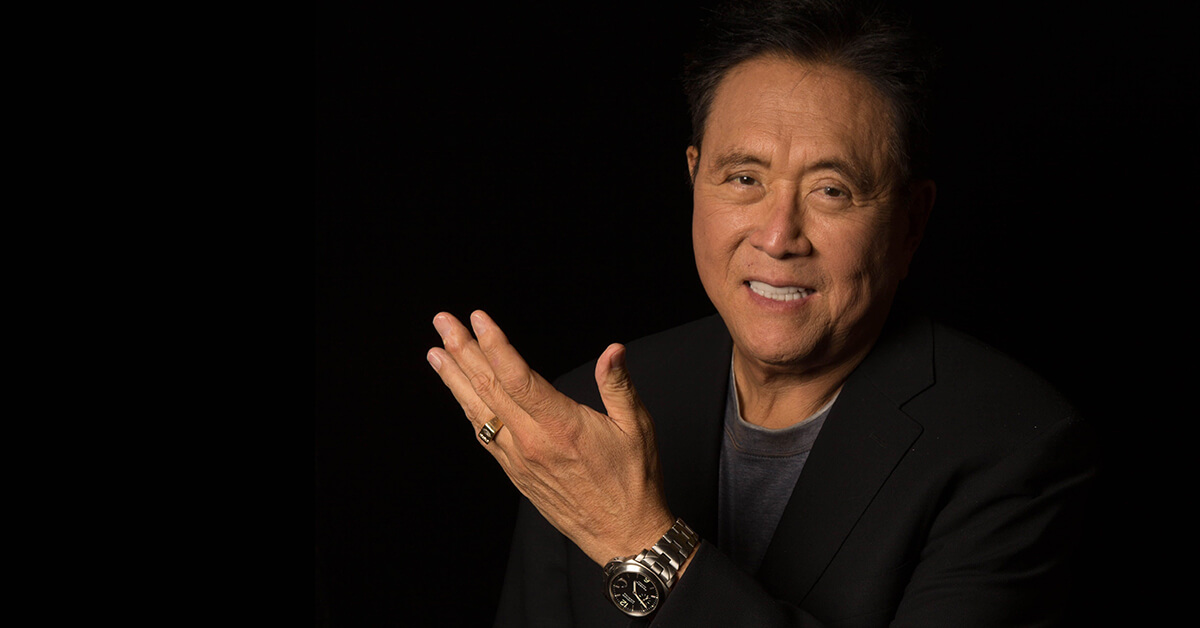

Here is What Robert Kiyosaki Expects From Bitcoin Until 2030

20.06.2025 20:00 1 min. read Alexander Stefanov

Robert Kiyosaki, the author behind Rich Dad Poor Dad, has once again made waves with a bold projection for Bitcoin.

He now sees the world’s leading cryptocurrency hitting $1 million by the end of the decade—a nearly 900% surge from its current value near $105,000.

Reflecting on his early experience with Bitcoin when it was priced at $6,000, Kiyosaki emphasized that wealth in the coming years won’t hinge on price alone, but rather on how much of the asset one owns.

“The rich will be those with the most Bitcoin,” he noted on X, highlighting the importance of accumulating hard assets rather than relying on depreciating fiat currencies.

His message doubles down on a recurring theme in his financial philosophy: the belief that gold, silver, and Bitcoin are the best defenses against inflation and economic instability. He warns that those clinging to traditional money will be left behind, while proactive investors who stack real assets could emerge far wealthier.

Earlier this month, Kiyosaki pointed to silver as an undervalued gem. Now, Bitcoin appears to have taken center stage in his long-term wealth playbook.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

Bitcoin touched a new all-time high of $118,000, but what truly fueled the rally?

Bitcoin Lesson From Robert Kiyosaki: Buy Now, Wait for Fear

Robert Kiyosaki, author of Rich Dad Poor Dad, has revealed he bought more Bitcoin at $110,000 and is now positioning himself for what macro investor Raoul Pal calls the “Banana Zone” — the parabolic phase of the market cycle when FOMO takes over.

Bitcoin ETFs See $1B Inflow as IBIT Smashes Global AUM record

Spot Bitcoin ETFs recorded a massive influx of over $1 billion in a single day on Thursday, fueled by Bitcoin’s surge to a new all-time high above $118,000.

Bitcoin Outlook: Rising U.S. Debt and Subdued Euphoria Suggest More Upside Ahead

As Bitcoin breaks above $118,000, fresh macro and on-chain data suggest the rally may still be in its early innings.

-

1

Trump-Linked Truth Social Pushes for Bitcoin-Ethereum ETF as Crypto Strategy Expands

25.06.2025 19:00 2 min. read -

2

Bitcoin Hashrate Declines 3.5%, But Miners Hold Firm Amid Market Weakness

27.06.2025 21:00 2 min. read -

3

Bitcoin’s Price Closely Mirrors ETF Inflows, Not Corporate Buys

26.06.2025 11:00 2 min. read -

4

Crypto Company Abandons Bitcoin Mining to Focus Entirely on Ethereum Staking

26.06.2025 20:00 1 min. read -

5

Bitcoin ETF Inflows Hit $2.2B as Market Calms After Ceasefire

25.06.2025 17:00 1 min. read