Global Money Flow Rising: Bitcoin Price Mirrors Every Move

26.07.2025 17:00 2 min. read Kosta Gushterov

Bitcoin is once again mirroring global liquidity trends—and that could have major implications in the days ahead.

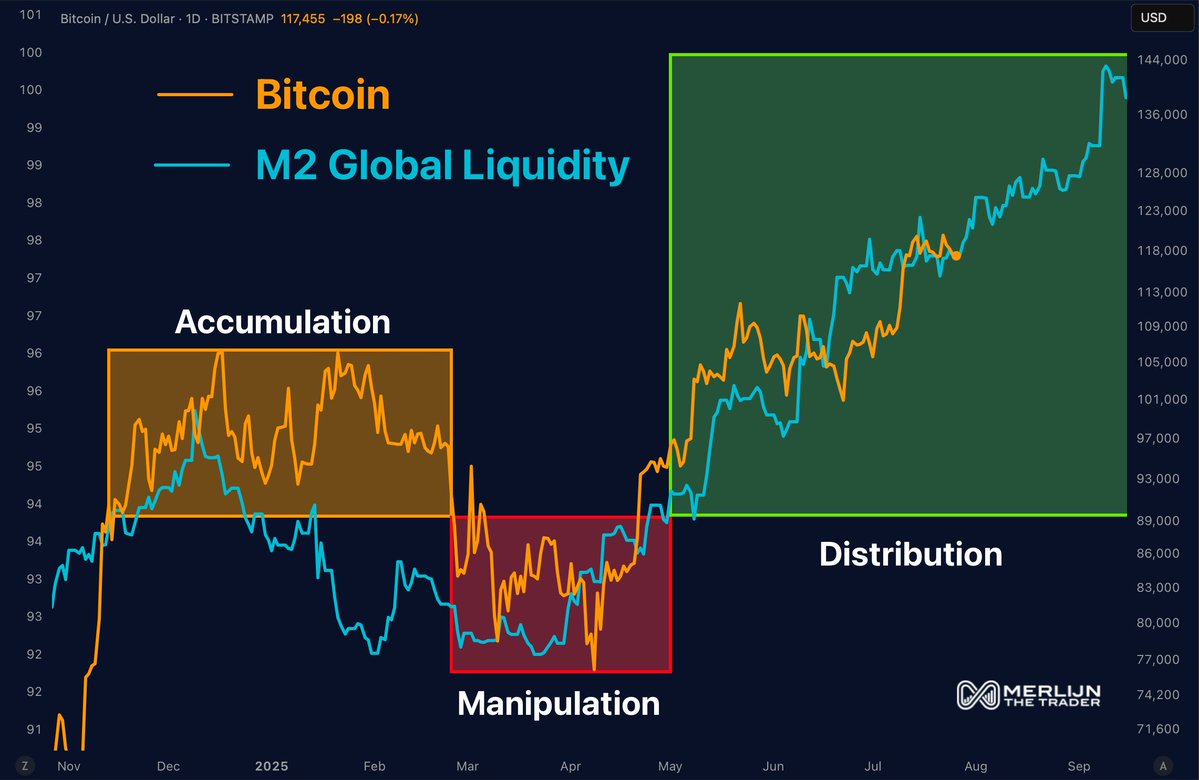

According to Merlijn The Trader, the recent explosion in M2 global liquidity is being directly reflected in Bitcoin’s price chart. His overlay analysis shows that Bitcoin has followed each phase of the liquidity cycle—accumulation, manipulation, and now distribution—with near-perfect correlation.

The takeaway? “Ignore the noise. Follow the liquidity,” Merlijn says, adding that price tends to obey wherever capital flows.

In his view, as M2 continues to surge, Bitcoin may soon break through to new highs. The chart currently shows BTC tracking global liquidity into a potential late-summer rally zone, already testing the $123,000 mark. Analysts are now eyeing $135,000 and even $144,000 as near-term extension targets—assuming M2 doesn’t reverse.

Meanwhile, Daan Crypto Trades adds another layer to the technical picture. His liquidation heatmap shows a very narrow risk corridor between $115,000 and $120,000. This tight band, shaped by recent sideways action, means that if Bitcoin dips below ~$115K or breaks above ~$120K, a large batch of liquidations could be triggered. That could create a sudden volatility spike—either upward or downward—depending on which direction hits first.

The Binance liquidation data reveals dense clusters of both long and short liquidations near these levels, suggesting that traders are heavily positioned on either side. If liquidity pressure continues to rise, the $120K ceiling could give way quickly, unleashing a round of liquidations that fuels a sharp breakout.

In short, global liquidity and leveraged positioning are converging to set up Bitcoin’s next major move. While short-term consolidation may continue, pressure is clearly building. As Merlijn puts it: “When liquidity floods in, Bitcoin doesn’t wait.”

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read

What is The Market Mood Right Now? A Look at Crypto Sentiment And Signals

The crypto market is showing signs of cautious optimism. While prices remain elevated, sentiment indicators and trading activity suggest investors are stepping back to reassess risks rather than diving in further.

What Price Bitcoin Could Reach If ETF Demand Grows, According to Citi

Citigroup analysts say the key to Bitcoin’s future isn’t mining cycles or halving math—it’s ETF inflows.

Is Bitcoin’s Summer Slowdown a Buying Opportunity?

Bitcoin may be entering a typical summer correction phase, according to a July 25 report by crypto financial services firm Matrixport.

Massive Bitcoin Move Sparks Panic, Price Tests Range Low

Bitcoin has dropped sharply to test its local range low near $115,000, with analysts pointing to renewed whale activity and long-dormant supply movements as key contributors to the decline.

-

1

Bitcoin: What to Expect After Hitting a New All-time High

10.07.2025 14:00 2 min. read -

2

Peter Brandt Issues Cautious Bitcoin Warning Despite Bullish Positioning

10.07.2025 20:00 2 min. read -

3

Standard Chartered Becomes First Global Bank to Launch Bitcoin and Ethereum Spot Trading

15.07.2025 11:00 1 min. read -

4

Vanguard Now Owns 8% of Michael Saylor’s Strategy, Despite Calling BTC ‘Worthless’

15.07.2025 17:09 2 min. read -

5

What’s The Real Reason Behind Bitcoin’s Surge? Analyst Company Explains

12.07.2025 12:00 2 min. read