Global Crypto Trading Set to Explode in 2024

01.08.2024 9:30 2 min. read Alexander Stefanov

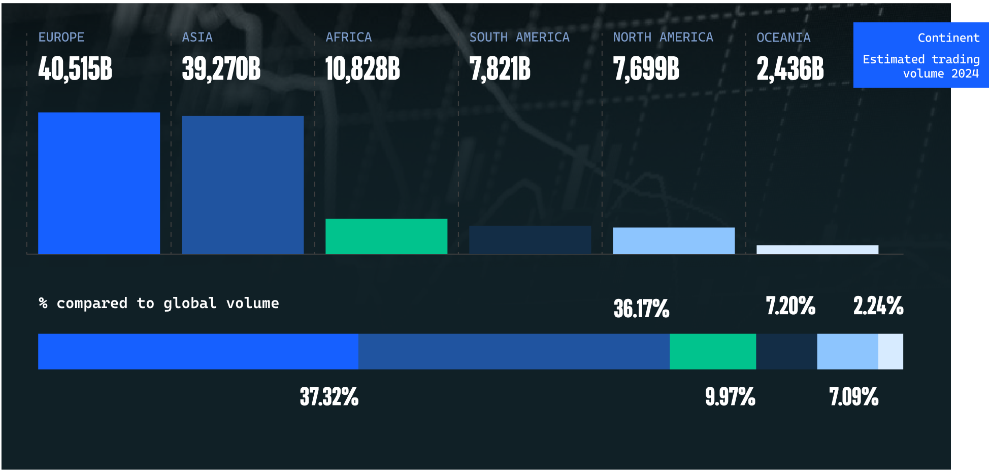

In 2024, global cryptocurrency trading is set to reach over $108 trillion, a dramatic increase of nearly 90% from 2022, according to Coinwire.

The U.S. is expected to lead this surge, with trading volumes projected to exceed $2 trillion.

Crypto trading volumes have grown 42% since 2023, reflecting a broader market expansion of 89% over the past three years. This growth underscores a worldwide rise in the adoption of digital assets.

Europe is the largest player in crypto trading, responsible for 37.32% of the global transaction value, with Russia and the UK leading in volume. Turkey and India are significant contributors, each surpassing $1 trillion in trading activity.

Asia ranks second in global crypto transaction value, holding 36.17% of the market. The region’s growth is driven by high mobile usage and strong technological infrastructure.

Binance remains the top crypto exchange, leading in 100 of 136 countries with a trading volume of $2.77 trillion. Other major exchanges include OKX and CEX.IO, with volumes of $759 billion and $1.83 billion, respectively. Coinbase and Bybit also have substantial volumes, trading in 90 and 87 countries.

Despite recent market turbulence, including the collapse of FTX and regulatory hurdles, centralized exchanges drove $36 trillion in trading last year, spurred by optimism around U.S. Bitcoin ETFs. The latest data also shows stablecoins surpassing Visa’s monthly transaction average, highlighting their growing influence in the financial landscape.

-

1

Key U.S. Events to Watch This Week That Could Impact Crypto

30.06.2025 11:00 2 min. read -

2

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

30.06.2025 10:00 2 min. read -

3

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

4

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

5

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read

Grayscale Confidentially Files for New SEC-registered Offering Amid Growing Crypto Market demand

Grayscale Investments announced today that it has confidentially submitted a draft registration statement on Form S-1 to the U.S.

Here is How to Read the Crypto Fear and Greed Index

In the volatile world of cryptocurrency, investor psychology is one of the most powerful forces behind price movement.

Bank of England Governor Warns Against Stablecoins, Backs Tokenized Deposits Instead

Bank of England Governor Andrew Bailey has voiced strong concerns about the rising push for stablecoin adoption, calling on banks to steer clear of issuing their own digital currencies.

Czech National Bank Enters Crypto Sector with $18M Coinbase Investment

The Czech National Bank (CNB) has entered the crypto sector with a $18 million investment in Coinbase, purchasing 51,732 shares in Q2 2025, according to a U.S. SEC filing.

-

1

Key U.S. Events to Watch This Week That Could Impact Crypto

30.06.2025 11:00 2 min. read -

2

Here Is How Your Crypto Portfolio Should Look Like According to Investment Manager

30.06.2025 10:00 2 min. read -

3

SoFi Returns to Crypto with Trading, Staking, and Blockchain Transfers

27.06.2025 8:00 1 min. read -

4

GENIUS Act Could Reshape Legal Battle over TerraUSD and LUNA Tokens

30.06.2025 9:00 1 min. read -

5

Here is How to Read the Crypto Fear and Greed Index

14.07.2025 15:00 3 min. read