Here’s When the Bitcoin Cycle May Peak, Based on Past bull Markets

22.07.2025 19:00 2 min. read Kosta Gushterov

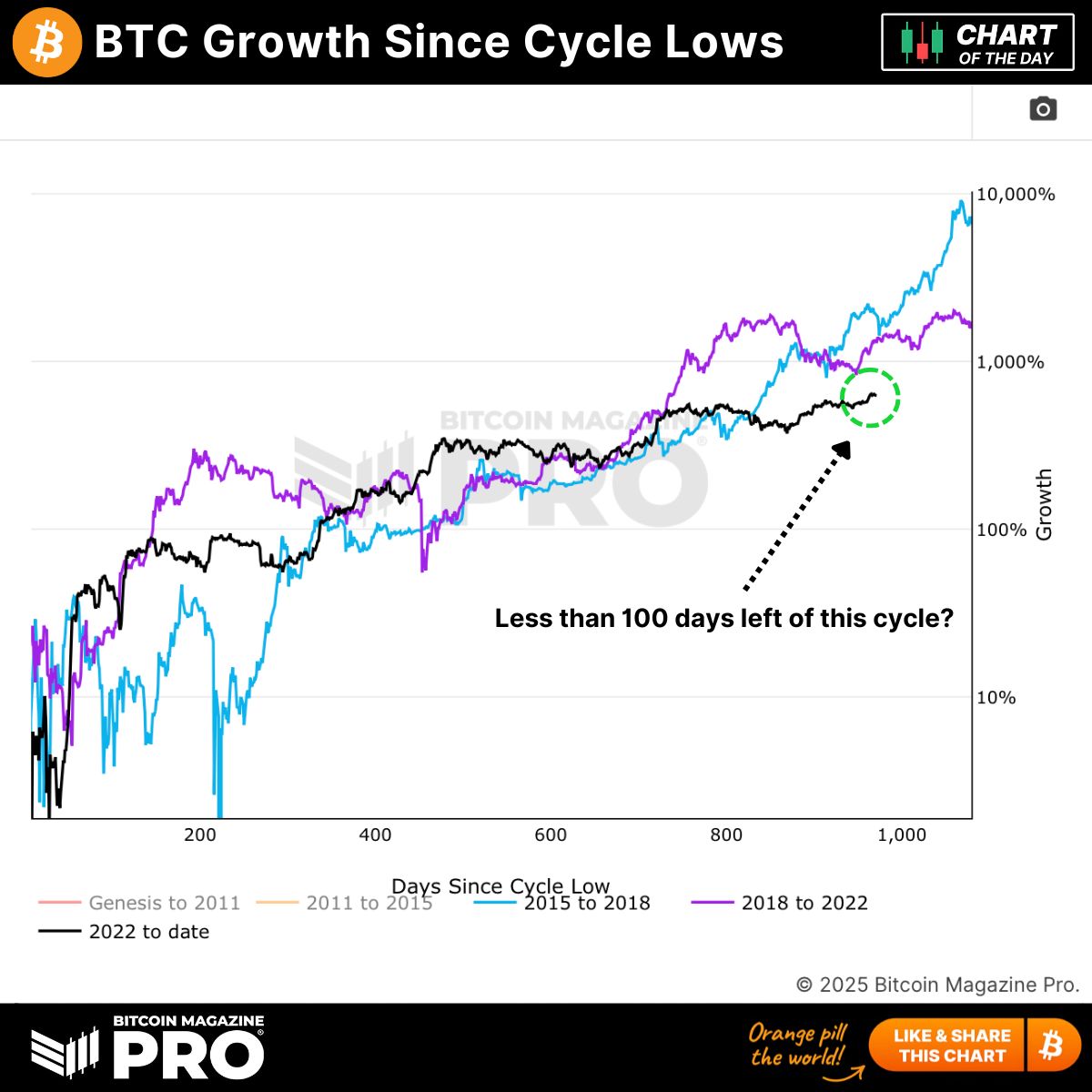

According to a new chart shared by Bitcoin Magazine Pro, the current Bitcoin market cycle may be entering its final stretch—with fewer than 100 days remaining before a potential market top.

The analysis compares the current cycle’s trajectory (2022 to 2025) to previous bull markets, specifically the 2015–2018 and 2018–2022 cycles, suggesting a possible peak in October 2025.

The chart plots Bitcoin’s percentage growth from each cycle low over time, and the similarities are striking. In all three cycles, BTC experienced an early surge, a period of mid-cycle consolidation, and a late-cycle acceleration in gains. The black line representing the current cycle is closely tracking the patterns of 2017 and 2021, both of which topped roughly 1,000 days after the cycle low.

If the current trend continues to mirror past behavior, that would place the Bitcoin peak in the October 2025 window—fewer than 100 days from now. While each cycle has its own macro context, this pattern suggests that historical rhythm still plays a powerful role in shaping market expectations.

This projection coincides with other data points, including the timing of Bitcoin’s halving cycles and the typical post-halving surge seen in previous years. However, some analysts argue that this time could be different, citing new market forces such as spot Bitcoin ETFs, stronger institutional adoption, and regulatory shifts under the Trump administration.

Still, the cyclical data is hard to ignore. If October does mark the top, it may signal a final window for late-cycle gains before the market enters a new accumulation phase. Whether or not history repeats exactly, traders are watching closely—because timing the top could be critical.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

4

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read -

5

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read

Bitcoin Price Prediction: $130K in Sight After ‘Crypto Week’ Boost

Bitcoin (BTC) is once again hovering near its all-time high today as trading volumes have jumped by 13% in the past 24 hours upon breaking the $119,000 barrier, favoring a bullish Bitcoin price prediction. The top crypto has booked gains of 16% in the past 30 days and reached a new record at $123,091 earlier […]

Support Test or Breakout Ahead? Bitcoin Hovers at Key Decision Zone

Bitcoin is consolidating around $119,000 after last week’s all-time high above $123,000.

Strategy Launches Fourth Preferred stock Offering to Fuel Bitcoin Buys

Strategy Inc. (NASDAQ: MSTR) has announced the launch of its fourth perpetual preferred stock offering, marking a new phase in the company’s ongoing efforts to expand its Bitcoin treasury holdings.

Public Companies Now hold Over $100 Billion in Bitcoin — 4% of Total Supply

According to new data shared by Bitcoin Magazine Pro, publicly traded companies now collectively hold over 844,822 BTC, valued at more than $100.5 billion, marking a historic milestone for institutional Bitcoin adoption.

-

1

Bitcoin Rises as Thousands of Altcoins Disappear

07.07.2025 13:00 2 min. read -

2

Bitcoin: Historical Trends Point to Likely Upside Movement

08.07.2025 16:00 2 min. read -

3

Strategy Buys 4,225 more Bitcoin, Pushing Holdings to 601,550 BTC

14.07.2025 18:34 2 min. read -

4

Bitcoin ETFs Top $50 Billion in Inflows, Marking Institutional Breakthrough

10.07.2025 11:00 2 min. read -

5

Bitcoin Shouldn’t Be Taxed, Says Fund Manager

07.07.2025 9:00 2 min. read