Hedera (HBAR) Faces Sharp Pullback After 49% Monthly Rally

16.07.2025 7:00 2 min. read Kosta Gushterov

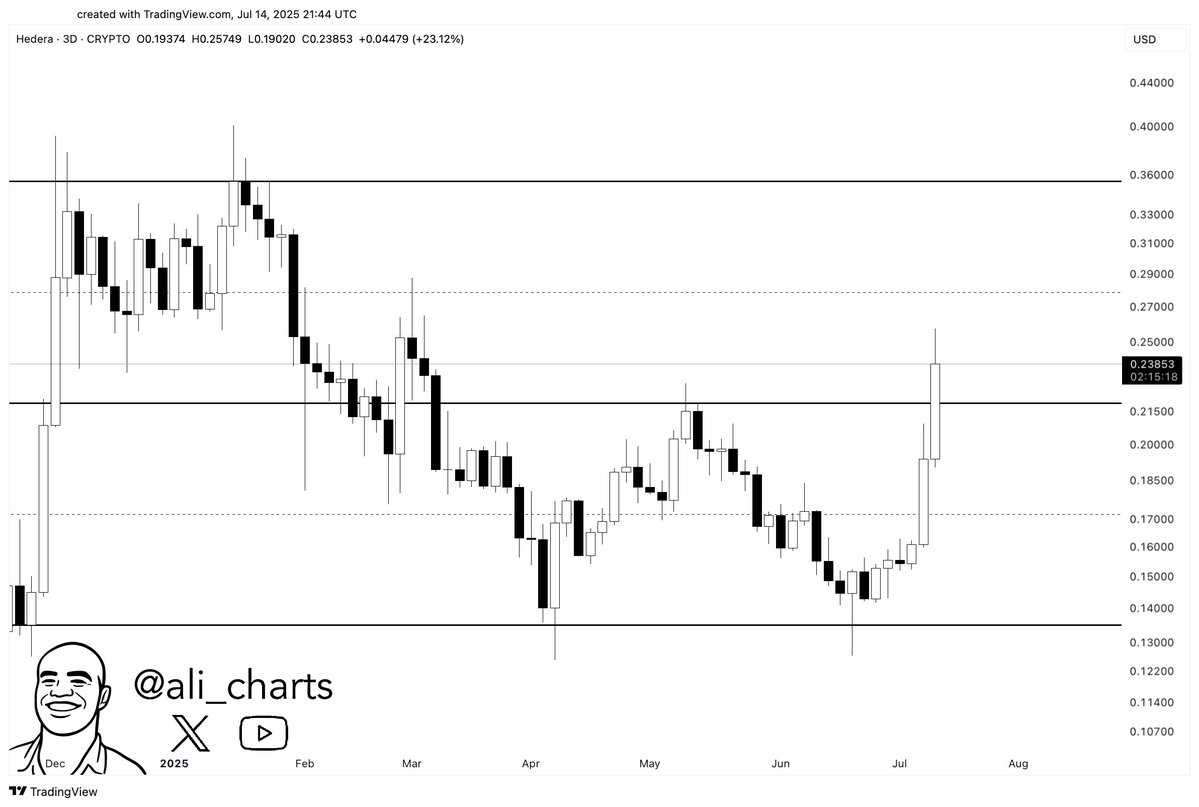

Hedera’s native token HBAR is facing selling pressure after an explosive 49% monthly surge, dropping over 5% in the past 24 hours at time of writing.

Despite holding above $0.22, technical signals and derivatives market dynamics suggest the altcoin could face more volatility in the short term.

Overbought signals trigger sharp correction

HBAR’s Relative Strength Index (RSI) hit extreme levels—87.9 on the 7-day and 79.8 on the 14-day—indicating overbought conditions. Historically, such levels have often preceded price corrections. The token was also trading 30% above its 50-day moving average, making it vulnerable to mean reversion.

Support near $0.225, based on Fibonacci retracement (23.6% level), failed to hold during Tuesday’s pullback. The next key support is around $0.206, corresponding to the 38.2% Fibonacci level.

Market-wide headwinds add pressure

HBAR’s underperformance came amid a 1.8% drop in the overall crypto market cap and a rise in Bitcoin dominance to 63.12%. This signals capital rotation toward BTC and away from riskier altcoins. Meanwhile, the Crypto Fear & Greed Index remains at 70, a traditionally contrarian signal warning of potential downside.

Still, prominent analyst Ali Martinez sees bullish potential if HBAR breaks above the $0.36 resistance. For now, traders are watching whether institutional adoption narratives can offset technical headwinds—especially if Bitcoin stabilizes above $117,000.

Key levels to watch: $0.206 support, $0.265 resistance, and Bitcoin’s $117.4K macro pivot.

READ MORE:

How Can You Tell When it’s Altcoin Season?

Futures market shows signs of overheating

Open interest in HBAR futures climbed to a record $450 million, according to Coingape, intensifying volatility. Within 24 hours, long positions worth $7.1 million were liquidated as the token failed to break resistance in the $0.233–$0.263 zone.

Trading volume also dropped 43% to $834 million, indicating fading momentum. The spot-to-perpetual ratio sits at 0.46, implying price movements are being driven largely by speculative derivatives rather than organic demand.

-

1

SEC Approves Grayscale ETF Tracking Top Five Cryptocurrencies

02.07.2025 9:06 1 min. read -

2

New Data Shows Shiba Inu is at Risk Due to Centralization

04.07.2025 10:30 2 min. read -

3

ProShares XRP ETF Set to Launch on July 18, Boosting Institutional Access

14.07.2025 8:00 2 min. read -

4

These Altcoins Just Took Over CoinGecko’s Trending List

26.06.2025 12:00 1 min. read -

5

Major Altseason May Be Incoming: Bullish Signals Strengthen as Q3 Begins

07.07.2025 15:13 2 min. read

Stellar (XLM) Surges 60% in 7 Days Amid Breakout and Partnerships

Stellar (XLM) is gaining strong bullish momentum, rising over 1.9% in the past 24 hours and 61% in the last day, topping $0.4725.

Ethereum Surges Above $3,420 While XRP Stays Stable Over $3

Ethereum (ETH) is showing renewed strength as it climbs to $3,418.86, posting a 21.33% gain over the past week.

Ethereum Overtakes Bitcoin in Retail FOMO as Traders Shift Focus to Altcoins

Ethereum has taken center stage in crypto discussions, overtaking Bitcoin in retail FOMO (fear of missing out) just days after BTC’s record-setting rally.

Ethereum Tops $3,285 for First Time Since January

Ethereum has reclaimed the spotlight, surging past $3,285 for the first time since January amid a powerful rebound in both price and network engagement.

-

1

SEC Approves Grayscale ETF Tracking Top Five Cryptocurrencies

02.07.2025 9:06 1 min. read -

2

New Data Shows Shiba Inu is at Risk Due to Centralization

04.07.2025 10:30 2 min. read -

3

ProShares XRP ETF Set to Launch on July 18, Boosting Institutional Access

14.07.2025 8:00 2 min. read -

4

These Altcoins Just Took Over CoinGecko’s Trending List

26.06.2025 12:00 1 min. read -

5

Major Altseason May Be Incoming: Bullish Signals Strengthen as Q3 Begins

07.07.2025 15:13 2 min. read