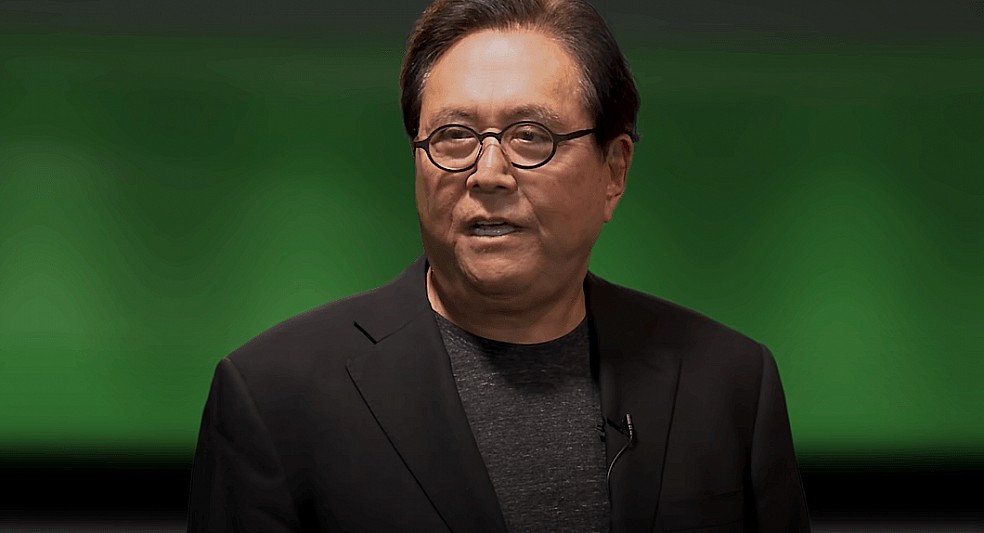

Global Economic Crash is Coming, Warns “Rich Dad, Poor Dad” Author

23.12.2024 19:00 1 min. read Alexander Stefanov

Robert Kiyosaki, the author of Rich Dad Poor Dad, has issued a stark warning about an imminent global economic downturn.

Kiyosaki claimed that a worldwide market collapse is already underway, pointing to significant financial troubles in Europe, China, and the United States. He suggested that this could mark the beginning of a deeper “depression” phase.

The renowned author urged individuals to take precautions, emphasizing the importance of securing their finances and holding onto stable employment. He highlighted the potential value of tangible assets during turbulent times, stating, “Crashes are often the best opportunities to build wealth,” and recommended gold, silver, and Bitcoin as key investments to weather the storm.

This warning follows his earlier prediction of what he described as the “largest crash in history.” Kiyosaki previously encouraged proactive financial planning, urging his followers to prepare for the fallout he believes will impact aging populations and traditional markets.

Despite the volatility in the cryptocurrency market, Kiyosaki reaffirmed his faith in Bitcoin, suggesting it could serve as a hedge against traditional market instability. Alongside gold and silver, he noted that Bitcoin may attract increased attention as economic uncertainty grows, positioning it as a potential safe haven during financial upheaval.

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

3

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read

BitGo Files Confidentially for IPO With SEC

BitGo Holdings, Inc. has taken a key step toward becoming a publicly traded company by confidentially submitting a draft registration statement on Form S-1 to the U.S. Securities and Exchange Commission (SEC).

Crypto Greed Index Stays Elevated for 9 Days — What it Signals Next?

The crypto market continues to flash bullish signals, with the CMC Fear & Greed Index holding at 67 despite a minor pullback from yesterday.

U.S. Public Pension Giant Boosts Palantir and Strategy Holdings in Q2

According to a report by Barron’s, the Ohio Public Employees Retirement System (OPERS) made notable adjustments to its portfolio in Q2 2025, significantly increasing exposure to Palantir and Strategy while cutting back on Lyft.

Key Crypto Events to Watch in the Next Months

As crypto markets gain momentum heading into the second half of 2025, a series of pivotal regulatory and macroeconomic events are poised to shape sentiment, liquidity, and price action across the space.

-

1

Here is Why the Fed May Cut Rates Earlier Than Expected, According to Goldman Sachs

08.07.2025 15:00 2 min. read -

2

Vitalik Buterin Warns Digital ID Projects Could End Pseudonymity

29.06.2025 9:00 2 min. read -

3

What Brian Armstrong’s New Stats Reveal About Institutional Crypto Growth

29.06.2025 15:00 2 min. read -

4

Donald Trump Signs “One Big Beautiful Bill”: How It Can Reshape the Crypto Market

05.07.2025 9:56 2 min. read -

5

Market Odds of a U.S. Recession in 2025 Drop in Half Since May

05.07.2025 18:30 2 min. read