Gold-Backed Token Surpasses $500 Million in Total Value

01.10.2024 20:00 1 min. read Alexander Stefanov

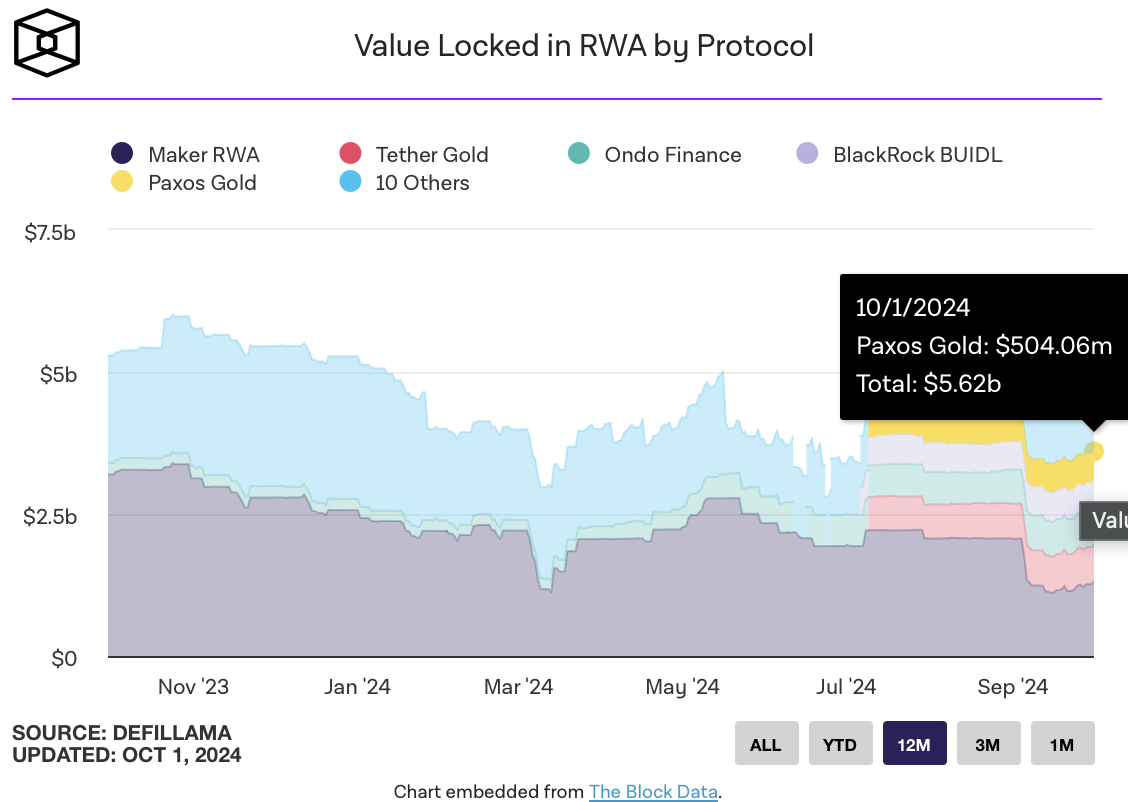

The gold-backed token has achieved a remarkable milestone, exceeding $500 million in total locked-in value (TVL) just months after its launch on July 9.

Currently, Paxos Gold (PAXG) boasts a TVL of $504 million, up from an initial $434 million. Each PAXG token is secured by one ounce of pure gold, providing the reliability of physical gold alongside the advantages of blockchain technology. Token holders can trade their tokens on cryptocurrency exchanges or redeem them for actual gold.

The growth of PAXG reflects a trend where traditional finance (TradFi) investors are increasingly looking to gain cryptocurrency exposure through familiar assets like gold-backed tokens. These tokens serve as a bridge for cautious investors, allowing them to explore blockchain technology while remaining connected to conventional financial assets.

This upward trajectory may lead to more collaborations between traditional finance and the crypto industry. As more traditional assets become tokenized, liquidity and trading opportunities within the crypto market could increase, and regulated offerings like PAXG enhance the overall credibility of the ecosystem.

PAXG’s success may also encourage further real-asset tokenization (RWA) initiatives, potentially speeding up the integration of traditional and digital finance. Although the broader crypto market continues to exhibit volatility, gold-backed tokens like PAXG could provide a safer refuge for investors navigating uncertain conditions.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

3

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

4

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

5

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read

Bitwise CIO: The Four-Year Crypto Cycle is Breaking Down

The classic four-year crypto market cycle—long driven by Bitcoin halvings and boom-bust investor behavior—is losing relevance, according to Bitwise CIO Matt Hougan.

Strategy to Raise Another $2.47 Billion for Bitcoin Acquisition

Strategy the company formerly known as MicroStrategy, has announced the pricing of a new $2.47 billion capital raise through its initial public offering of Variable Rate Series A Perpetual Stretch Preferred Stock (STRC).

AI Becomes Gen Z’s Secret Weapon for Crypto Trading

A new report from MEXC reveals a striking generational shift in crypto trading behavior: Gen Z traders are rapidly embracing AI tools as core components of their strategy.

3 key Reasons Behind Today’s Crypto Market Drop

The crypto market shed 1.02% in the past 24 hours, led by a sharp Bitcoin drop and fading altcoin interest.

-

1

Binance Could Introduce Golden Visa Option for BNB Investors Inspired by TON

07.07.2025 8:00 1 min. read -

2

Weekly Recap: Key Shifts and Milestones Across the Crypto Ecosystem

06.07.2025 17:00 4 min. read -

3

Trump Imposes 50% Tariff on Brazil: Political Tensions and Censorship at the Center

10.07.2025 7:00 2 min. read -

4

Key Crypto Events to Watch in the Next Months

20.07.2025 22:00 2 min. read -

5

USA Imposes Tariffs on Multiple Countries: How the Crypto Market Could React

08.07.2025 8:30 2 min. read