Bitcoin ETFs Continue Inflow Streak While Ethereum ETFs See Decline

01.10.2024 12:30 1 min. read Alexander Stefanov

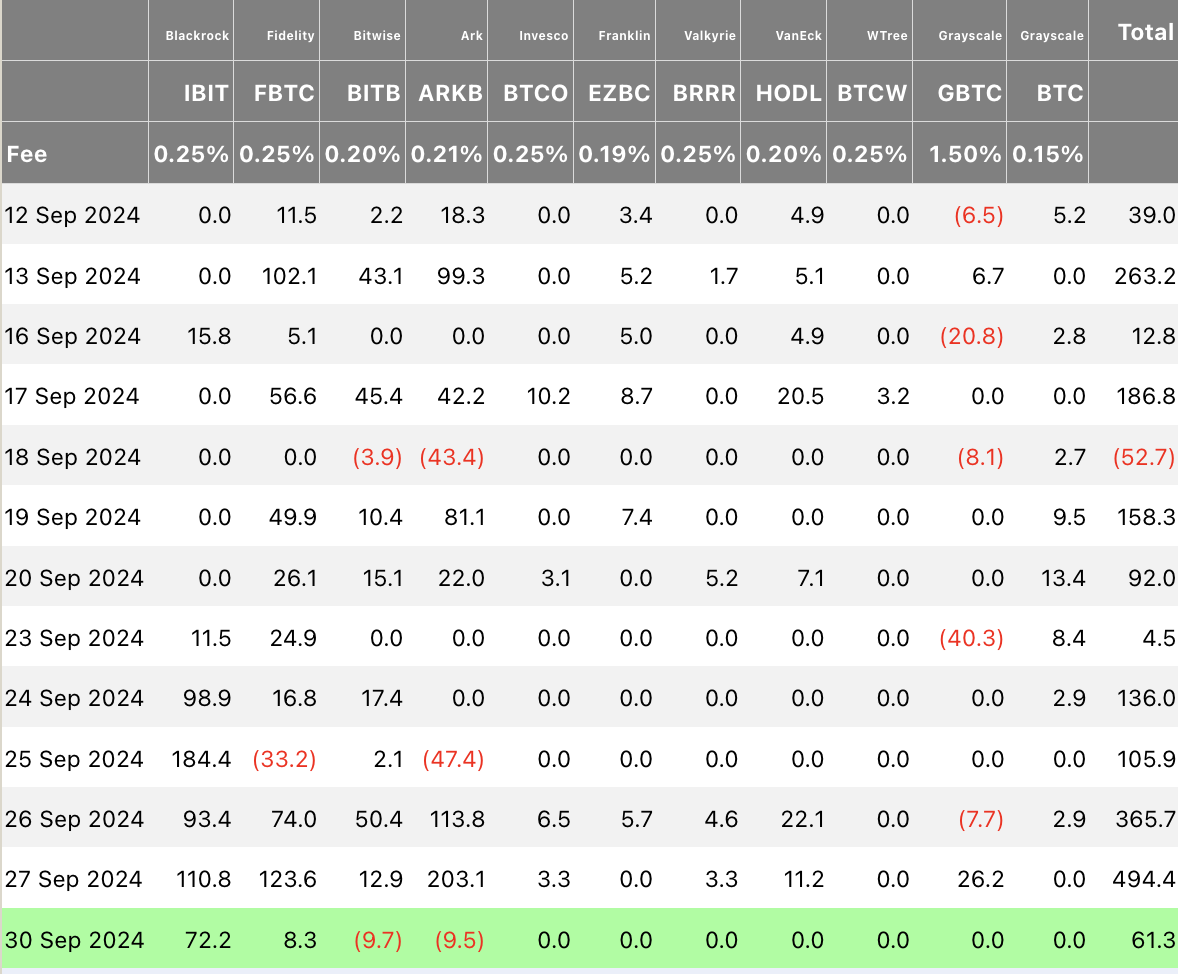

Bitcoin spot ETFs in the U.S. maintained their positive streak on Monday, with net inflows reaching $61.3 million, marking eight straight days of gains.

BlackRock’s IBIT led the charge, pulling in $72.15 million, while Fidelity’s FBTC grew by $8.32 million.

Meanwhile, Ark and 21Shares’ ARKB saw outflows of $9.5 million after significant gains last Friday, and Bitwise’s BITB also reported outflows of $9.67 million.

Grayscale’s GBTC had no activity after an inflow of $26.15 million on Friday. Total trading volume for Bitcoin ETFs dropped to $1.37 billion from $1.87 billion.

Ethereum ETFs, by contrast, faced net outflows of $822,290, despite BlackRock’s ETHA gaining $10.99 million, marking five consecutive days of inflows.

Grayscale’s ETHE lost $11.81 million. Total trading volume for Ethereum ETFs also declined from $249.09 million to $149.14 million.

-

1

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read -

2

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

3

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

4

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

5

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read

Strategy Boosts Bitcoin Holdings to 597,325 BTC with Latest Purchase

Bitcoin giant Strategy has added another 4,980 BTC to its reserves in a purchase worth approximately $531.9 million, according to Executive Chairman Michael Saylor.

Veteran Trader Peter Brandt Shares Simple Wealth Strategy with Bitcoin at Its Core

According to renowned market veteran Peter Brandt, trading isn’t the path to prosperity for the vast majority of people.

TRON (TRX) Eyes Breakout as Bollinger Bands Signal Squeeze

According to a new analysis from CryptoQuant, TRON (TRX) may be gearing up for a breakout as tightening Bollinger Bands point to an imminent expansion in volatility.

Why Bitcoin Is Stuck Despite Wall Street Demand

Charles Edwards, founder and CEO of Capriole Investments, has offered a fresh perspective on Bitcoin’s stalled price movement near the $100,000 mark, despite growing institutional enthusiasm.

-

1

Sui Price Prediction: SUI Could Rise to $5 If This Pattern Plays Out

16.06.2025 23:35 3 min. read -

2

Trump Family Reaches Resolution on Memecoin Dispute, Eyes Major Token Purchase

08.06.2025 14:00 2 min. read -

3

XRP Could Beat Solana to the ETF Finish Line, Analysts Say

12.06.2025 17:00 2 min. read -

4

Pi Price Prediction: Can Pi Coin Retest All-Time Lows?

13.06.2025 20:10 3 min. read -

5

Plasma’s ICO: A $500M Frenzy Sparks Fairness Debate

10.06.2025 22:00 2 min. read