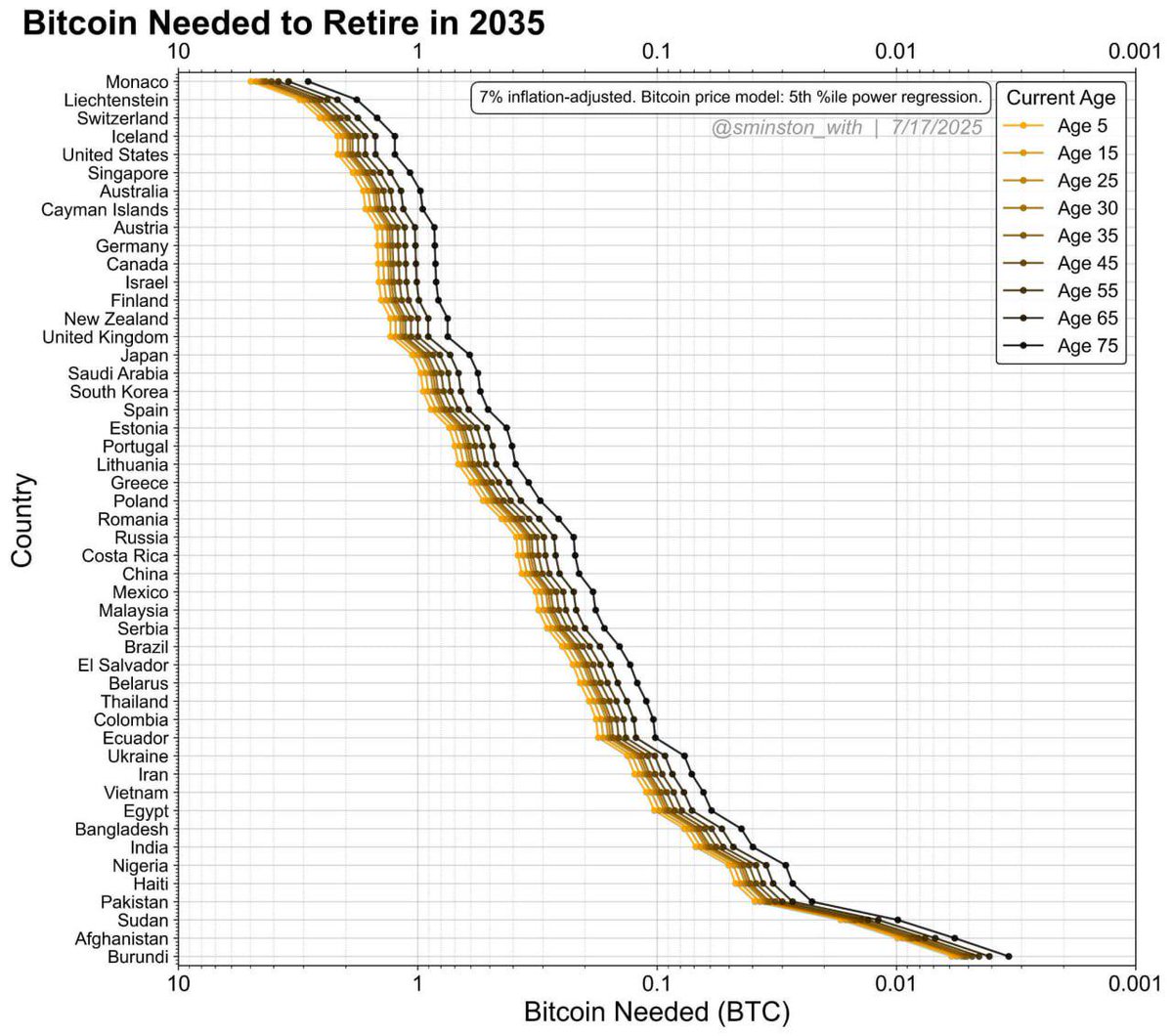

A new chart analysis offers a striking projection: how much Bitcoin one would need to retire comfortably by 2035 in different countries—assuming continued BTC price appreciation and 7% inflation adjustment.

The model uses a 5th percentile power regression for Bitcoin price growth and plots how much BTC residents of various countries might need to sustain retirement. The graph breaks down the data by age groups, ranging from age 5 to age 75, revealing how retirement targets change based on both geography and generational timing.

At the top of the list are ultra-wealthy nations like Monaco, Liechtenstein, Switzerland, and Iceland, where individuals may need between 1 and 5 BTC—or more—to retire in a decade. The United States also ranks among the most expensive retirement zones, closely followed by Singapore, Australia, and Germany. In these countries, even someone aged 25 today would require at least 1 BTC to secure a comfortable future.

Conversely, residents in developing nations like Afghanistan, Sudan, Haiti, and Burundi might only need fractions of a Bitcoin—sometimes as little as 0.001 BTC—to retire, due to significantly lower average living costs. Countries like India, Nigeria, and Pakistan fall somewhere in the middle, where between 0.01 and 0.1 BTC may suffice depending on current age.

The chart also highlights the dramatic shift in required Bitcoin as age increases. Younger individuals need considerably more BTC, reflecting the longer horizon they must fund. For example, a 5-year-old in Monaco would need nearly 10 BTC, while someone already aged 75 might require only a small fraction due to fewer remaining retirement years.

The analysis paints Bitcoin not just as a speculative asset, but as a potential long-term retirement hedge—particularly in high-income countries where fiat currencies may face erosion.

It also underscores the global wealth gap, showing how drastically retirement costs vary worldwide.

As Bitcoin adoption grows and institutional demand expands, projections like these could become vital tools for planning future financial security—especially in an increasingly digital economy.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read

Trump Media Holds $2B in Bitcoin as Crypto Plan Expands

Trump Media and Technology Group, the parent company of Truth Social, Truth+, and Truth.Fi, has officially disclosed that it now holds approximately $2 billion in Bitcoin and Bitcoin-related securities.

Strategy Adds 6,220 BTC, Pushing Total Holdings Past 607,000

Michael Saylor’s Strategy has confirmed another major Bitcoin purchase, acquiring 6,220 BTC last week for approximately $739.8 million.

Bitcoin Open Interest Hits $42B as Funding Rates Signal Bullish Overextension

Bitcoin’s derivatives market is heating up, with open interest climbing back to $42 billion while funding rates continue to surge.

Tim Draper Predicts Bitcoin Will Replace U.S. Dollar

Tim Draper isn’t just betting on Bitcoin—he’s forecasting the death of the U.S. dollar.

-

1

UniCredit to Launch Structured Product Tied to BlackRock’s Spot Bitcoin ETF

01.07.2025 17:53 1 min. read -

2

Saylor’s Strategy Halts Bitcoin Buying After Historic Accumulation

07.07.2025 17:00 2 min. read -

3

Trump’s Two big Bitcoin Moves: Key Catalysts or Just Noise for BTC Price?

08.07.2025 7:30 2 min. read -

4

Bitcoin Market Stalls as Profit-Taking, Whale Dispersal, and Sideways Action Define the Cycle

01.07.2025 20:00 3 min. read -

5

Speculation Surges as Binance BTC Futures Volume Tops $650 Trillion

04.07.2025 17:37 2 min. read