Gemini Launches Tokenized MicroStrategy Stock for EU Users

28.06.2025 9:30 2 min. read Kosta Gushterov

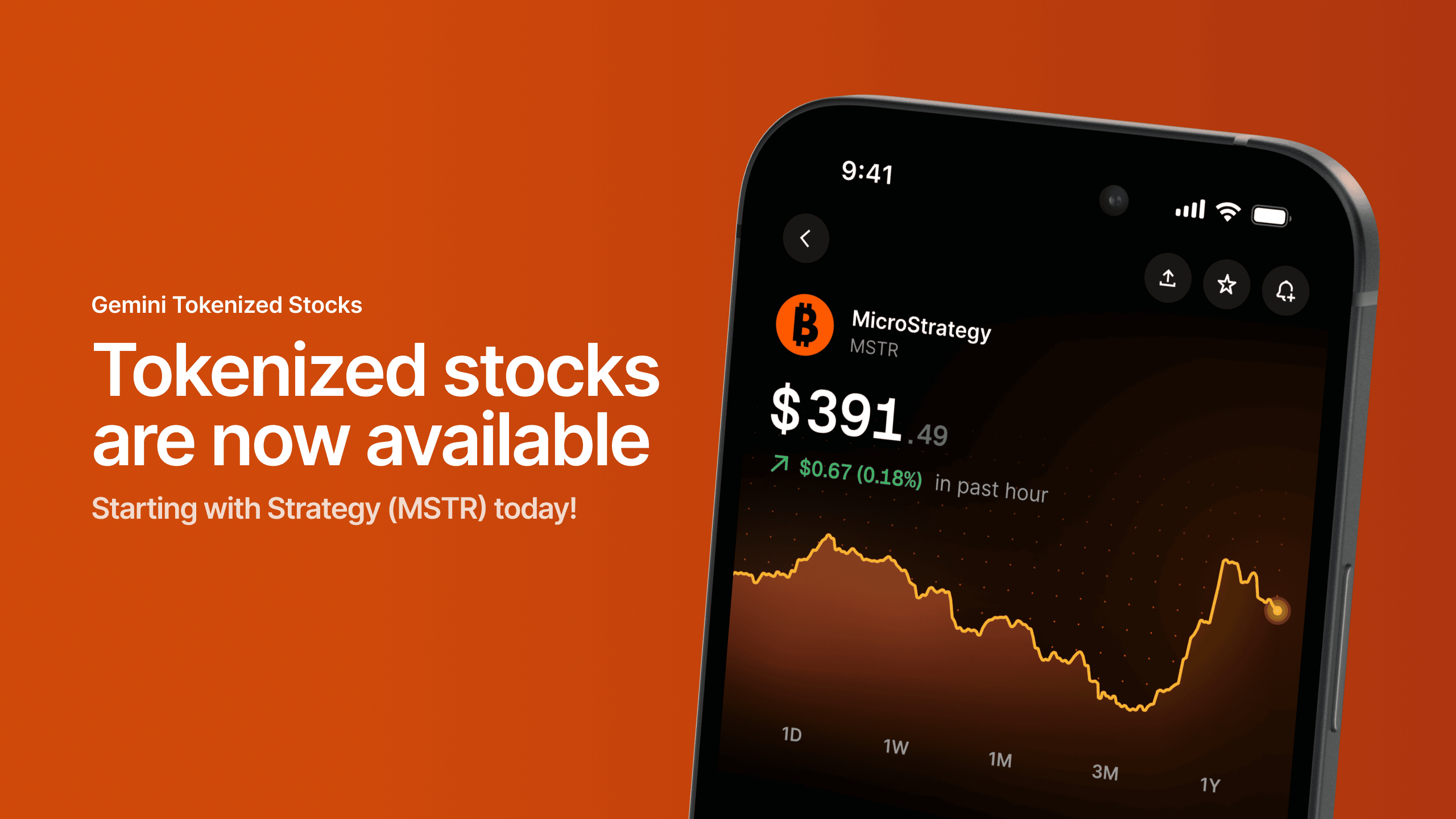

Cryptocurrency exchange Gemini has announced the launch of tokenized MicroStrategy (MSTR) stock for customers in the European Union, enabling onchain access to one of the most prominent Bitcoin-related equities.

The asset is now available on the Arbitrum network, with support for additional blockchains on the way.

The offering allows global users — anyone with a smartphone and internet connection — to gain blockchain-based exposure to U.S. equities, starting with MicroStrategy. According to Gemini, the initiative marks a step toward merging traditional financial assets with the 24/7, decentralized infrastructure of crypto.

“This is the future of finance, and the future has arrived,” Gemini stated in its official release. “We’re starting with MSTR and will roll out more tokenized stocks and ETFs in the coming days.”

Tokenized Stocks Powered by Dinari

To bring this product to market, Gemini has partnered with Dinari, a leader in tokenized U.S. securities. Dinari’s on-demand tokenization model allows Gemini to offer token holders the same economic rights as the underlying securities — including dividends, where permitted — along with increased liquidity and transparency.

This new functionality aims to democratize access to U.S. equities, exporting shares of companies like MicroStrategy beyond traditional finance hubs and into the hands of retail users worldwide.

Global Expansion Plans Underway

Gemini described the tokenized equity push as a “win-win” for both the U.S. and global investors — a means of connecting the “greatest companies on planet earth” to “the people of planet earth.” A full list of supported jurisdictions is available on Gemini’s website.

As the platform expands, it plans to offer more tokenized U.S. stocks and ETFs, paving the way for broader integration between blockchain and global equity markets.

-

1

Russia Hits Pause on Expanding Crypto Mining Restrictions

07.06.2025 11:00 1 min. read -

2

U.S. State of Connecticut Blocks Crypto from Public Sector Operations

12.06.2025 16:00 1 min. read -

3

Vietnam Charts a Clear Course for Digital Assets With New 2026 Law

16.06.2025 18:00 1 min. read -

4

Federal Reserve Clears Path for Banks to Enter Crypto Market

24.06.2025 8:00 2 min. read -

5

U.S. Senate Moves Closer to Passing Landmark Stablecoin Legislation

17.06.2025 10:00 1 min. read

Ripple Drops Cross-Appeal, Moves to End SEC Case “Once and for All”

Ripple CEO Brad Garlinghouse announced Friday that the company is officially dropping its cross-appeal in its long-running legal battle with the U.S. Securities and Exchange Commission (SEC), signaling a final move toward ending the years-long case.

Turkey Targets Crypto Crime With New Withdrawal Delays and Transfer Limits

Turkey is preparing to roll out a series of strict crypto regulations aimed at curbing financial crimes tied to illegal gambling and online fraud, according to new comments from Finance Minister Mehmet Simsek.

Japan Plans Major Crypto Reform with New Tax Rules and ETF Access

Japan is preparing to dramatically reshape its cryptocurrency regulations, with officials drafting a proposal that would reclassify digital assets and streamline their tax treatment.

Federal Reserve Clears Path for Banks to Enter Crypto Market

In a significant policy shift, the U.S. Federal Reserve has quietly removed reputational risk as a factor in evaluating banks, a move that could make it easier for financial institutions to offer cryptocurrency services without fear of regulatory backlash.

-

1

Russia Hits Pause on Expanding Crypto Mining Restrictions

07.06.2025 11:00 1 min. read -

2

U.S. State of Connecticut Blocks Crypto from Public Sector Operations

12.06.2025 16:00 1 min. read -

3

Vietnam Charts a Clear Course for Digital Assets With New 2026 Law

16.06.2025 18:00 1 min. read -

4

Federal Reserve Clears Path for Banks to Enter Crypto Market

24.06.2025 8:00 2 min. read -

5

U.S. Senate Moves Closer to Passing Landmark Stablecoin Legislation

17.06.2025 10:00 1 min. read